CIO View: January 2026

This month’s CIO View reviews key global economic and policy developments before turning to an emerging investment opportunity. The global landscape continues to be shaped by diverging growth trajectories and policy settings, prompting investors to reassess portfolio concentration risk and broaden allocations beyond traditional U.S. exposures. Recent data from the United States reaffirmed the economy’s resilience. According to the updated estimate released by the U.S. Bureau of Economic Analysis on January 22, 2026, real GDP grew at an annualized rate of 4.4 percent in the third quarter of 2025, an upward revision from the initial 4.3 percent reading and the fastest pace in two years. The revision was driven primarily by a stronger contribution from exports and investment, partly offset by a modestly weaker estimate of consumer spending. Inflation remained stable, with the PCE price index rising 2.8 percent and the core PCE index increasing 2.9 percent, both unchanged from prior estimates.

U.S. monetary policy developments further underscored a complex balancing act. After restarting its easing cycle in September 2025, the Federal Reserve delivered three consecutive 25‑basis‑point cuts—in September, October, and again at its December meeting—bringing the federal funds rate down from 4.00–4.25 percent to 3.50–3.75 percent, a cumulative reduction of 75 basis points heading into the new year. The December decision itself was notable for its split 9–3 vote and the announcement that the Fed would begin purchasing USD 40 billion in Treasury bills to maintain ample reserves.

At its most recent meeting on January 27–28, 2026, the FOMC opted to pause further easing, leaving the policy rate unchanged at 3.50–3.75 percent in a 10–2 vote, with Governors Stephen Miran and Christopher Waller dissenting in favor of an additional 25‑basis‑point cut. The Committee described economic activity as expanding at a “solid pace” and noted that inflation “remains somewhat elevated.” Chair Jerome Powell emphasized that, following last year’s cumulative reductions, the current stance of monetary policy is now at the “higher end of the plausible range of what could be considered neutral”—a reference point broadly aligned with the Fed’s longer‑run neutral rate estimate of around 3.0 percent. Powell added that any further adjustments would depend on the evolution of incoming data, the balance of risks, and the degree to which inflation and labor‑market indicators continue to move toward the Fed’s dual‑mandate objectives.

Beyond the United States, the policy picture remains varied. In Europe, markets widely expect the European Central Bank to hold rates steady at its upcoming February meeting. The deposit facility rate has been at 2.00 percent since mid‑2025 following an extensive easing cycle, and President Christine Lagarde has repeatedly emphasized that policy is currently “in a good place,” with no urgency to adjust further. Recent ECB communications have maintained the familiar commitment to a meeting‑by‑meeting, data‑dependent approach, reinforcing expectations of policy stability in the near term.

- In Japan, the Bank of Japan voted 8–1 to keep its policy rate unchanged at 0.75 percent. Board member Hajime Takata dissented, advocating for a hike to 1.0 percent on the grounds that inflation risks were tilted upward. The BOJ’s quarterly outlook report painted a more optimistic economic picture, upgrading GDP growth forecasts for fiscal years 2025 and 2026 to 0.9 and 1.0 percent respectively, while raising the forecast for core CPI inflation in fiscal 2026 to 1.9 percent. Governor Kazuo Ueda maintained a cautious but hawkish stance, stating that if the economy and prices evolve in line with projections—particularly regarding wage growth—further rate hikes later in 2026 remain possible.

China ended 2025 with GDP growth of 5 percent, meeting its official target despite ongoing domestic challenges and external uncertainties. However, momentum weakened toward year‑end: retail sales grew 3.7 percent for the year but slowed to 0.9 percent year‑on‑year in December and declined slightly on a monthly basis. Fixed‑asset investment contracted 3.8 percent for the full year, driven largely by a more than 17 percent drop in real‑estate investment. The external sector was a key offset, with exports rising 6.1 percent and imports increasing 0.5 percent. Monetary policy remained steady, as the People’s Bank of China left both the one‑year and five‑year Loan Prime Rates unchanged at 3.0 and 3.5 percent respectively for an eighth consecutive month. Deputy Governor Zou Lan signaled that there is still room to reduce the reserve requirement ratio and policy rates in 2026 should conditions require further support.

Political calendars in Asia add another dimension to the regional outlook. In Japan, Prime Minister Sanae Takaichi dissolved the Lower House on January 23, triggering a snap general election scheduled for February 8. The dissolution—unusual in its timing at the very start of a regular parliamentary session—comes just three months into Takaichi’s tenure, during which her approval ratings have remained strong. The move is widely seen as an effort to consolidate her coalition’s position in the more powerful lower chamber. In Southeast Asia, Thailand’s Election Commission has set the country’s next general election for the same date, February 8, following Prime Minister Anutin Charnvirakul’s decision on December 11 to dissolve parliament. Advance voting will take place on February 1, and official results are expected by early April. The race is shaping up to be highly competitive: recent opinion polls indicate strong support for the progressive People’s Party, positioning it as a key challenger to Anutin’s Bhumjaithai Party, while Pheu Thai has lost ground and the Democrat Party has seen a modest recovery in voter sentiment. A sizeable share of undecided voters also remains, leaving room for unexpected outcomes as the campaign progresses. Given Thailand’s fragmented political environment and fluid voter preferences, analysts expect coalition negotiations to play a decisive role in determining the composition and policy direction of the next government.

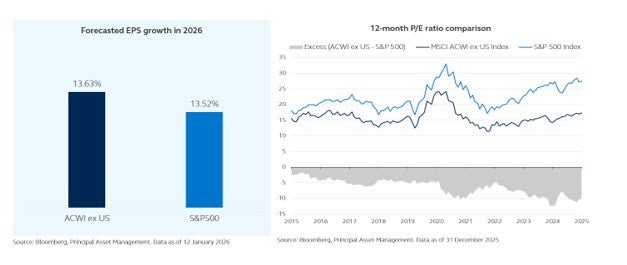

Against this backdrop of diverging macroeconomic trends, policy dynamics, and political developments, a compelling investment opportunity is emerging in Global ex‑US equities. Investors continue to reassess the degree of U.S. concentration in their portfolios. Many global benchmarks allocate roughly two‑thirds of equity exposure to the United States, while thematic strategies often push effective U.S. weights to between 70 and 90 percent. At the same time, relative valuations remain more attractive outside the U.S. As of year‑end 2025, the MSCI ACWI ex USA traded at a forward P/E of roughly 17.3x, compared with approximately 27.3 for the S&P 500. Earnings expectations are also broadly aligned: Bloomberg and major sell‑side forecasts point to low‑teens earnings growth for non‑U.S. markets in 2026, similar to the S&P 500’s consensus outlook of around 13.5 percent.

Importantly, earnings growth outside the United States is expected to be more evenly distributed across regions. Europe, the United Kingdom, Asia ex‑Japan, China, and emerging markets all show prospects for double‑digit earnings expansion based on improving global demand conditions, ongoing investment cycles, and a more balanced currency backdrop. Sentiment and positioning also appear supportive. Fund‑flow data from late 2025 indicate strengthening inflows into international equities and a gradual diversification away from U.S.‑centric exposures, with several 2026 outlooks highlighting reallocation as a recurring theme.

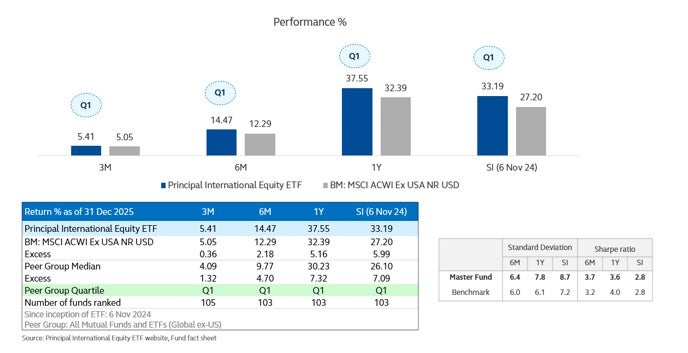

For investors seeking to capture this opportunity while managing concentration risk, the Principal International ex US Equity Fund (PRINCIPAL INXUS) offers a timely and focused vehicle. Available during its IPO period from February 9–20, 2026, PRINCIPAL INXUS is Thailand’s first fund dedicated specifically to Global ex‑US equities. The fund invests in the Principal International Equity ETF as its master fund and adopts an active, high‑conviction approach across both developed and emerging markets. Its portfolio is concentrated but deliberately diversified across regions and sectors, with an investment philosophy centered on free‑cash‑flow analysis and the identification of companies whose cash‑generation potential is underappreciated. By blending growth and value styles and relying on rigorous fundamental research, the underlying strategy has delivered strong performance: as of December 31, the master fund returned 14.5 percent over six months, 37.6 percent over one year, and 33.2 percent since inception (MSCI ACWI Ex USA NR USD return: 12.3 percent over six months, 32.4 percent over one year and 27.2 percent since inception), ranking in the first quartile relative to peers across all reported horizons.

In our view, the combination of comparable earnings growth, materially cheaper valuations, broadening regional performance drivers, and improving flow dynamics makes a strong case for increasing exposure to Global ex‑US equities as part of a balanced multi‑asset allocation. PRINCIPAL INXUS provides a targeted and effective way to implement this shift in the current environment.

*PRINCIPAL INXUS is still being considered for approval by the SEC.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL MAGLOBAL has highly concentrated investment in US. Therefore, investors should consider the overall diversification of their investment portfolio. / The fund has a policy to invest in foreign funds. The management company may invest in derivatives for the purpose of hedging foreign exchange risk that may arise from overseas investments, as appropriate and depending on market conditions at any given time, at the discretion of the fund manager. As a result, there may still be residual foreign exchange risk, which may cause investors to incur losses from exchange rate movements or receive proceeds lower than the initial investment. In addition, hedging transactions may involve costs, which could reduce the fund’s overall return due to increased expenses. / The fund’s foreign exchange risk hedging policy: at the discretion of the fund manager (dynamic hedging) (0%–105% of the value of the exposure). / Past performance does not guarantee future results.