CIO View: December 2025

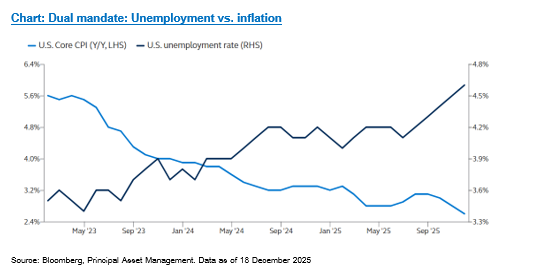

As 2025 draws to a close, the year has been characterized by economic volatility, evolving monetary policies, and shifts in global growth dynamics. We begin this month’s article with key updates from the US labor market and inflation data, as the Bureau of Labor Statistics (BLS) released its long-awaited employment report on December 16th, followed by the Consumer Price Index (CPI) report on December 18th. These are the first reports that encompass the period during which the US government was shut down. Non-farm payroll numbers rose by 64,000 in November, better than economists’ expectations of about 40,000 jobs. However, November’s jobs report, which is a combined employment reading for the past two months, also showed that an estimated 105,000 jobs were lost in October. The massive drop in October was largely a result of 162,000 federal government jobs being cut. This follows a trend seen throughout 2025 of significant reductions in the federal workforce. The unemployment rate jumped to 4.6% in November, giving investors hope that inflationary pressures may be cool enough for the US monetary policy to ease more than previously anticipated. The CPI number rose at a 2.7% annualized rate in November. Economists expected the CPI to have risen 3.1%. The core CPI, which strips out volatile food and energy prices, was also cooler than anticipated, increasing 2.6% over the 12-month period. It was expected to have risen by 3%.

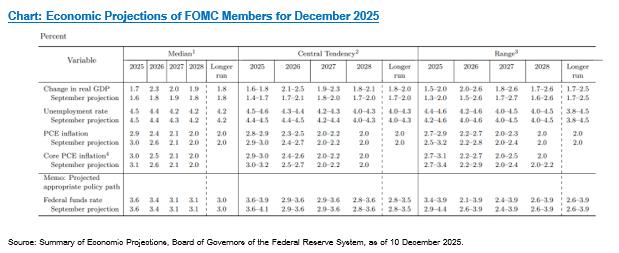

At the December meeting, The Federal Reserve (Fed) voted 9 to 3 to lower the target range for the benchmark federal funds rate by 0.25% from 3.75%-4.00% to 3.50%-3.75%. This marked the third consecutive cut, totaling a 0.75% reduction to close out the year. The 9-3 vote again featured hawkish and dovish dissents - Governor Stephen Miran favored a steeper half-point reduction while regional Presidents Jeffrey Schmid of Kansas City and Austan Goolsbee of Chicago backed a rate pause. In Fed parlance, hawks are generally more concerned about inflation and favor higher rates, while doves focus on supporting the labor market and want lower rates. In addition to the rate decision, the Fed also announced it will resume buying Treasury securities, following up on an announcement at the October meeting that it would halt its balance sheet runoff this month. The move came amid concerns about pressures in the overnight funding markets. The central bank will start by buying $40 billion in Treasury bills, beginning December 12th. The dot plot of individual officials’ expectations on rates indicated just one cut in 2026 and another in 2027 before the federal funds rate hits a longer-run target around 3%. Those projections were unchanged from the September update. On the economy, the committee raised its view of GDP growth for 2026, boosting its September projection up by half a percentage point, to 2.3%. The committee continued to expect inflation to hold above its 2% target until 2028. In a post-meeting news conference, Fed Chair Jerome Powell said additional rate cuts will be tougher to justify, and the Fed can step back and see how hiring and inflation develop.

In monetary policy developments elsewhere, the European Central Bank (ECB) held its deposit facility rate at 2% on December 18th for the fourth consecutive meeting, as widely anticipated. The ECB staff revised their economic growth projections higher as recent growth figures for the eurozone have beaten the ECB’s expectations, buoyed by exporters navigating US tariffs more effectively than anticipated and by domestic spending that has counterbalanced a malaise in manufacturing. The ECB now expects growth of 1.4% in 2025, 1.2% in 2026, and 1.4% in 2027 and 2028. The Governing Council said that inflation should stabilize at the target of 2% in the medium term. However, staff projections for inflation were revised up to 1.9% from 1.7% in September’s assessment. In the post-meeting news conference, President Christine Lagarde reiterated that the Governing Council will remain data-dependent and move on a meeting-by-meeting basis. She explicitly stated there were no discussions of either hikes or further cuts at this meeting. Meanwhile, the Bank of Japan (BOJ) unanimously voted to increase the short-term policy rate to 0.75% from 0.5% as widely expected by economists. The move takes Japan’s interest rate above 0.5% for the first time since 1995. Despite the hike, Governor Kazuo Ueda emphasized that real interest rates remain significantly negative and that the overall monetary environment is still supportive of the economy. The governor also said the BOJ will keep increasing rates if economic and price data are in line with the BOJ’s forecast but offered little guidance on the pace of rate increases, saying it will depend on the economic situation. The People’s Bank of China (PBOC) kept its loan prime rates (LPR) steady on December 22. The 1-year and 5-year LPR were unchanged at 3% and 3.5%, respectively.

At the 2025 Central Economic Work Conference (CEWC) held in Beijing from December 10th to 11th, China’s top leadership gathered to set the economic policy agenda for the coming year, including the annual GDP growth target and the budget deficit target. While many of these targets will not be publicized until the Two Sessions meetings in March 2026, information from the meeting provided a glimpse of where the country’s current policy priorities lie. According to the CEWC meeting, China will implement more proactive and impactful macroeconomic policies, formulate more far-sighted, more targeted and better-coordinated policies, continuously expand domestic demand and optimize supply, and develop new quality productive forces according to local conditions. China will continue to implement a more proactive fiscal policy and maintain necessary fiscal deficits, overall debt levels and expenditure scale, while standardizing tax incentives and fiscal subsidy policies. China will continue to implement a moderately loose monetary policy, employ various monetary policy tools such as reserve requirement ratios and interest rates in a flexible and efficient manner to maintain ample liquidity. The CEWC acknowledged that the main contradiction in the economy is now a lack of domestic demand rather than supply-side constraints. The meeting explicitly called for plans to increase household incomes to restore consumer confidence. A new national program will be rolled out in 2026, focusing on services and expanding the trade-in subsidies for consumer goods.

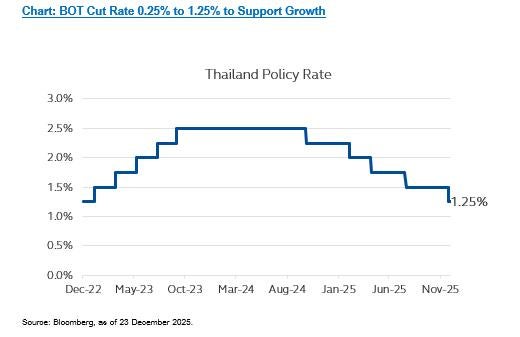

The Bank of Thailand (BOT) reduced its policy rate by 0.25% to 1.25%. The decision to lower the interest rate by 0.25% was unanimous this time, with the policy rate now at its lowest level in three years. The committee highlighted that the Thai economy is currently expanding below its potential, with vulnerabilities from both domestic structural issues and external factors exacerbating the situation. Particularly in the latter half of the previous year, economic conditions worsened more than anticipated due to several temporary factors, weakening growth prospects for the coming years. Economic pressures in the second half of the year stemmed from specific events, including factory closures and disruptions in the beverage production sector, which directly impacted manufacturing. Additionally, severe flooding in southern Thailand caused widespread damage to both lives and properties. The impact of the floods is expected to last into the first quarter of the 2026, with economic activities in affected areas continuing to be hampered, further slowing down the overall economy. The Monetary Policy Committee (MPC) revised its 2026 GDP growth forecast down to 1.5% from 1.6%.

Thailand’s Prime Minister, Anutin Charnvirakul, decided to move ahead with dissolving the parliament, which paved the way for early general elections. The move followed a major fallout with the People’s Party, the largest opposition group in the parliament. Previously, the People’s Party had provided conditional support to Anutin in exchange for a promise to draft a new constitution, but negotiations broke down, leading to a planned no-confidence motion. By law, the election must be held 45 to 60 days after the royal endorsement, a period during which Anutin will continue to head the government in a caretaker capacity.

Our colleagues at the parent company in the US, Principal Asset Management, recently released an article on the investment outlook for next year, titled "2026 Perspective", which can be found at https://www.principalam.com/us/insights/macro-views/2026-perspectives. According to Seema Shah, our Chief Global Strategist; despite policy volatility, trade tensions, and geopolitical fragmentation, the global economy demonstrated resilience in 2025, supported by strong corporate and household balance sheets, adaptive fiscal and monetary policies, and a surge in AI-related investment, with the United States central to global growth dynamics. Looking into 2026, the outlook is constructive yet nuanced: structural investment in AI and selective fiscal stimulus are expected to support growth, even as late-cycle risks—including uneven income distribution, moderating labor markets, and persistent inflation—limit monetary policy flexibility. Globally, China is positioning itself as a key beneficiary of the AI and technology-driven growth narrative, leveraging innovation and diversifying its supply chains away from the U.S. while maintaining a strong external surplus. This reinforces China’s growth potential but also intensifies competition for export markets. Europe, by contrast, shows a stabilizing but moderate economic outlook. While easing financial conditions and reduced fiscal austerity support activity, European manufacturing faces pressure from increased competition, and the region’s relatively low exposure to AI limits its ability to capture rapid tech-driven gains. For investors, this environment favors exposure to structural growth themes, particularly AI-driven innovation, while disciplined risk management and portfolio flexibility remain critical to navigate valuation concerns, concentration risks, and late-cycle uncertainties.

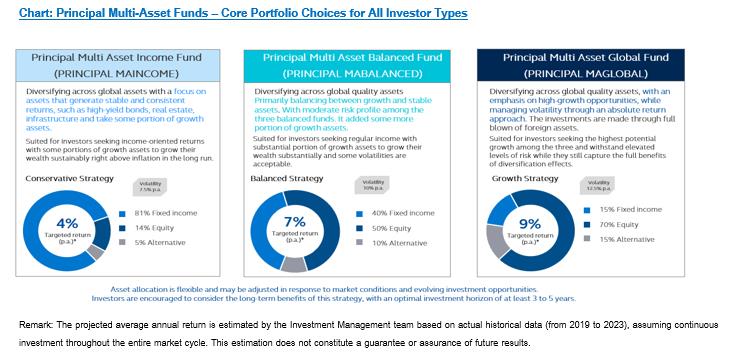

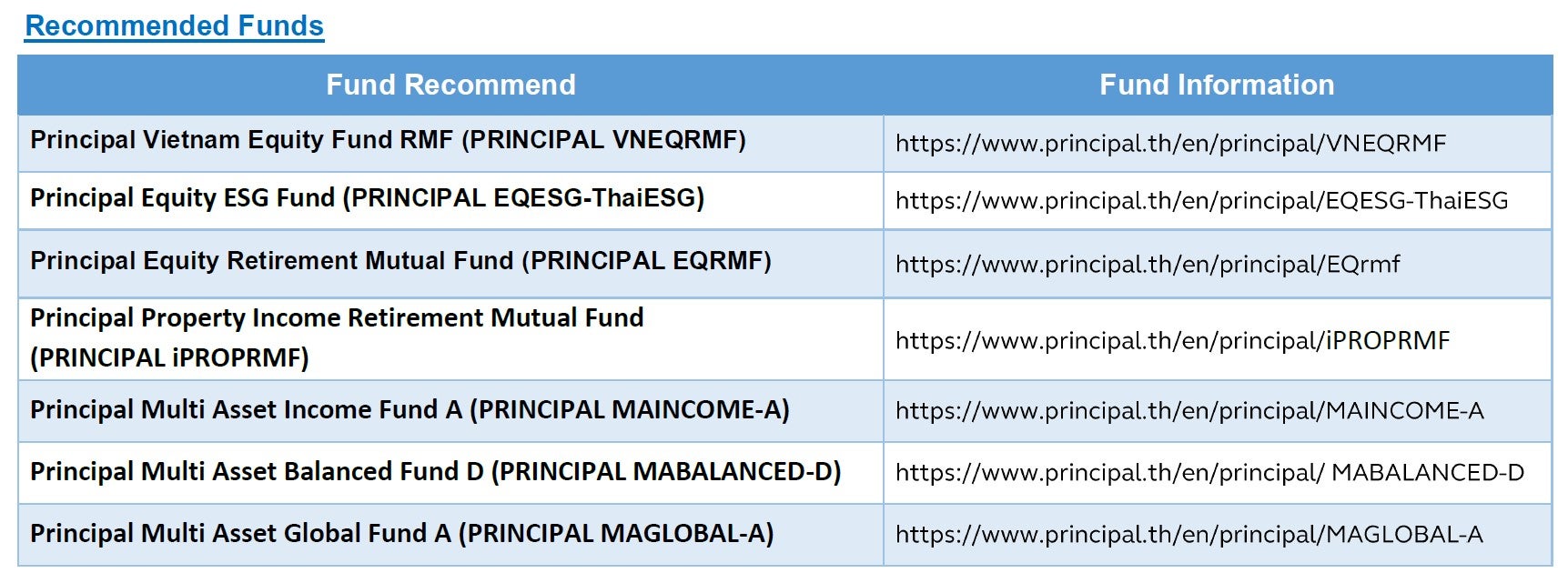

In 2026, we recommend multi-asset funds as the core holding of investors’ portfolios. Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED) provides a balanced allocation between equities and fixed income, helping manage volatility while targeting steady returns. Principal Multi Asset Income Fund (PRINCIPAL MAINCOME), with a higher allocation to fixed income, is more suitable for conservative investors, who prefer to have just some level of volatility and downside risk associated with exposure to growth assets; whereas Principal Multi Asset Global Fund (PRINCIPAL MAGLOBAL), with greater exposure to growth-oriented assets, is designed for the more aggressive investors, who can tolerate more volatility and downside risk, with higher growth exposure to the portfolio.

For investors seeking tax-efficient opportunities, we recommend Principal Vietnam Equity Fund RMF (PRINCIPAL VNEQRMF), which benefits from Vietnam’s robust economic growth, a government GDP target above 10% in 2026, rising corporate profits, ongoing infrastructure and private sector development, and the country’s recent upgrade to the FTSE Emerging Market Index. For Thai equities, Principal Equity ESG Fund (PRINCIPAL EQESG-ThaiESG) and Principal Equity Retirement Mutual Fund (PRINCIPAL EQRMF) offer attractive opportunities, supported by reasonable valuations and improving fundamentals. While uncertainties surrounding the early 2026 elections that could weigh on growth, dividend-yielding stocks are expected to perform relatively well during slower economic periods. We apply a barbell strategy, combining high-quality stocks with consistent earnings and dividends alongside selectively targeted companies that have bottomed out or have specific catalysts, such as deleveraging or enhanced shareholder returns. Finally, Principal Property Income Retirement Mutual Fund (PRINCIPAL iPROPRMF) provides exposure to Thailand and Singapore REITs, delivering an expected dividend yield of 5–7%. The portfolio focuses on bottom-up stock selection and strong company fundamentals to generate excess returns. By emphasizing quality and selectively overweighting resilient long-term earnings growers, the portfolio is positioned to perform well during periods of economic weakness and low yields. In a more risk-on market environment, some relative performance headwinds may occur, but the fund remain supported by solid fundamentals and reliable income characteristics.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL MAGLOBAL has highly concentrated investment in US. Therefore, investors should consider the overall diversification of their investment portfolio. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results./ PRINCIPAL VNEQRMF has highly concentrated investment in Vietnam. So, investors have to diversify investment for their portfolios./ PRINCIPAL iPROPRMF mainly focuses on investment units of property fund and/or real estate investment trust (REITs) and/or infrastructure fund that the fund is exposed to the same risk as investing in real estate or infrastructure directly such as the risk of fluctuations in rental rates and lease rates, Increase in property taxes, changes in relevant laws or regulations, risk from natural disasters, building depreciation over time and the increase in interest rates, etc., as well as the risk of concentration may cause more volatility than investments distributed in many industries / PRINCIPAL iPROPRMF is concentrated in the property sector. Therefore, if there are negative factors that affect the investment, investors may lose a lot of money /PRINCIPAL Iproprmf, PRINCIPAL VNEQRMF, PRINCIPAL EQESG-ThaiESG, PRINCIPAL EQRMF investor should also study information about tax benefits as specified in the investment guideline. If not complying with investment conditions investors will not receive tax benefits and must return tax benefits.