Monthly Report as of September 2023 for PVD Members

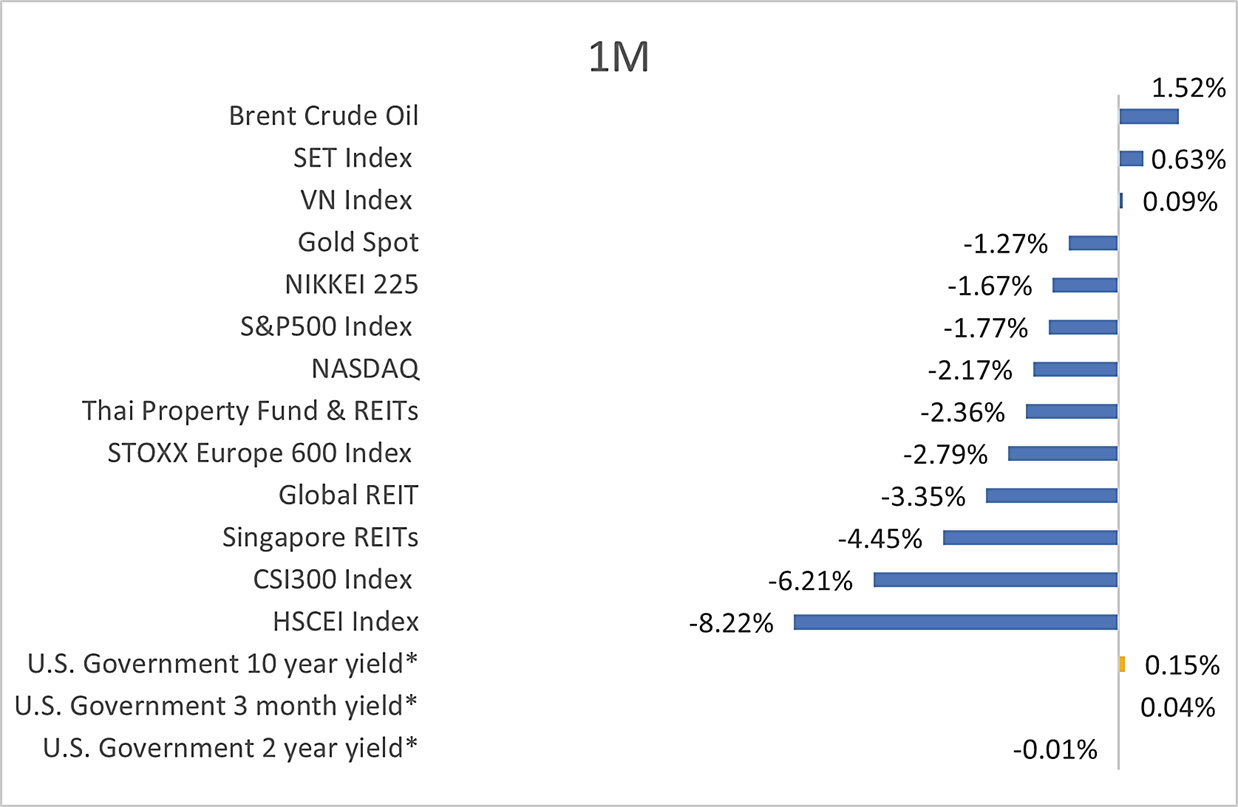

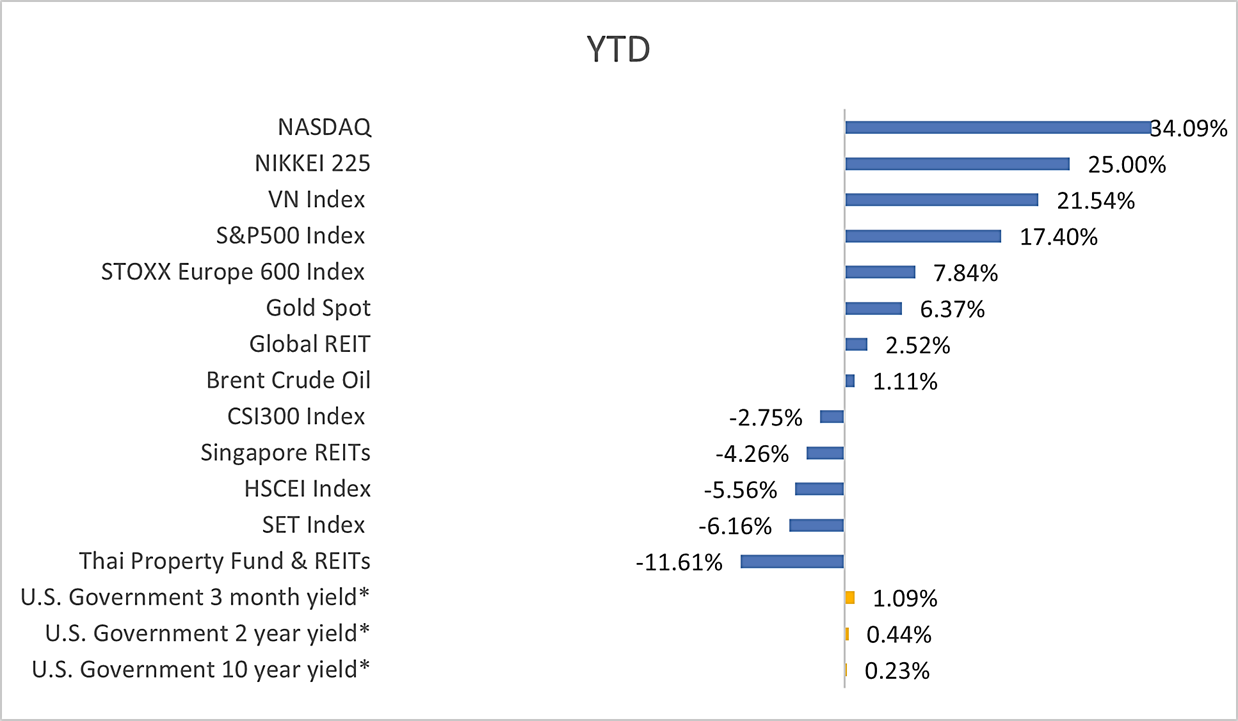

Global Markets Performance in August 2023

Note*: This shows a change in yield not price return.

Source: Bloomberg as of 31 August 2023

Market Review for August 2023

Global stock market mostly delivered negative returns and had more volatility in August particularly in China stock market which dropped dramatically because of troubles with the property sector such as the missed payment of Country Garden. However, Thai and Vietnam stock markets would be able to give small returns. US inflation and the message Jerome Powell delivered at Jackson Hole Symposium about opening an opportunity for an interest rates hike during the fourth quarter resulted in a rise of the U.S. treasury yield.

US Stock Market:

S&P500 Index declined by 1.77% in August 2023. The index dropped significantly during the first half of the month before getting started to recover. At the start of the month, the credit rating agency Fitch downgraded the US government’s credit rating from AAA to AA+ because of unsustainable debt and continuous deficit trajectories. Nevertheless, the US Labor market pointed out a cooling sign of the labor market with payroll job gains of 187,000, slightly less than markets’ expectation of 200,000, probably leading to a decline in inflation in the foreseeable future. Headline CPI in July increased slightly to 3.2% YoY due to higher food and energy prices. In the end of the month, the message conveyed by Jerome Powell at Jackson Hole Symposium suggested that the Fed’s policy in next meetings would remain data dependent.

EU Stock Market:

STOXX Europe 600 Index dropped by 2.79% in August 2023. Overall EU economy is still uncertain as the August composite PMI decreased to 47, its lowest level (ex-Covid) since 2012, showing a signal of economy contraction. While headline EU CPI in August remained flat in August at 5.3% YoY in line with what markets expected, core inflation fell modestly from 5.5% YoY in July to 5.3% YoY in August. However, due to stubbornly high inflation ECB tends to hike its interest rates during the rest of this year.

China Stock Market:

In August, China stock indexes both A-Share and H-Share dramatically decreased from the previous month by 6.21% and 8.22%, respectively. The main reason for the turbulence came from liquidity crisis in the real estate sector, especially in top largest real estate developer such as Country Garden. Meanwhile, many economic indicators displayed the negative signal of China’s current economy. Consumption in China was not fully recovered in August resulting in low inflation rate of 0.1% YoY. Furthermore, export sector contracted by 8.8% YoY from low global demand and the U.S. – China trade war, although China’s central bank, PBOC, put efforts to stimulate the economy and loan demand by decreasing 1-year medium-term lending rate (MLF) and 1-year loan prime rate (LPR) in August.

Japan Stock Market:

NIKKEI225 index slightly dropped by 1.67% from last month. Inflation and core inflation in August rose from July to 0.1% MoM and 0.4% MoM (or 2.9% YoY and 2.6% YoY), respectively. As the inflation has been higher than Bank of Japan’s target of 2% for 16 consecutive months, domestic consumption has continued to be weak. However, Japan economy has benefited from Yen currency depreciation, which directly improves the export sector. The textile exports increased by 9.4% YoY in August. Besides, the number of international tourists in the first half of the year was close to the pre-Covid level. From January to July, there were 10.7 million tourists approximately accounting for 70% of the number of tourists in 2019.

Vietnam Stock Market:

VN Index in August stayed at the same of last month level after considerably climbed up in previous months thanks to several economic stimulus policies and monetary easing. The inflation in August rose to 0.88% MoM (2.96% YoY), which was the biggest increase during the past five months, caused mainly by higher food prices. Export in August decreased by 7.6% YoY from economic contraction of Vietnam’s major partners, including China, the U.S. and Europe. Nowadays, domestic consumption becomes Vietnam’s main economic driver, as shown by retail sales, which rose from 7.1% YoY in July to 7.6% YoY in August.

Fixed Income Market:

The US 2-year Treasury yield and 10-year Treasury yield rose to 5.08% and 4.34%, respectively, during August 2023. In the Jackson Hole meeting, Fed Chairman Jerome Powell indicated that while inflation has declined drastically from its peak, it remains above the target level of 2%, necessitating a further interest rate hike. However, the US 2-year Treasury yield and 10-year Treasury yield fell at the end of the month due to mixed economic data. While Core PCE and PCE inflation data went up as expected, overall employment figures showed a cooling labor market. This caused investors to expect that the Fed will keep interest rates unchanged in September 2023. Meanwhile, the yield on 2-year and 10-year Thai government bonds rose slightly to 2.22% and 2.60%, respectively, at the end of August 2023, as the Bank of Thailand (BoT) raised interest rates by 0.25% to 2.25% at the August meeting. We believe that interest rates at the current level have probably reached their peak. While inflation rose by 0.88% in August, it remains below the target level.

REITs:

The Global REITs and Singapore REITs index dropped by 3.35% and 4.45%, respectively in August 2023 as bond yield increased following the statement by the Fed Chairman at the Jackson Hole meeting, which led to a decrease in REITs. Regarding Singapore REITs, the REITs with office buildings in the United States dropped the most by 30% in August from a decreased occupancy rate. Most recently, the median occupancy rate dropped to 87.4%, the lowest since 2020. Additionally, office buildings in the US that heavily rely on high leverage are directly affected by the Fed's increase in interest rates.

Meanwhile, Thai REITs dropped by 2.36% in August 2023, mainly pressured by the office sector, which dropped by 12.4% because of concerns about sluggish earnings. The decline was caused by the decrease in demand for office space rentals, a consequence of many companies adopting a Work from Home policy along with a continuous increase in the supply of office buildings. This situation has had a negative impact on the occupancy rate and rental rate within the office sector for the upcoming period.

Gold: Gold prices dropped by 1.27% in August 2023 mainly because of US dollar appreciation. Although the rise of US inflation in July was slightly below markets’ expectations, the inflation was higher than the Fed’s target of 2%. Furthermore, the Fed has a chance to raise interest rates before the end of the year according to Jerome Powell’s statement at Jackson hole.

Market Outlook and Investment Strategy for the next 3 months

- Investing in quality and defensive stocks through Principal Global Quality Equity Fund (PRINCIPAL GQE) as core portfolio is of vital importance as we expect a US mild recession to happen in the first or second quarter of next year and to last for two quarters. Based on historical data, quality stocks generally outperform during the period of recession.

- According to the Fed’s meeting in September, Although the Fed held interest rates steady most officials expected one more hike before the end of the year and the Fed is likely to keep rate higher for longer through 2024, resulting in economic uncertainty.

- Our recommendation for satellite portfolio is to capture the opportunity of market correction by accumulating global quality fund focusing on both growth and quality stocks through Principal Global Opportunity Fund (PRINCIPAL GOPP) according to seasonality effect. In other words, based on historical data for 10 and 15 years ago, the average return of US stock market tends to be negative in September and be positive both in October and November.

- We maintain the slightly overweight view on fixed income, focusing mainly on global fixed income thanks to attractive yield, US recession probability and a tendency to end rate hike cycle of the Fed, boosting the chance for investors to receive the capital gain. PIMCO GIS Income Fund, the master fund of Principal Global Fixed Income Fund (PRINCIPAL GFIXED), has a YTM of 7.36% as of 31 August 2023.

Portfolio Adjustment

- According to the latest Fed meeting, we can perceive that the Fed is still concerned about inflation although it dropped significantly from the peak in the middle of last year. One of the reasons is that energy prices increasing recently tend to cause inflation to go up and stay away from the Fed’s target of 2%. Therefore, the Fed holds the view that interest rates should be higher for longer in the next year.

- Neutral exposure is given to Global equity, focusing primarily on quality stocks as the economic outlook for the next year is uncertain. US recession and higher-for-longer interest rates can be expected.

- We are cautious about investing in China stock market due to the issue of the property sector, lower-than-expected economic data and economic stimulus announced which still could not revive China economy significantly and effectively. As a result, having the exposure of China stocks lower than the target asset allocation is recommended and investors may trim the position especially when the market has rebounded in the short term.

- Regarding REITs, the valuation is attractive (Thai REITs and SG REITs provide yield of 7% and 5% respectively) and the end of central bank tightening and rising yields is historically a strong catalyst for REIT outperformance compared to equity. Still, based on the latest Fed meeting the Fed pencils in one more hike this year. We, therefore, remain the slightly underweight view on this asset class in the short term.

- More importantly, investors should do asset allocation to create a proper portfolio by diversifying each asset class based on their risk appetites and to help reduce portfolio volatility.

Note:

- • Fed stands for Federal Reserve, US central bank.

• ECB stands for European Central Bank

• BOT stands for Bank of Thailand

• REIT stands for real estate investment trust

• YoY stands for year-over-year, which is a way of measuring how a number has changed compared to the same period a year earlier.

• CPI stands for consumer price index, a key indicator to measure inflation.

• PCE refers to a measure of the spending on goods and services, a kind of inflation the Fed prioritizes.

• PMI refers to the Purchasing Managers Index, a measure of economic health in the future.

• H-Shares stands for stocks of Chinese mainland companies that are listed on the Hong Kong Stock Exchange.

• A-Shares stands for stocks of mainland China-based companies that trade on the two Chinese stock exchanges, the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

• Overweight refers to a larger portion of an asset class compared to a benchmark.

• Neutral refers to the same portion of an asset class as a benchmark.

• Underweight refers to a smaller portion of an asset class compared to a benchmark.

Suppachark Erbprasartsook – Head of Investment Strategy

Thaned Lertpetchpun – Investment Strategist

Mintra Juntavitchaprapa – Investment Strategist

Monsichar Utitchalanont – Investment Strategist

Read more : Monthly Report as of September 2023 for PVD Members