CIO View: Strong Q4 results prolonging the markets rally

This month we start off with companies’ Q4 earnings in the US, Europe and Japan, as they have been making the headlines of late. So far, as of 23 February, over 80% of S&P 500 companies, 55% of Stoxx 600 companies, and 94% of Topix have reported Q4 results. In the US, EPS growth for Q4 is looking to deliver +7% y/y growth, with 77% of companies that have reported beating consensus EPS estimates. Except for Tesla, the Magnificent 7 stocks have had another strong quarter. But excluding the Magnificent 7 stocks, S&P 500 EPS growth would have been just -4%. In Europe, EPS growth is on track for -11% y/y, with 52% of companies that have reported beating estimates. In Japan, EPS growth is tracking at +10% y/y, with 55% of reported companies beating EPS estimates. Strong earnings in the developed markets are propping up DM equities in the year to date, with the S&P 500, Stoxx 600 and Nikkei 225 making all-time highs.

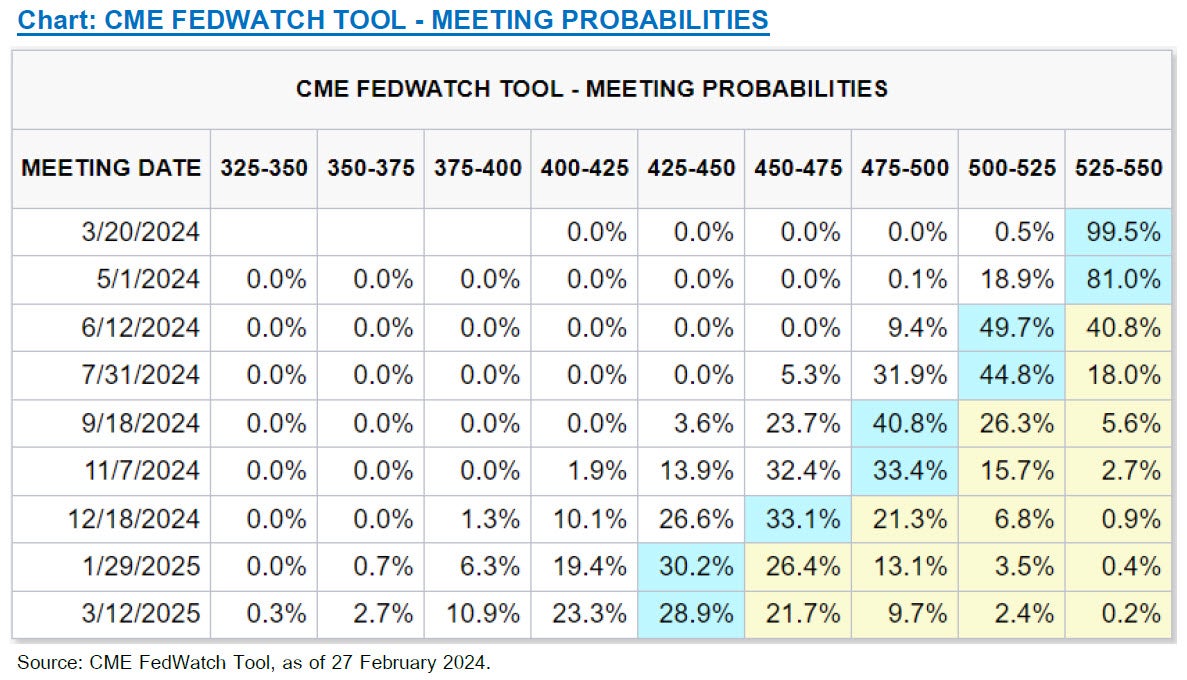

Financial markets no longer expect central banks in developed economies (DM) to cut interest rates soon. This is because inflation remains high, economic growth is still strong, and central bankers are signaling a cautious approach. However, most experts still believe that these central banks will start lowering rates later this year, around June. The timing of these rate cuts may vary slightly between different DM economies, depending on their specific inflation situations.

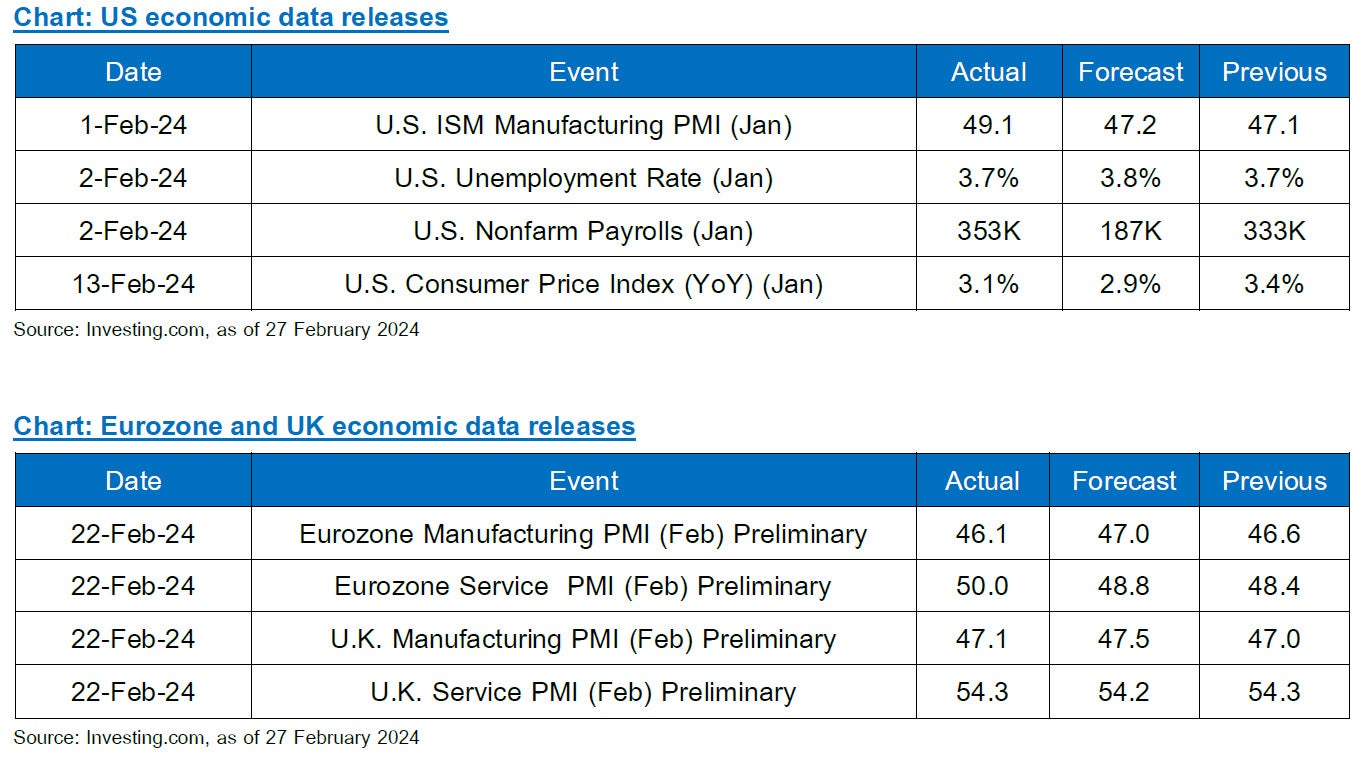

While the Red Sea disruptions haven't significantly impacted Eurozone manufacturing yet, concerns are increasing due to lingering weakness in the sector. The most recent Eurozone manufacturing has shown a drop in activity, so this will need close monitoring over the next few months. Despite positive signs from global demand and rising trend in purchasing manager indices (PMIs) for both the Eurozone and UK over the past several months, the details paint a mixed picture. The Eurozone manufacturing PMI itself is still in contraction, and Germany, a key European economy, shows particular weakness. This suggests underlying structural issues in German industry that could limit the overall Eurozone manufacturing rebound.

Although the Japanese stock market reached a record high this week, economic data paints a different picture. Factory shutdowns and supply chain issues are dragging down business activity, impacting both manufacturing and services. While retail sales may show a slight increase next week, industrial production is expected to fall sharply. The Bank of Japan (BoJ) is likely to adjust its policies and guidance in upcoming meetings, potentially leading to the first interest rate hike in mid-2024.

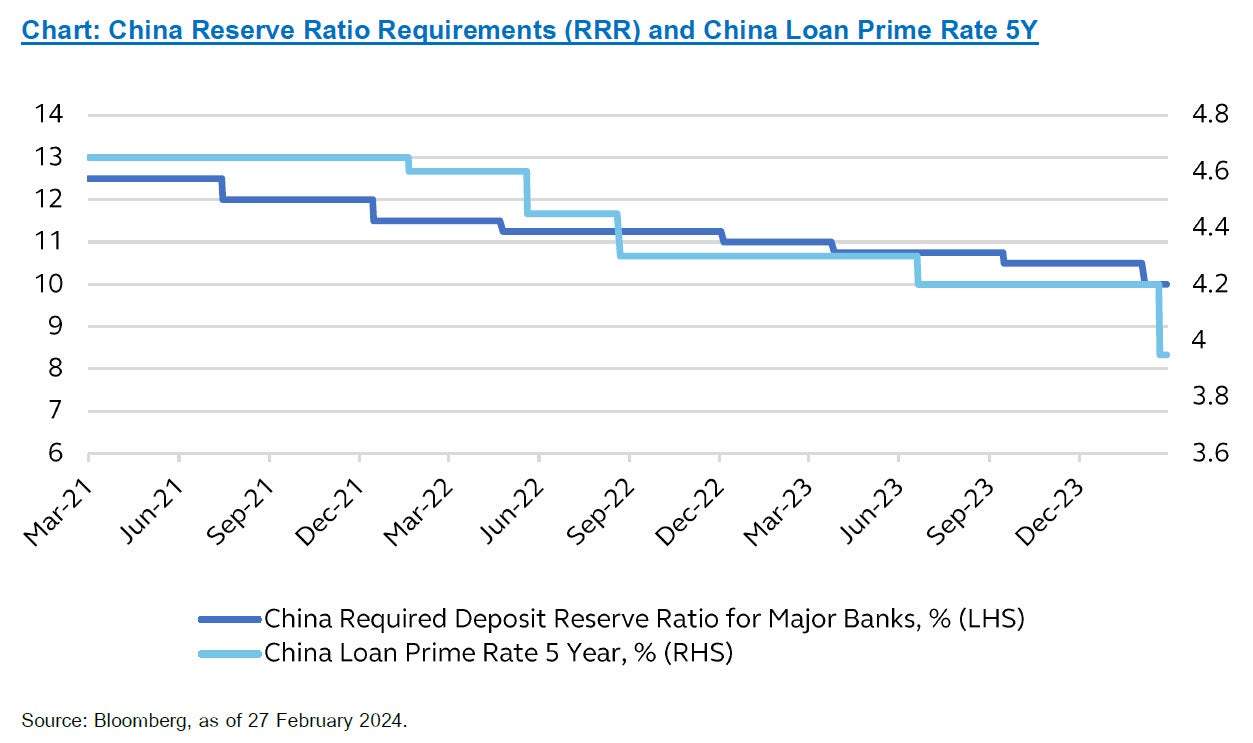

While China's economy has seen some positive signs, like increased spending during holidays, overall consumption remains sluggish. This, along with high inventory levels, is putting downward pressure on prices. To address this, the central bank (PBOC) has been cutting interest rates and injecting money into the economy. These measures, including a recently largest-ever cut to the 5-year Loan Prime Rate (LPR), which is the benchmark for mortgage rates in China, and a large liquidity injection via the January’s 50bp cut in the Reserve Requirement Ratio (RRR), are expected to gradually boost credit and economic growth. We expect further monetary policy support later this year, either in the form of interest rate cuts or reserve requirement ratio cuts, which could potentially support further stock market rebound.

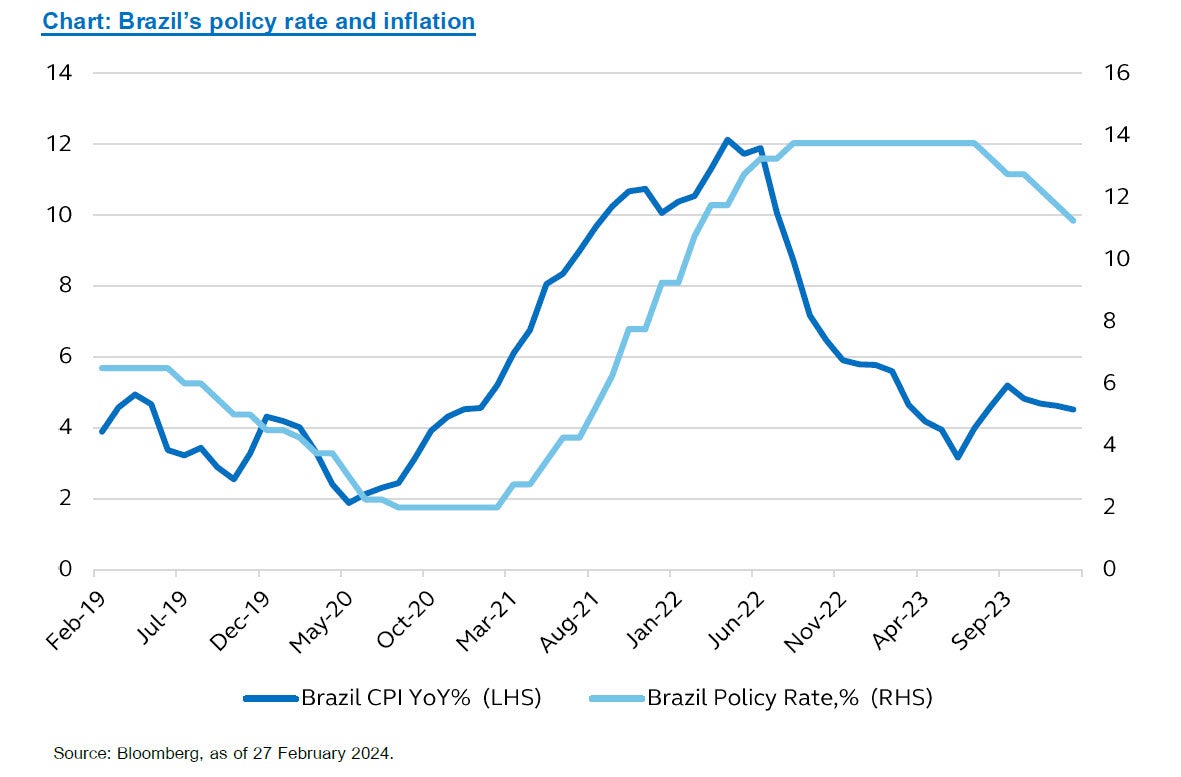

Brazil's central bank (Copom) lowered interest rates by 0.5% to 11.25%, keeping its plan to continue reducing rates in the near future. While acknowledging the external uncertainties and decelerating domestic activities, they emphasized the need to maintain their stance on rate cuts to address the risk of disinflation. For the Copom, if the macro scenario evolves as expected, its members unanimously anticipate further cuts of the same magnitude in the next meetings, and judge that this -50bp pace of rate cuts is appropriate to keep the monetary stance contractionary.

Mexico's central bank (Banxico) kept interest rates unchanged at 11.25% in their February meeting. They signaled a potential shift towards lowering rates in the future, depending on economic data. While economic activity slowed down, especially in manufacturing, most members expect it to pick up in the first half of 2024. Inflation is showing signs of decline, but some sectors like services haven't cooled down yet. The central bank remains cautious due to potential risks, but most members seem open to a small rate cut in March, followed by careful adjustments based on future developments.

The overall environment remains supportive for EM ex-China. The EM growth backdrop remains resilient, while inflation prints have surprised on the downside, suggesting EM rate cutting cycles should continue. Overall, the global backdrop also remains supportive as inflation is declining without a significant growth slowdown, which should allow DM central banks join EM in cutting around mid-year. Regionally, we continue to prefer LATAM for portfolio’s satellite ideas, while we are more cautious on China and Asian equities on a longer-term horizon; however, EM ex-China equities would be able to address our concern on this.

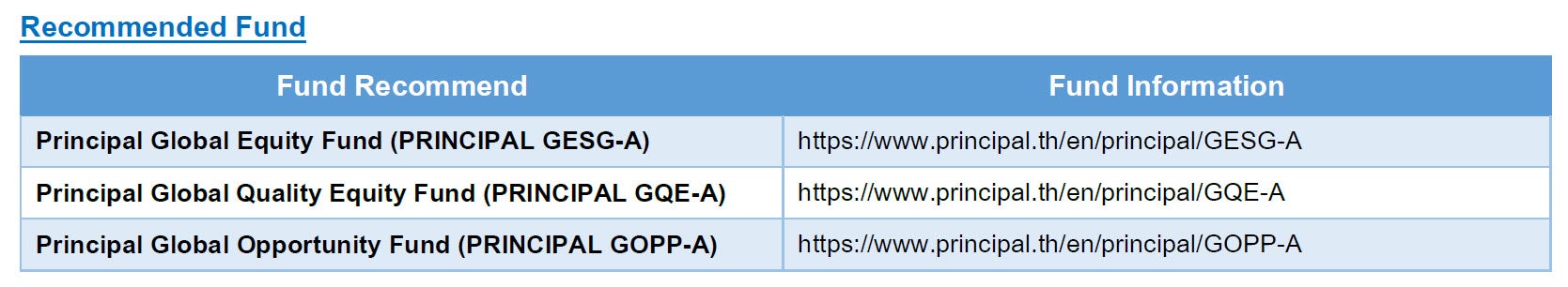

In addition to our positive stance on LATAM and EM ex-China for this year, we would reiterate our choices for the two global equity funds as excellent choices for the construction of the core portfolio, namely Principal Global Equity Fund (PRINCIPAL GESG) and Principal Global Quality Equity Fund (PRINCIPAL GQE). Another one of our global equity fund choices would be more fitting as a key satellite idea due to its higher growth and higher volatility characteristics, namely Principal Global Opportunity Fund (Principal GOPP). With the strong Q4 results reported thus far, and the expectation that central banks in the developed markets will be cutting policy rates in the middle of the year, global equities could stay expensive for a while before a new unknown risk factor comes into the picture and pop that bubble.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision / PRINCIPAL GQE and PRINCIPAL GESE are highly concentrated investment in USA, so investors have to diversify investment for their portfolios. / PRINCIPAL GOPP is highly concentrated investment in Northern America, so investors have to diversify investment for their portfolios. / PRINCIPAL GESG is not subject to sustainability disclosure, management and reporting requirements of mutual fund as SRI Fund of Thai SEC / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. Past performance does not guarantee future results.