Principal Update: CIO's View July 2021

Principal Update: CIO's View July 2021

By Khun Supakorn Tulyathan, Chief Investment Officer

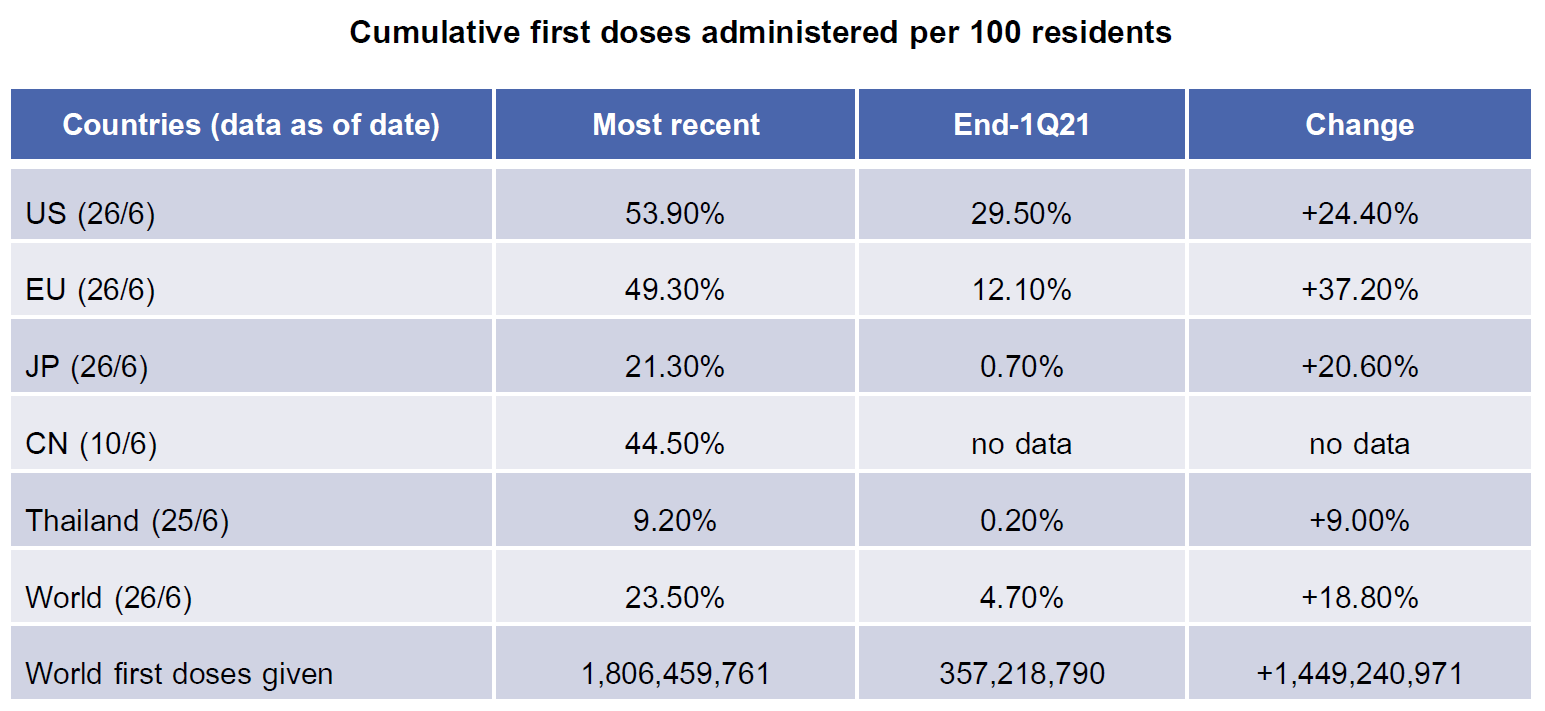

The global economy has seen a significant progress in terms of the vaccination rates. Information from vaccination data based on the Financial Times would put the number of people, who have already received their first shot globally, at around 1.8 billion people, or accounting for around 23.5% of the global population. This is a significant improvement compared to the situation at the end of the first quarter, when only about 4.7% globally have been given their first dose. We think that the outlook of the global economy would still depend a great deal on how fast people can be vaccinated.

Looking at large economies, the US has already given first doses to 53.9% of the population; the European Union has already vaccinated 49.3%; Japan has already vaccinated 21.3%; and China has already vaccinated 44.5% (official data as of June 10 only). These large economies have exhibited a great deal of vaccination progress over the past quarter. Looking at Thailand, we’ve only administered the first dose of the Covid vaccine to around 9.2% of the population as of June 25th. Even though it is quite low compared to these other large economies, it is still a significant improvement from 0.2% at the end of last quarter.

source: The Financial Times; data as of 26 June 2021; retrieved from https://ig.ft.com/coronavirus-vaccine-tracker/?areas=tha&cumulative=1&d…

As many countries have successfully brought down infection cases, and vaccinated a significant number of their population, they were able to loosen up their lock-down measures and increase their economic activities.

![]() In the US, retail sales growth was 40% per month during April and May, compared with 14% per month during the first quarter. And the NFIB Small Business Optimism Index was 99.7 per month during April and May, compared with 96.3 per month during the first quarter.

In the US, retail sales growth was 40% per month during April and May, compared with 14% per month during the first quarter. And the NFIB Small Business Optimism Index was 99.7 per month during April and May, compared with 96.3 per month during the first quarter.

![]() In Europe, retail sales growth was 18% per month during April and May, compared to negative 2.9% growth per month during the first quarter. And the Eurozone Services Sentiment Index improved to 6.7% per month during April and May, compared to negative 14.7% per month during the first quarter. Europe has been able to innoculate people as a faster rate in the past few months; and they are approaching 50% of the population soon, following the US, which has already passed the 50% mark.

In Europe, retail sales growth was 18% per month during April and May, compared to negative 2.9% growth per month during the first quarter. And the Eurozone Services Sentiment Index improved to 6.7% per month during April and May, compared to negative 14.7% per month during the first quarter. Europe has been able to innoculate people as a faster rate in the past few months; and they are approaching 50% of the population soon, following the US, which has already passed the 50% mark.

![]() However, economic activities grew at a lesser rate in China, as retail sales number grew by 15.2% per month during April and May, compared to 24.2% growth rate per month seen during the first quarter. But China’s service sector seemed to be doing better, as Caixin China Services Purchasing Managers Index increased to 55.7 per month during April and May, compared to 52.6 a month during the first quarter.

However, economic activities grew at a lesser rate in China, as retail sales number grew by 15.2% per month during April and May, compared to 24.2% growth rate per month seen during the first quarter. But China’s service sector seemed to be doing better, as Caixin China Services Purchasing Managers Index increased to 55.7 per month during April and May, compared to 52.6 a month during the first quarter.

![]() In Japan, we have seen lackluster number in the service sector, as the Japan Services Purchasing Managers’ Index remained at around 47.3 per month during the first six months. However, large companies, reported by the Japan Reuters Tankan Index, significantly improved to 18.7 per month during April and May, compared to 2.7 a month during the first quarter. The focus on Japan has been on the fast-approaching Tokyo Olympics due to take place later in July. We will follow up later how and whether the event affects infection cases there.

In Japan, we have seen lackluster number in the service sector, as the Japan Services Purchasing Managers’ Index remained at around 47.3 per month during the first six months. However, large companies, reported by the Japan Reuters Tankan Index, significantly improved to 18.7 per month during April and May, compared to 2.7 a month during the first quarter. The focus on Japan has been on the fast-approaching Tokyo Olympics due to take place later in July. We will follow up later how and whether the event affects infection cases there.

![]() As for Thailand, despite the negative 2.6% first quarter GDP growth, we have seen significant improvement in the export sector, as the export growth has been averaging at 27.3% per month during April and May, compared to just 2.1% during the first quarter. The economy seems to be doing better, but we need to pay close attention to the uneven outbreaks and vaccinations.

As for Thailand, despite the negative 2.6% first quarter GDP growth, we have seen significant improvement in the export sector, as the export growth has been averaging at 27.3% per month during April and May, compared to just 2.1% during the first quarter. The economy seems to be doing better, but we need to pay close attention to the uneven outbreaks and vaccinations.

Investment Outlook 2H/2021

Looking ahead to the rest of 2021, we think there are still some risks around the investment outlook. Inflation numbers coming out of the US have been increasing at a higher rate, pointing to an economy that may be getting too hot. However, the latest inflation expectation numbers are starting to come down, after it has been increasing for the good part of the year, which may point to the market’s underlying confidence that the Fed will be able to reign in the future inflationary pressure. The recent FOMC meeting in June has seen its members moved up their expectation of the first-rate hikes to 2023, which came as a surprise to the market. This may mean that the Fed will start to reduce their QE program within this year, which will also come as a surprise to people as well. Additionally, there is still the inconclusive risk that the potential tax increase that will need to be announced by the Biden administration, will come as another negative factor to the overall investment outlook. However, we still think that the infrastructure investment bill currently being discussed between the Democrats and the Republicans, totaling $579 billion in new spending money, will prove as a strong support for the investment backdrop.

Coming back to the investment outlook in Thailand, our development of the infection rates and the progress of the vaccination would, by and large, determine the direction of the markets in the second half of the year; along with the new initiative to jumpstart the tourism sector via the Phuket Sandbox measure. This means that, overall, we have a positive view on developed market equities, especially the US and Europe, that should have a strong earnings growth trajectory. We are turning a bit more positive, in the next 12 months, on Thai equities and REITs as well. We believe that we should enter 2022 with significantly more people having received their first doses by that time; which would then lead to a looser lockdown measure and increased level of economic activities. Thai equities and REITs are also considered as laggard, compared to developed market countries. The ownership level of foreign investors is also quite low, after continued foreign outflows during the first six months; therefore, improvement in the vaccination rates could attract these flows back into the market later in the year.

source:

- The Financial Times; data as of 26 June 2021; retrieved from https://ig.ft.com/coronavirus-vaccine-tracker/?areas=tha&cumulative=1&d…

- Investing.com; data as of 26 June 2021; retrieved from https://www.investing.com/economic-calendar/

- Politi, J. & Fedor, L. (2021, June 25). Biden agrees slimmed-down $1tn infrastructure deal with senators. The Financial Times Limited 2021. https://www.ft.com/content/b262ed46-152d-42bd-9a6d-b70d679bb282