CIO View: September 2025

For this month’s CIO View piece, we will start with the usual review of selected key financial market news. We will then dedicate the latter part to talk about the Malaysian bond market as the better opportunity than Thai fixed income for investors.

The US job market showed clear signs of a continued slowdown. The data reflects a shift away from the rapid hiring pace of previous years toward a more cautious labor market. The US economy added only 22,000 jobs in August, a figure that was revised down to -13,000 in June. This marked a significant slowdown in job creation and the first net job loss since December 2020. The unemployment rate edged up to 4.3% in August, reaching its highest level since 2021. However, wage growth remains elevated despite the cooling job market. Average hourly earnings rose by 0.3% in August, consistent with July’s pace. On a year-over-year basis, average hourly earnings were up 3.7%.

In monetary policy development, The Federal Open Market Committee (FOMC) on September 17th cut its benchmark lending rate by 0.25% to a new range of 4.00% to 4.25%. It is the first rate cut of President Donald Trump’s second term, following a nine-month pause prompted by the uncertainty surrounding the administration’s major policy shifts. The Federal Reserve’s (Fed) latest decision was not unanimous as Fed Governor Stephen Miran, a Trump appointee sworn in right before the Fed’s meeting began, dissented, backing a larger, half-point rate cut. Federal Reserve Chair Jerome Powell made it clear that growing risks to the labor market were a key reason why the Fed finally lowered rates, even though there is also a risk of Trump’s tariffs pushing up prices. Powell suggested that the Fed is not behind the curve, given that the latest decision is functioning as an insurance policy to defend against future weakness in the labor market. Based on the Fed’s dot plot from the September meeting, the median projection of FOMC members indicates that the federal fund rate is expected to be in a range of 3.5%-3.75% by the end of 2025. This suggests that the members anticipate two additional quarter-point rate cuts at the remaining two meetings of the year. The dot plot also projects just a single cut in 2026, down from two projected cuts in June’s dot plot, and one rate reduction in 2027. The Summary of Economic Projections (SEP) showed a slightly stronger estimate for real GDP in 2025, up 1.6% compared to 1.4% in June estimate. The estimate for 2026 was also increased by 0.2%, to 1.8%. For 2027, the estimate for real GDP growth increased by 0.1%, to 1.9%.

The European Central Bank (ECB) held interest rates steady on September 11th as widely expected by market participants. ECB’s deposit facility rate is kept at 2.0% for the second consecutive meetings. The ECB President Christine Lagarde noted that risk to economic growth have become more balanced and emphasized a data-dependent and meeting-by-meeting approach to future monetary policy decisions. She stated that the ECB is not pre-committing to a particular rate path. The unanimous decision to keep rates steady in September suggests that the Governing Council is in no rush to implement further cuts. The ECB’s staff projections were updated at the September meeting. GDP growth is now projected to be 1.2% in 2025, a significant increase from the 0.9% expected in June. The growth projection for 2026 was slightly lowered to 1.0%. The latest projections for headline inflation are 2.1% in 2025, 1.7% in 2026, and 1.9% in 2027. The ECB’s assessment is that inflation is currently at around its 2% medium-term target and the outlook remains broadly unchanged. The Bank of Japan (BOJ) maintained its short-term policy interest rate at 0.50% on September 19th. This was the fifth consecutive meeting where the rate was held steady since the rate hike in January. The decision was made by a 7-2 vote, with two members, Hajime Takata and Naoki Tamura, dissenting in favor of an immediate rate hike to 0.75%. In a significant and unanimous decision, the BOJ announced it would begin preparing to sell its holdings of exchanged-traded funds (ETFs) and Japanese real estate investment trusts (J-REITs). This move signals a further step toward unwinding its long-standing ultra-loose monetary policy and reducing its presence in the market. The central bank’s statement noted that Japan’s economy has been recovering moderately. However, the BOJ also highlighted concerns about a potential slowdown in overseas economies and a decline in domestic corporate profits, partly due to US tariff policies.

The People’s Bank of China (PBOC) maintained its key interest rates, including the one-year Loan Prime Rate (LPR) and the seven-day reverse repo rate, at their current levels. This decision came despite the US Federal Reserve’s recent rate cut. The PBOC has continued to rely on targeted liquidity injections and a data-dependent approach to monetary policy. In September, the central bank injected 487 billion yuan into the economy through reverse repurchase agreements to maintain ample liquidity in the banking system. The PBOC’s stance remains moderately loose monetary policy, with an emphasis on targeted support for key sectors of the economy, including the real estate market. The central bank is focused on stabilizing expectations and using a mix of policy tools to support sustainable economic growth.

On September 7th, Japanese Prime Minister Shigeru Ishiba announced his intention to step down as premier and as president of the Liberal Democratic Party (LDP). An election will take place on October 4th to choose the party’s next leader, who will have a strong chance to serve as prime minister as well. Potential successors including Sanae Takaichi and Shinjiro Koizumi. The primary reason for Ishiba’s resignation was LDP’s poor performance in two national elections since he took office in October 2024. The party lost its majority in both the powerful Lower House and the Upper House of the Japanese Diet. Following the electoral losses, pressure for Ishiba to step down intensified from within the LDP. Facing a vote on holding an early leadership election – which would have effectively served as a no-confidence-vote – Ishiba chose to resign to avoid a formal challenge. In addition, public dissatisfaction over the rising cost of living also contributed to his declining approval ratings.

On September 8th, the government of French Prime Minister Francois Bayrou was toppled by a no-confidence vote in the National Assembly. The vote passed with 364 deputies voting against the government, while only 194 voted in favor. The vote was triggered by Bayrou’s highly unpopular plan to pass a budget that included a 44-billion-euro austerity package. The plan, which was aimed to slash France’s public debt, was widely rejected by opposition parties on both the left and the far-right. Bayrou had called the no-confidence vote himself to force Parliament to back his budget plan. Following the vote, Bayrou submitted his resignation to President Emmanuel Macron. This marks the second time in less than a year that a Prime Minister has been ousted by a no-confidence vote, deepening France’s political crisis.

In Thailand, the Constitutional Court had dismissed suspended Prime Minister Paetongtarn Shinawatra from office for an ethical breach over her private conversation with Samdech Techo Hun Sen, President of the Senate of Cambodia. The decision was made on August 29th, when the nine judges of the Constitution Court voted 6-3 against Ms. Paetongtarn, saying that she had violated the ethical standards a prime minister is subjected to under the Constitution. The ruling by the court means the suspended prime minister will be immediately removed from office, together with her entire Cabinet. On September 5th, Bhumjaithai Party leader Anutin Charnvirakul was chosen as Thailand’s 32nd prime minister. The opposition People’s Party, the largest parliamentary bloc with 143 seats, agreed to support a Bhumjaithai minority government if certain strict conditions were met. The main condition was that the House must be dissolved within four months of the government presenting its policy plans, paving the way for a new election, which is likely to be in February or March next year. Mr. Anutin had pledged to focus on tackling the high cost of living and elevated household debt levels, besides taking steps to address a currency rally that has been threatening the country's exports and tourism.

Fitch Ratings recently downgraded its outlook on Thailand’s Long-Term Foreign-Currency Issuer Default Rating to negative from stable, while affirming the rating itself at BBB+. The downgrade was primarily attributed to a combination of political instability, fiscal deterioration, and sluggish economic growth. Fitch highlighted the erosion of Thailand’s fiscal buffers. Public debt has been steadily rising and now stands at 59.4% of GDP, a significant increase from pre-pandemic levels and close to the median for BBB-rated countries. The agency also projected continued budget deficits in the coming fiscal year, while there has been a lack of a clear plan to reduce the deficits in the medium term, especially in light of the ongoing political uncertainty. Fitch’s forecasts for Thailand’s economic growth in 2025 and 2026 are relatively low, below the average for other countries in the BBB rating category. The report noted that key sectors like tourism and exports have not yet fully recovered, which has been contributing to the weak economic outlook. This outlook downgrade by Fitch followed a similar move by Moody’s Ratings earlier in the year, which had also changed Thailand’s outlook to negative due to similar concern.

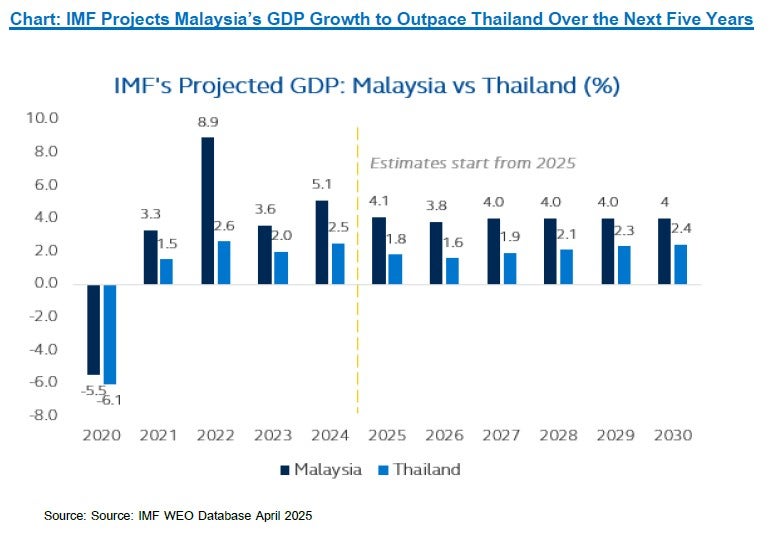

The Thailand downgrade news has highlighted an opportunity in Malaysian fixed income as the better opportunity market than Thai fixed income. Malaysia is emerging as one of the more attractive destinations for fixed income investment in Asia, backed by solid macroeconomic fundamentals, a supportive policy environment, and a resilient bond market. The International Monetary Fund (IMF) has projected a real GDP growth of 4.1% for Malaysia in 2025. Key driver of strong GDP growth is strong domestic demand supported by stable labor market, along with measures to increase household income, such as targeted cash transfers and wage increases. Public and private investment will also be a significant contributor to growth. The government is advancing strategic projects under the 13th Malaysia Plan (13MP) for the period 2026-2030. Key initiatives like the New Industrial Master Plan 2030 (NIMP 2030) and the National Semiconductor Strategy (NSS) are attracting both foreign and domestic direct investment, particularly in high-value sectors like semiconductors, aerospace, and renewable energy. The Visit Malaysia 2026 campaign is expected to provide a significant boost to the tourism sector, further contributing to services growth. Headline inflation has remained moderate, with the annual rate in August at 1.3%. Bank Negara Malaysia has been in an accommodative monetary policy stance. On September 20th, S&P Global Ratings (S&P) reaffirmed Malaysia’s sovereign credit ratings at ‘A-‘ with a stable outlook. S&P said that the stable outlook reflects their expectation that Malaysia’s growth momentum and prevailing policy environment will allow modest improvements in fiscal performance over the next two to three years. Additionally, S&P said Malaysia’s economy is well-diversified and resilient in times of adversity, while acknowledging the government’s commitment to fiscal consolidation through subsidy reforms and revenue enhancement measures.

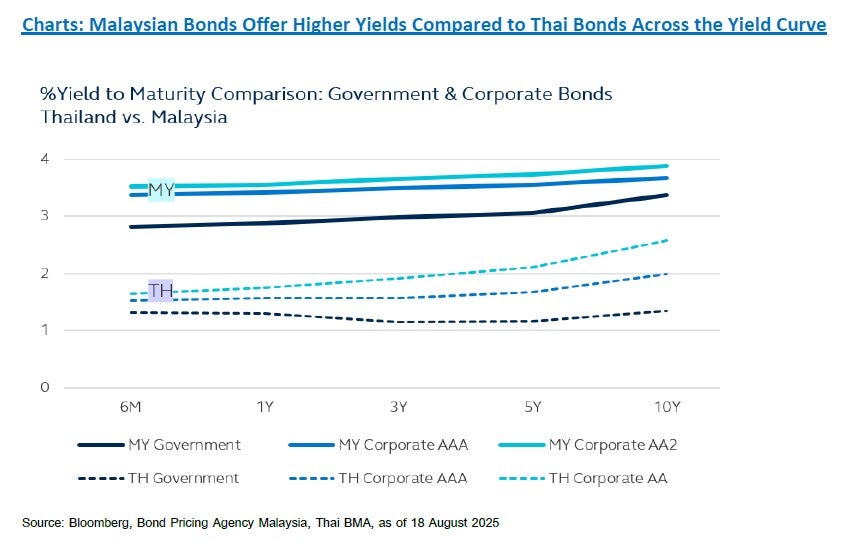

From a fixed income investment perspective, Malaysian bonds currently offer a notably more attractive yield profile compared to Thai bonds. Both Malaysian Government Securities (MGS) and high-quality corporate bonds provide yields approximately 2% higher across most segments of the yield curve. For instance, as of August 18th, the 5-year Malaysian government bond offers a yield-to-maturity (YTM) of 3.06%, significantly exceeding the 1.16% YTM of an equivalent Thai government bond. This yield differential presents a compelling opportunity for income-focused investors seeking enhanced returns in a relatively stable market environment. In addition to offering higher yields, Malaysia holds a monetary policy advantage. The country remains in the early phase of its interest rate easing cycle, with Bank Negara Malaysia having reduced its policy rate only once in the past five years — from 3.00% to 2.75% this year. By contrast, the Bank of Thailand has implemented four policy rate cuts, lowering its rate to 1.50%. Malaysia’s relatively wider policy room provides a more supportive backdrop for fixed income investors, with greater potential for future bond price appreciation should further easing occur. Moreover, the Malaysian credit market demonstrates a lower historical default rate, underscoring its relative credit stability. Between 2017 and the present, Malaysia has recorded only six bond defaults, compared to seventeen in Thailand over the same period.

Notably, from 2024 to date, there have been no reported bond defaults in the Malaysian credit market. This reinforces the strength of Malaysia’s credit framework and enhances the attractiveness of Malaysian bonds as instruments for both income generation and capital preservation.

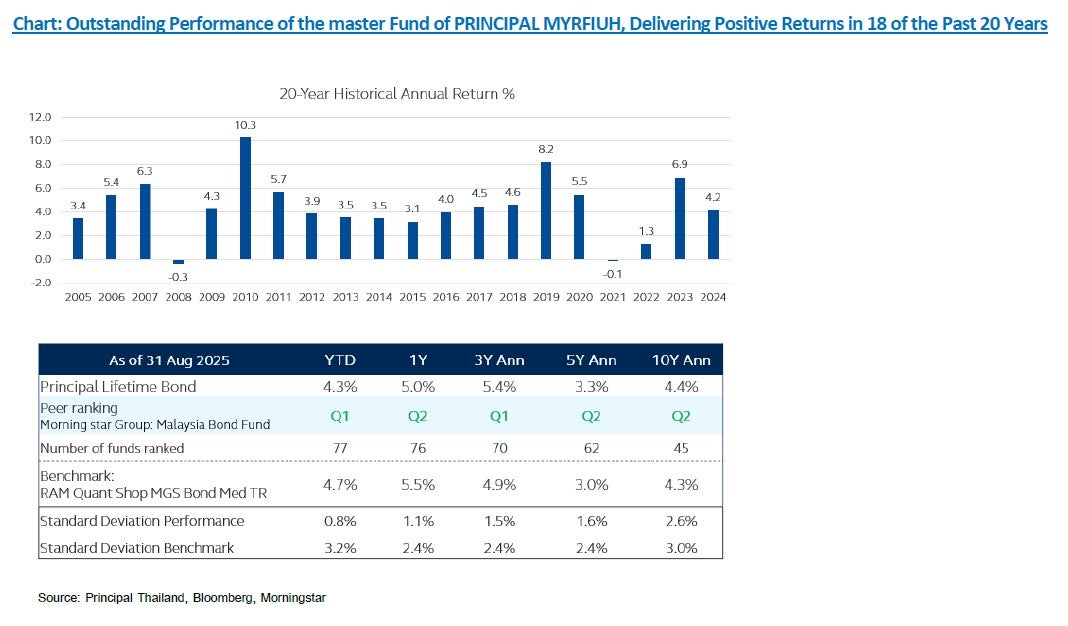

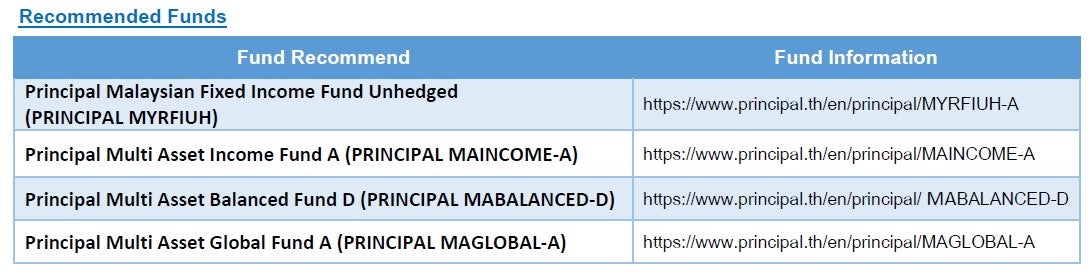

Given this favorable combination of higher yields, an accommodative monetary policy stance, and lower credit risk, Malaysian fixed income securities present a compelling proposition for investors seeking to diversify their portfolios and enhance overall return potential. In light of these positive fundamentals, we recommend the Principal Malaysian Fixed Income Fund Unhedged (PRINCIPAL MYRFIUH) — the first fund in Thailand to invest in Malaysia’s fixed income market. The fund invests in the Principal Lifetime Bond Fund (master fund), which has nearly 30-year track record of consistent performance. The master fund primarily focuses on Malaysian government and investment-grade corporate bonds. As of July 2025, the portfolio maintains a credit rating range from AAA to AA1, with an effective duration of 4.41 years and a yield to maturity of 3.79%. The investment process is well disciplined, combining top-down macroeconomic analysis with rigorous bottom-up credit evaluation. This prudent management style has contributed to a strong long-term performance track record and zero default since the fund’s inception. The master fund has demonstrated resilience across market cycles, delivering positive returns in 18 of the past 20 years. In 2023, the master fund achieved a return of 6.9%, while its best annual performance was recorded in 2010 at 10.3%. Even during periods of significant market volatility, such as the Global Financial Crisis in 2008 and the sharp interest rate hikes in 2021, the fund exhibited minimal drawdowns of only -0.3% and -0.1%, respectively. These outcomes highlight the effectiveness of the fund’s risk management and conservative portfolio construction. Moreover, the fund has consistently ranked within the first or second quartile among its peers. As of August,, the year-to-date return stands at 4.3%, the one-year return at 5.7%, and the three-year average annual return at 5.4%. This consistent performance reflects the fund’s ability to generate steady income even in uncertain market environments.

With the Thai fixed income market currently characterized by lower yield levels and heightened volatility, PRINCIPAL MYRFIUH offers a timely and attractive alternative for investors seeking better risk-adjusted returns. The fund provides strategic diversification into a more favorable interest rate environment, with the potential for higher yields and historically lower default risk. It is well-positioned as a core holding for investors aiming to enhance income while preserving capital over the medium to long term. PRINCIPAL MYRFIUH is available for IPO until 10 October 2025. We encourage investors to seize this opportunity to gain exposure to Malaysia’s high-quality fixed income market through a professionally managed vehicle with a proven track record and strong fundamental support.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL MAGLOBAL has highly concentrated investment in US. Therefore, investors should consider the overall diversification of their investment portfolio. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results/ PRINCIPAL MYRFIUH has highly concentrated investment in Malaysia. Therefore, investors should consider the overall diversification of their investment portfolio. The fund has a policy to invest in foreign investments, and investors may incur losses or gains due to exchange rate fluctuations. PRINCIPAL MYRFIUH does not hedge against foreign exchange risk (unhedged). As a result, the fund is exposed to currency risk, which may cause investors to incur losses from exchange rate movements or receive less than their initial investment.