CIO View: April 2024

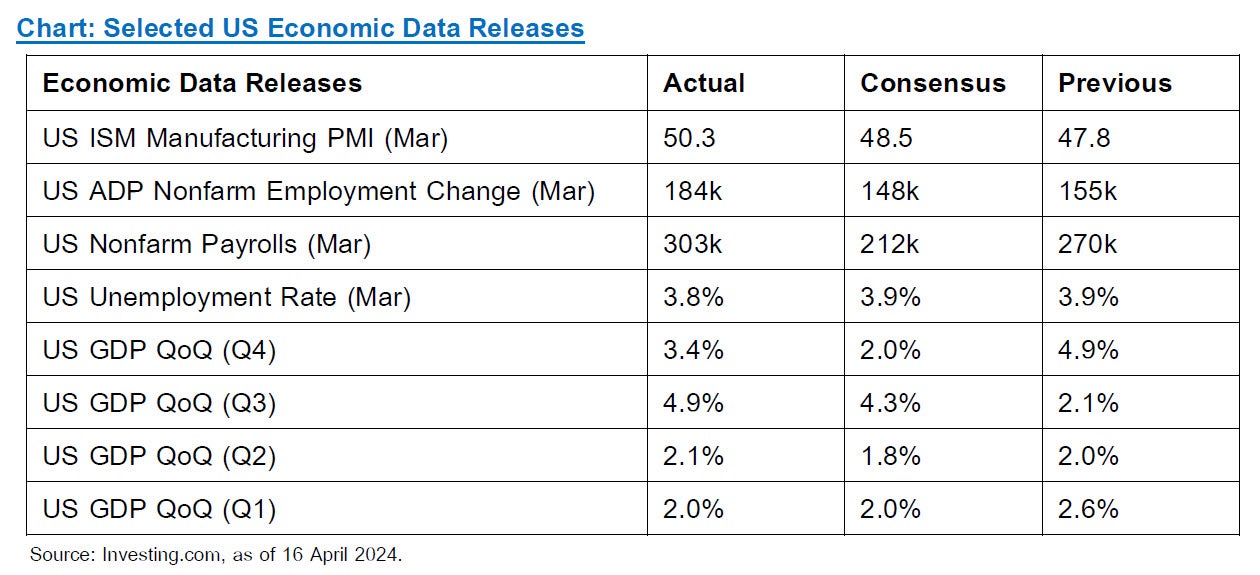

Recent US economic data has outperformed expectations, raising questions about the Federal Reserve's monetary policy trajectory. The ISM Manufacturing PMI for March surprised at 50.3, exceeding the anticipated 48.5. Similarly, labor market data impressed, with ADP Nonfarm Employment Change exceeding forecasts (184,000 vs. 148,000) and Nonfarm Payrolls surging to 303,000 (against expectations of 212,000). This robust job growth was accompanied by a decline in the unemployment rate to 3.8%, lower than the projected 3.9%. Indeed, the US economy grew strongly over the last two quarters of 2023, averaging at 4.2% annualized rate, which was a significant increase from the 2.0% average annualized rate achieved during the first two quarters of last year.

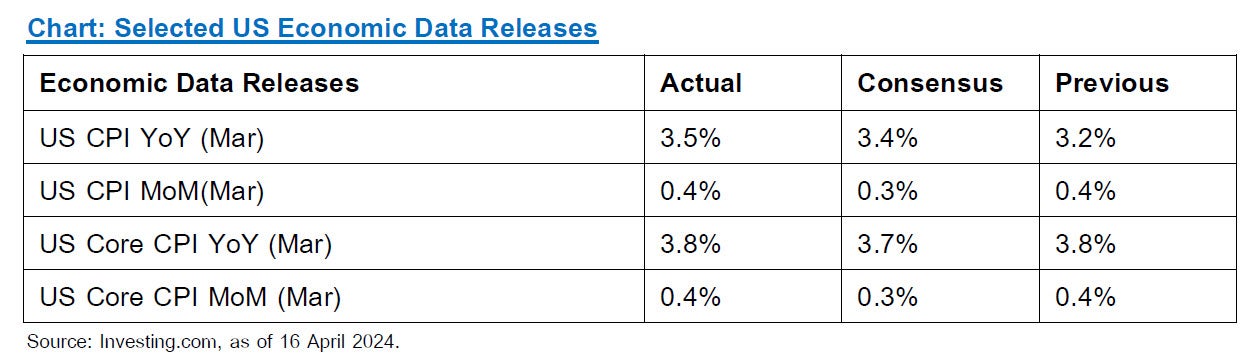

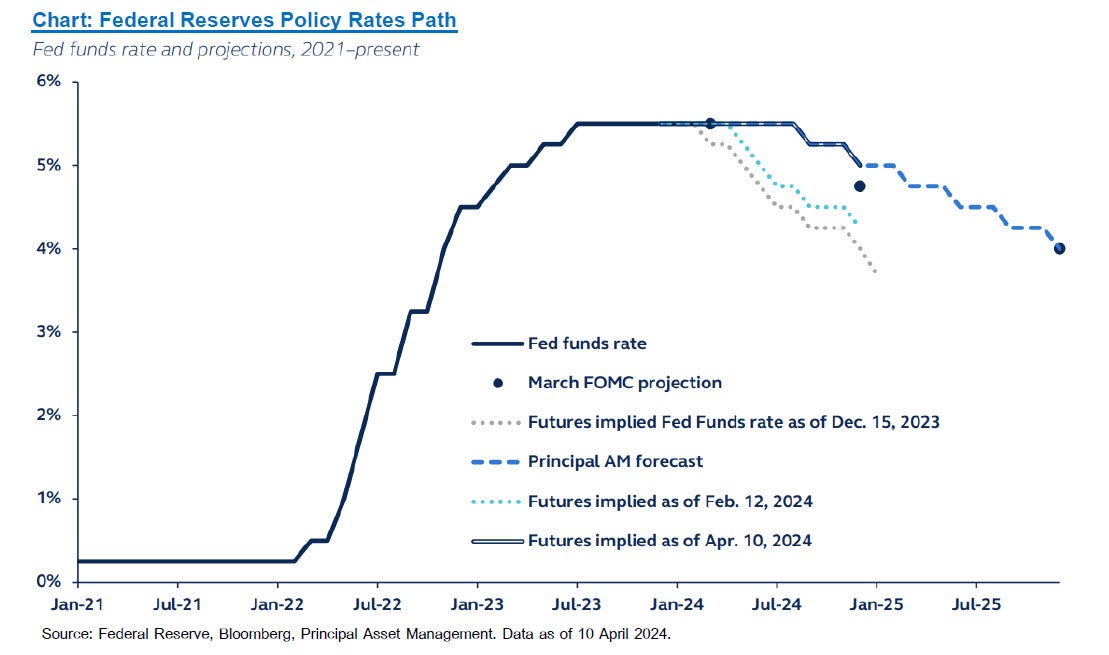

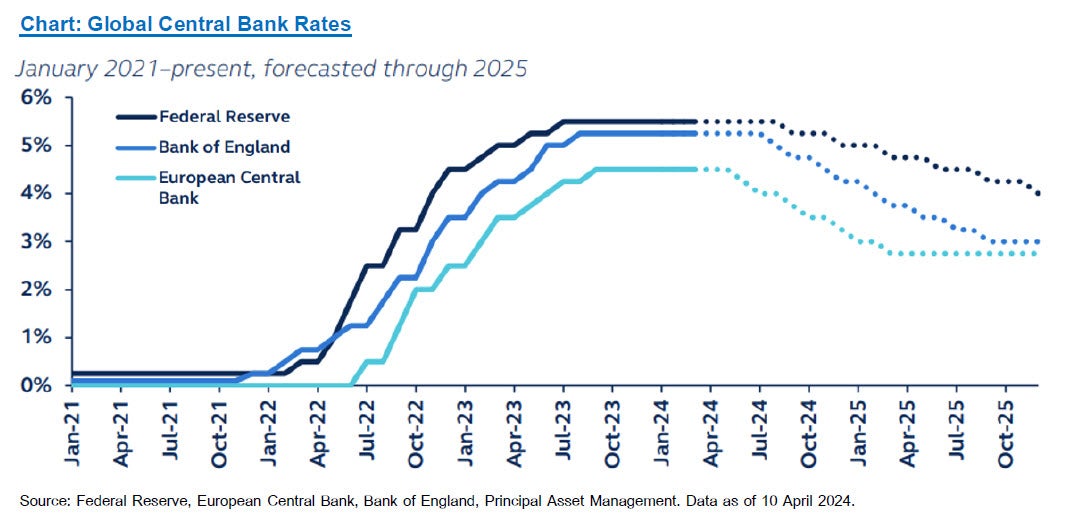

However, inflation data has also shown upside surprises. Consumer Price Index (CPI) for March climbed 3.5% year-over-year, exceeding the anticipated 3.4%. This inflation rise translates to a 0.4% increase from February, which was higher than the expected 0.3%. Core inflation followed a similar trend, rising 3.8% year-over-year (against expectations of 3.7%) and increasing 0.4% from February (exceeding the 0.3% forecast). These strong growth and inflation figures suggest the Fed may maintain higher interest rates for a longer period. Our analysis of market expectations for future rate cuts by the Fed reveals a downward revision from six rate cuts at the beginning of the year down to less than two cuts currently expected by the market. The Fed has made it clear through its Dot Plot and press releases that it wants to go ahead with rate cuts this year. Note that when the Fed revised upward their expectation on growth and inflation, they continued to expect 75 basis points of rate cuts in 2024. It will be interesting to see if this changes in time when they take in the new data into consideration. We think that with the strength of the US economy, only one cut is now required; however, the Fed’s clear desire for three cuts must be taken into account. Our global colleagues in charge of global market forecasting have revised their forecast from three cuts to two cuts in 2024, with the first one coming in September. However, it is quite clear that the direction of strong growth and high inflation, coupled with a US election in November means that there may just be one cut happening in Q4.

The European Central Bank (ECB) will be moving ahead of the Fed starting with the ECB in June. The ECB is struggling with weak economies and have clearer need for monetary policy stimulus than the Fed. Indeed, recent data releases were a mix of positive and negative signals that overall still point towards earlier rate cuts than the Fed. Service PMI increased to 51.5 in March, suggesting relatively stronger service sector compared to the manufacturing sector. Unemployment rate remained stable at 6.5% in February, indicating a healthy labor market. Inflation has been on a downward trend, falling to 2.4% in March from 2.6% in February. Economic sentiment has improved in March, suggesting a more optimistic outlook for businesses. On the other hand, industrial production continued to contract in February at -6.4%. The manufacturing PMI also remained below 50 since August 2022, suggesting an entrenched weakness in the manufacturing sector. Overall, the Eurozone economy grew by a mere 0.1% in Q4 last year compared to a year ago, while the economy was flat at 0.0% growth rate from the previous quarter, suggesting a very sluggish economy. Last week, the ECB kept its benchmark deposit rate at an all-time high of 4%. They also signaled that with the Eurozone predicted to grow only slowly this year and inflation continuing to fall towards its 2% target, it expects to start cutting the policy rate in June.

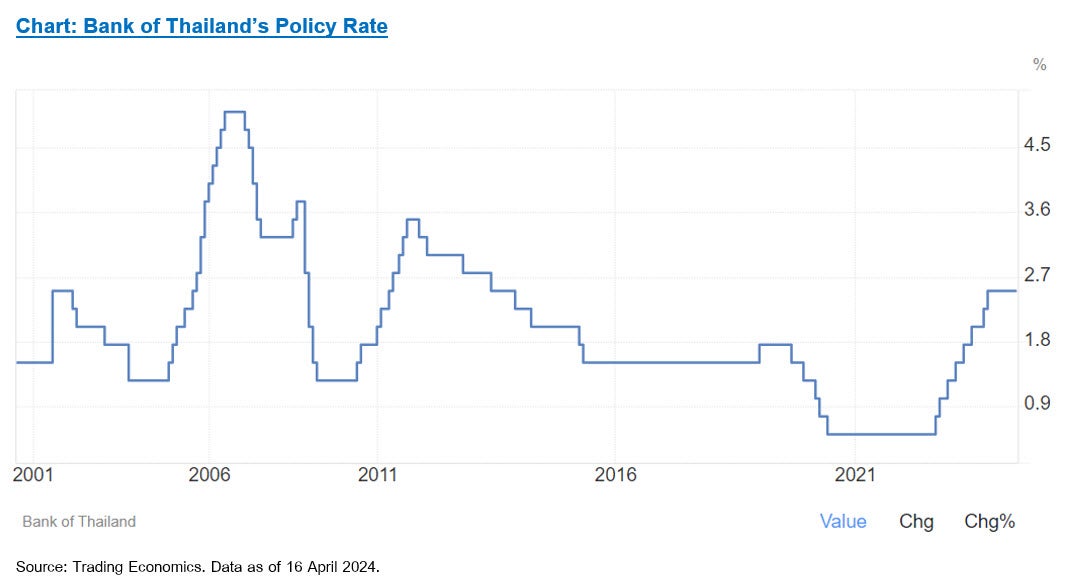

The Bank of Thailand (BOT) has adopted a more cautious stance on monetary policy. At their last meeting, the MPC voted 5-2 to maintain the policy rate at 2.5%. This echoes the previous meeting in February, where a similar 5-2 vote held the rate steady. The BOT cites Thailand's projected economic improvement in 2024, driven by rising consumption, tourism, and public spending. Additionally, they expect inflation to rise towards the year's end. The majority view (5 votes) on the MPC emphasized that the current rate safeguards macro-financial stability and that monetary policy has limited effectiveness in addressing structural issues. However, the dissenting minority (2 votes) advocated for a rate cut, citing Thailand's lower potential growth due to structural challenges and the potential to alleviate borrower debt burdens. With the change in tone of the BOT to being more hawkish compared to previously, we are revising our expectation for two rate cuts by the BOT to now expect them to be on hold throughout this year

The government's recently announced details for the Digital Wallet scheme introduce a fiscal stimulus element to the economic outlook. On the same day that the result of the MPC meeting was announced, Thailand’s Prime Minister also made an announcement on further details for the Digital Wallet scheme. The Thai PM has confirmed the government’s intention to move forward with the Digital Wallet program, expecting it to be launched during Q4. The government plans to fund the digital wallet scheme by using Bt175 billion from FY2024 budget, Bt152 billion from FY2025 budget, and Bt173 billion by borrowing from the state-owned Bank for Agriculture and Agricultural Cooperative. The long-delayed FY2024 fiscal budget has already passed the National Assembly earlier in March and is now awaiting an announcement in the Royal Gazette before it can be disbursed. With public spending due to be picking up starting from Q2 with the passage of the fiscal budget for FY2024, we expect Thailand’s economic activity to be picking up meaningfully for the rest of the year. This should lead to better sentiment from local investors and foreign investors alike. Therefore, we expect significantly better outlook for Thai equities starting from Q2. However, a medium-term risk on financial stability would need to be closely monitored, as the funding of the Digital Wallet scheme would potentially push the public debt to reach the 70% ceiling faster than expected, especially if the program failed to push Thailand’s economic growth over the medium term like the government expected.

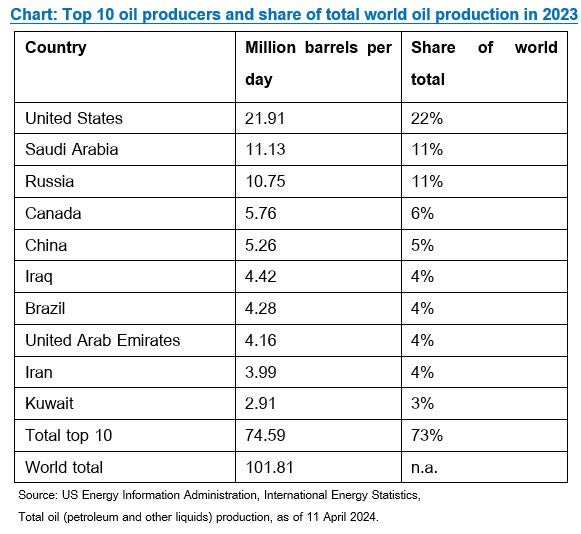

Geopolitical tensions pose a growing threat to commodity prices. The recent drone strike on Ukraine by Russia raises concerns about potential disruptions to global oil supply. Russia could be forced to curtail crude production or even ban gasoline exports in retaliation, pushing prices higher. Additionally, Iran's unprecedented direct military attack on Israel using hundreds of drones and missiles intensifies the risk of a wider conflict in the Middle East. Iran, as OPEC's fourth-largest oil producer, holds significant crude oil reserves. Any escalation could lead to a significant spike in oil prices. The combination of above-trend economic growth and rising geopolitical tensions creates a challenging environment for central banks. While inflation concerns have recently eased, the current situation increases the likelihood of inflation re-emerging as a significant issue. The recent rise in oil prices adds to existing inflationary pressures caused by supply chain disruptions and strong demand for goods. Central banks will need to carefully navigate this complex situation to maintain price stability without derailing economic growth. The current environment suggests that inflation may re-emerge as a significant problem for both policymakers and markets.

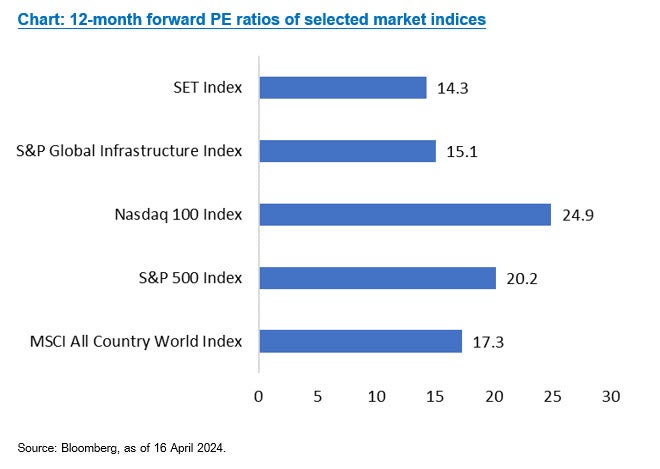

Global equity markets have delivered strong returns over the past twelve months. The MSCI ACWI Index gained 18%, with a forward PE ratio of 17. The S&P 500 outperformed, rising 24% with a forward PE of 20. The NASDAQ 100 led the pack with a 37% increase, though its forward PE is the highest at 25. This performance skew highlights the dominance of large-cap growth stocks in the recent rally.

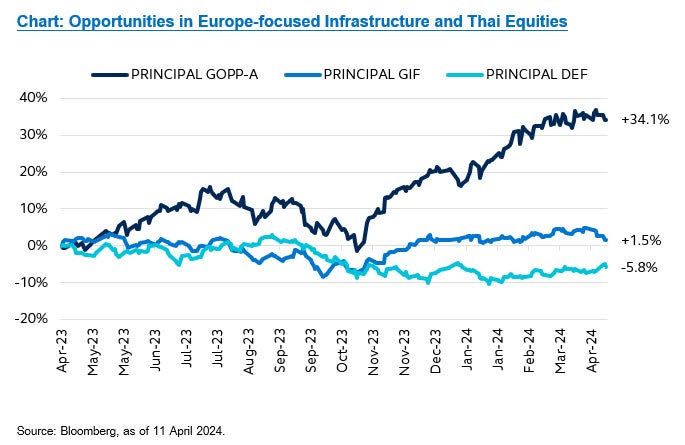

In contrast, the S&P Global Infrastructure Index has remained stagnant over the past year, with a forward PE of 15. This significant valuation discount compared to the broader market, particularly growth stocks, presents a potential opportunity. Given the revised expectations of fewer Fed rate cuts this year coupled with extremely expensive valuations, we recommend profit-taking on large-cap growth exposure (e.g., PRINCIPAL GOPP – Principal Global Opportunity Fund) and reallocating towards undervalued and defensive sectors like infrastructure (e.g., PRINCIPAL GIF – Principal Global Infrastructure Equity Fund). With the prospect of the ECB moving with rate cuts ahead of the Fed, this raises the outlook for European assets that have both a defensive and an interest-rate sensitive characteristics such as PRINCIPAL GIF, which is more geared towards European exposure.

Thailand offers another compelling tactical play. As previously discussed, the recent passage of the fiscal budget paves the way for increased government spending, fueling economic momentum in the second half of 2024. The Thai equity market's 10% decline over the past year, coupled with a forward PE of 14, positions it attractively relative to both historical valuations and global peers. We believe this is a suitable entry point for PRINCIPAL DEF (Principal Dividend Equity Fund). The time is right for a reallocation from global equities towards Thai equities in the portfolio.

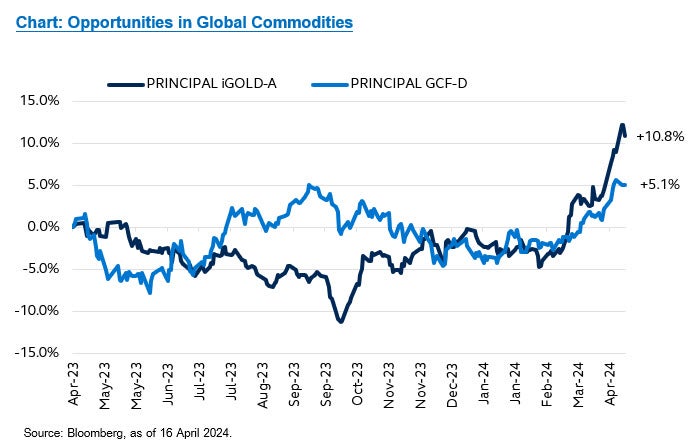

The escalation of geopolitical tensions reinforces the need for commodity exposure, particularly crude oil. While the S&P GSCI Commodity Index has seen muted performance in the past year, we anticipate price increases due to the evolving geopolitical landscape. To hedge against this risk, a higher allocation to PRINCIPAL GCF (Principal Global Commodities Fund) is recommended.

Finally, gold's 18% gain over the past year can likely be attributed to both expectation of rate cuts by the Fed and speculative positioning by speculative traders. However, with several potential rate cuts already priced into the current market price, correction risks are rising. Given the recent price appreciation, we recommend considering profit-taking on PRINCIPAL iGOLD (Principal Gold Income Fund).

Recommended Fund

Read CIO View: April 2024

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision / PRINCIPAL GIF has highly concentrated investment in Europe, United Kingdom and North America. So, investors have to diversify investment for their portfolios. / PRINCIPAL GCF is high risk and complex. Investors are advised to seek additional advice from official before making an investment decision. / PRINCIPAL GCF has higher risk than other mutual funds. Therefore, it is suitable for investors who prefer high return and able to accept more investment risks than general investors. / PRINCIPAL GOPP has highly concentrated investment in North America. So, investors have to diversify investment for their portfolios. / PRINCIPAL iGOLD, since the fund has a policy to invest in foreign countries, the fund may have exchange rate risk. Investors may lose or receive foreign exchange gains / or receive a lower return than the initial investment. However, the Fund will hedge the exchange rate risk not less than 90% of the value of the invested asset Investing in Investment