CIO View: April 2025

April has been a month of significant developments in global capital markets, marked by heightened volatility and shifting investor sentiment. Three major news stories have dominated the landscape: escalating trade tensions, evolving central bank policies, and the latest World Economic Outlook from the International Monetary Fund (IMF). Trade tensions, particularly involving the United States, have created uncertainty and impacted global trade flows. Meanwhile, central banks around the world are adjusting their policies in response to economic conditions, with the European Central Bank continuing to cut interest rates, while the U.S. Federal Reserve maintaining its current stance. Additionally, the IMF's report has highlighted a slowdown in global growth and intensified downside risks, further influencing market movements. These factors combined have shaped the market dynamics throughout April, heightening the increase in volatility since the start of the year, and the need to consider a balanced portfolio to ride out these risks.

On April 2, President Donald Trump issued an executive order imposing a 10% baseline reciprocal tariff on nearly all U.S. trading partners, effective April 5, along with an additional country-specific reciprocal tariff on 57 countries, effective April 9. However, on April 10, President Trump suspended the country-specific tariffs for all countries except China for a period of 90 days to allow time for negotiations, while maintaining the 10% baseline tariff. Trade tensions between the United States and China have escalated sharply this month. The U.S. imposed a 145% tariff on imports from China, while China retaliated with a 125% tariff on U.S. products. Additionally, China has warned it will take action against any countries that enter into agreements with the U.S. that negatively impact Beijing’s interests.

More recently, President Trump’s administration has begun to tone down it hawkish comments on China, indicating its desire to talk with China. However, China has expressed its willingness to engage in trade discussions with the United States, contingent upon certain key preconditions being met. These demands include a call for greater diplomatic respect, a consistent U.S. trade policy, attention to China's concerns regarding sanctions and Taiwan, and the appointment of a lead negotiator with full backing from President Trump. To date, the U.S. administration has implemented 25% tariffs on aluminum and steel, 25% tariffs on goods from Mexico and Canada that do not comply with the USMCA free-trade agreement, a significant 145% duty on Chinese imports, a 25% tariff on automobiles (with additional tariffs on auto parts set to take effect on May 3), and a 10% baseline tariff on all U.S. imports.

In monetary policy developments, the European Central Bank (ECB) lowered its deposit facility rate by 25 basis points to 2.25% on April 17, in line with market expectations. The ECB noted that the economic outlook has deteriorated due to rising trade tensions, with heightened uncertainty likely to erode confidence among households and businesses. The ECB also emphasized that the adverse and volatile market reactions to trade disputes are likely to tighten financial conditions. In contrast, the U.S. Federal Reserve remains in a wait-and-see mode. Fed Chairman Jerome Powell, speaking at the Economic Club of Chicago, indicated that the central bank would require greater clarity before considering any changes to interest rates. He highlighted that the newly imposed tariffs are expected to result in higher inflation and slower growth, making monetary policy decisions more challenging.

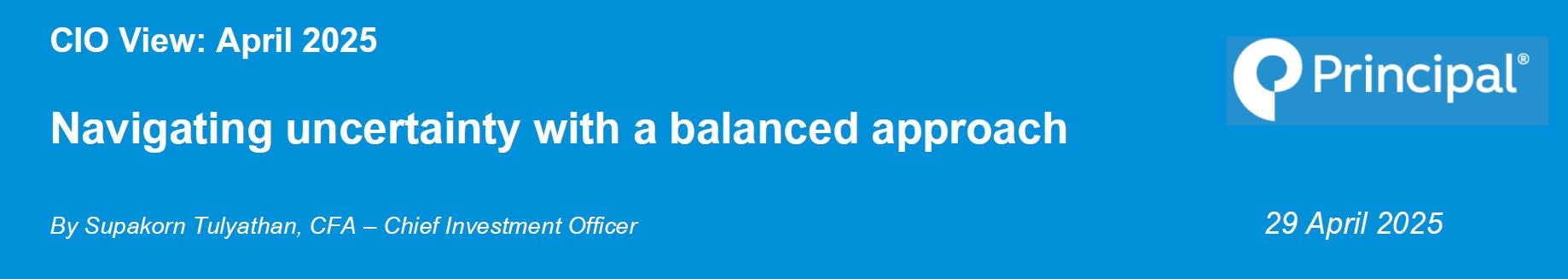

The International Monetary Fund (IMF) has lowered its forecast for global economic growth to 2.8% for 2025, down from its previous estimate of 3.3%, citing the negative impact of escalating tariffs between the U.S. and its trading partners. The IMF also cut its 2025 U.S. growth projection to 1.8%, a reduction of 0.9% from its January forecast. Furthermore, growth forecasts for major Asian economies have been downgraded due to rising trade tensions and elevated policy uncertainty. The IMF now projects GDP growth of 4.0% for China, 0.6% for Japan, and 6.2% for India, each down notably from prior expectations. The IMF has also increased its estimated probability of a global recession to 40%, up from 25% as of October 2024. Meanwhile, China's National Bureau of Statistics (NBS) reported that China’s first quarter GDP expanded by 5.4% year-on-year, more than consensus expectation of a 5.1% growth. This performance reflects strong momentum building from the recovery that began in late 2024. The NBS struck an overall-negative tone cautioning that the external environment is becoming increasingly complex and challenging, while domestic demand remains insufficient, overshadowing the positive note that the economy began the year with a good start.

Chart: IMF Downgrades Global Growth Forecast

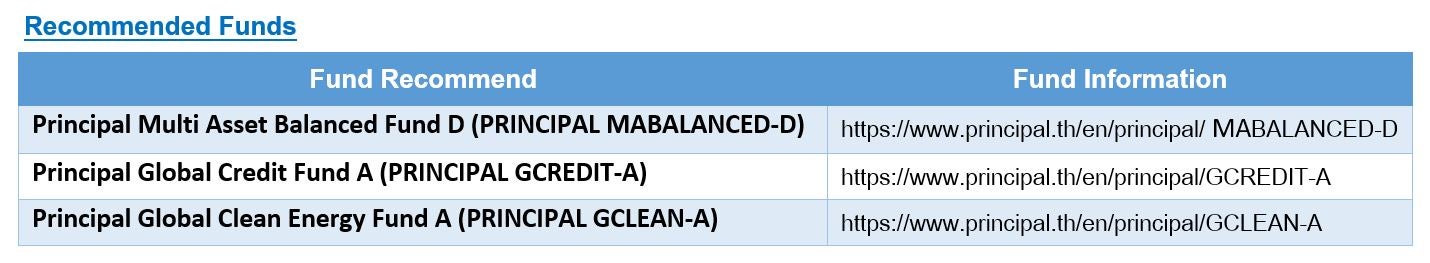

Given the heightened uncertainty and potential disruption to global economic growth, we maintain a neutral stance on risk assets to reflect our cautious outlook. We believe that the full implementation of the proposed tariff, if it were to happen, poses a significant threat to global economic stability. Even though, the 90-day pause to the full implementation of the reciprocal tariff is allowing the markets to recover some of the drawdowns, we cannot predict with any kind of certainty that the Trump administration will not backtrack on its recent friendlier tone; or that they will not come out with more drastic trade protectionism announcement. As such, we recommend a balanced approach, with a balanced asset allocation fund as a core portfolio; a global fixed income fund for a defensive barbell strategy; and a thematic growth fund for a growth barbell strategy. Our core recommendation is the Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED), which offers a balanced allocation between equities and fixed income, helping to mitigate volatility while seeking steady returns. For our defensive barbell strategy, we recommend the Principal Global Credit Fund A (PRINCIPAL GCREDIT), which offers a defensive positioning against rising recession risks. This fund invests in the BNY Mellon Global Credit Fund, focusing on investment grade credit with a yield to maturity of 5.5% and an average rating of A, positioning it to benefit from potential declines in bond yields.

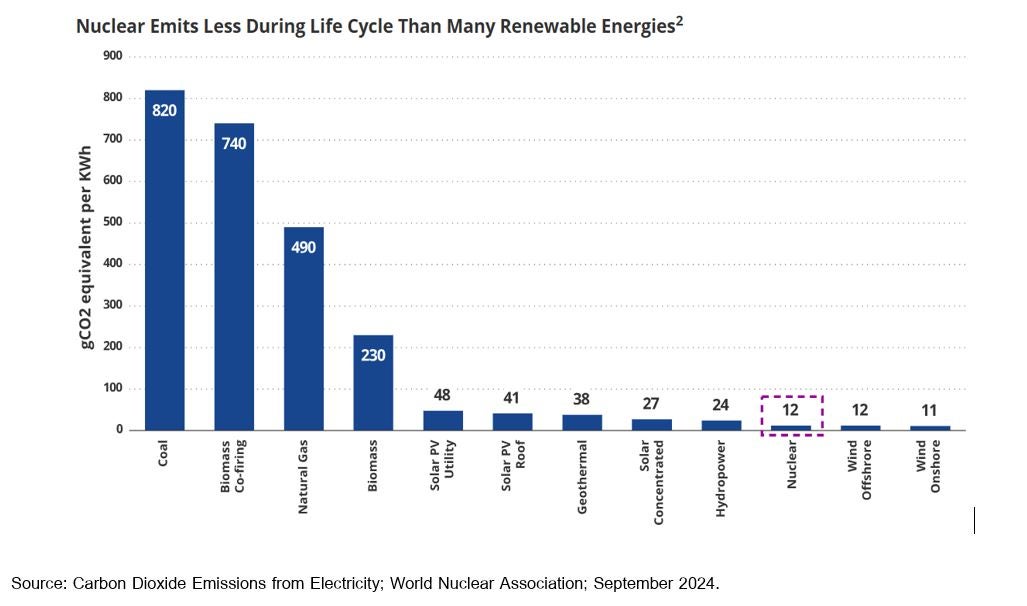

For our recommendation on the growth side of the barbell strategy, we recommend the Principal Global Clean Energy Fund (PRINCIPAL GCLEAN), which focuses on investment in nuclear energy—a vital solution for the future of clean power. As global electricity demand continues to surge, driven by innovations such as artificial intelligence (AI) and the rapid expansion of data centers, nuclear energy offers a reliable, large-scale, and stable source of clean energy. Unlike wind and solar power, which face challenges from intermittency, nuclear energy ensures continuous and consistent power generation. Furthermore, nuclear energy is internationally recognized for its minimal carbon emissions compared to other energy sources, positioning it as a critical component in achieving global Net Zero carbon targets by 2050. Regulatory support for nuclear energy is strengthening worldwide, with countries like the United States extending the operational lives of existing nuclear plants to secure future energy supply.

- Chart: Nuclear Energy as a Low-Carbon Power Source Recognized Worldwide

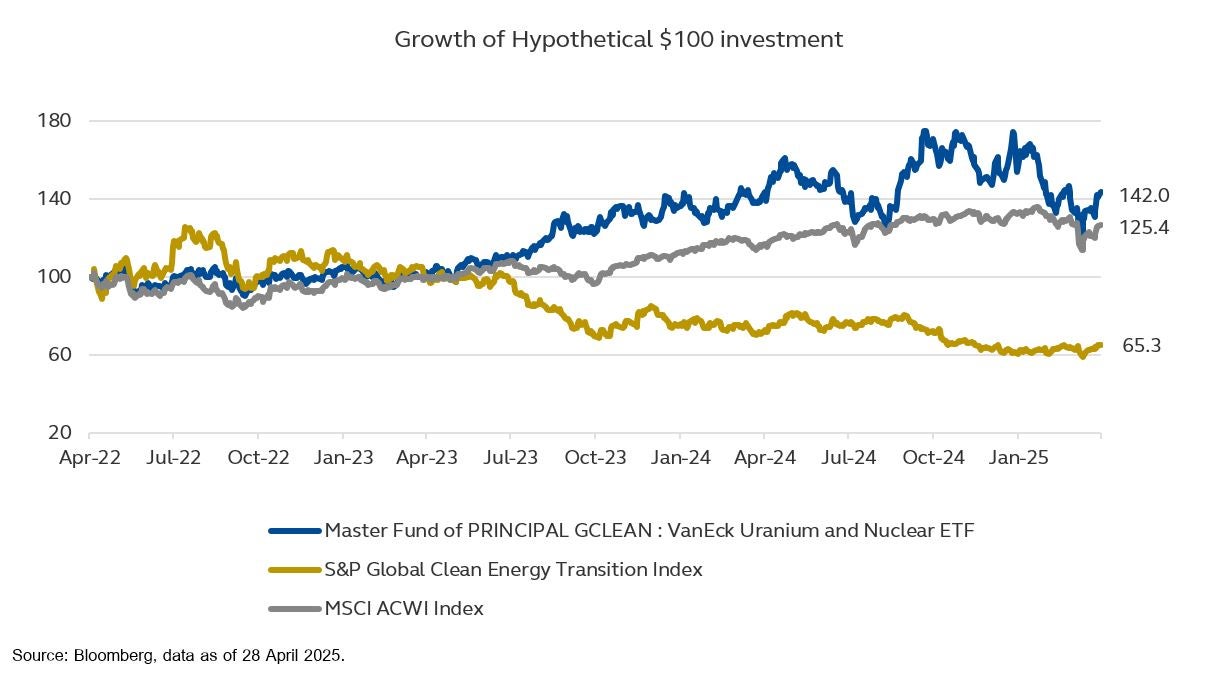

PRINCIPAL GCLEAN invests primarily in the VanEck® Uranium and Nuclear ETF, which targets companies involved in nuclear energy production, nuclear plant construction and maintenance, nuclear technology and equipment, and uranium mining. The portfolio is globally diversified, with investment exposures led by the United States (48%), Canada (13%), and Italy (7%), among others. The fund predominantly invests in large-cap stocks, which account for approximately 61% of the portfolio, with exposure across three key sectors: Utilities (50%), Energy (35%), and Industrials (14%). The master fund holds around 25 securities, carefully selected from leading global companies specializing in the uranium and nuclear industries. Key holdings include Constellation Energy Corp., the largest producer of carbon-free energy in the United States, that partners with technology leaders such as Microsoft to power next-generation data centers, and Cameco, one of the world’s largest uranium producers, with premium mining operations across Canada, the United States, and Kazakhstan. Over the past three years, the master fund has delivered an impressive, annualized return of 11.41%, and 15.80% over five years. The master fund’s underlying index, the MVIS Global Uranium & Nuclear Energy Index (MVNLRTR), delivered an average annual return of 11.45% and 15.65% over the 3-year and 5-year periods, respectively (data as of 31 March 2025). We believe PRINCIPAL GCLEAN presents a compelling thematic investment opportunity, ideally positioned to benefit from the accelerating global shift toward clean and reliable energy.

Chart: 3-Year Performance of Vaneck Uranium and Nuclear ETF, Global Clean Energy, and Global Equities as of 28 April 2025

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL GCLEAN has a concentrated investment in businesses related to nuclear and uranium sectors. Investors should thoroughly review the prospectus before making an investment decision. The master fund of PRINCIPAL GCLEAN also has a concentrated investment in the United States. Investors should therefore consider the overall diversification of their investment portfolio. / The master fund of PRINCIPAL GREDIT has a concentrated investment in the United States and Europe. Investors should therefore consider the overall diversification of their investment portfolio. /Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results.