CIO View: July 2025

News reports over the past month continued to be dominated by trade and tariff deals involving the US and its trading partners. In addition to the news headlines from major news sources, who regularly report on this topic, we invite our readers to visit our global website – https://www.principalam.com – where readers can follow deeper analyses by our global colleagues, who regularly cover topics such as trades and tariffs for more useful insights to complement the readers’ consumption of daily news reports.

In monetary policy development, the Federal Open Market Committee (FOMC) decided to hold interest rates steady at the current range of 4.25% to 4.50% at their meeting on July 30. Chair Powell reiterated the Fed’s dual mandate of achieving maximum employment and 2% inflation. He noted that new tariffs are beginning to impact consumer prices, and the Fed is closely watching for signs of sticky inflation. Powell emphasized caution, warning against premature rate cuts that could reignite inflation. The Fed will monitor upcoming jobs and inflation reports before the September meeting to guide its next steps. Another notable detail is that for the first time since 1993, two Fed Governors dissented from the decision to hold the policy rate, signaling internal disagreement on the future path of monetary policy. According to the CME’s FedWatch Tool, market expectation for a September cut adjusted lower to 43% from 63%; and the expectation for a hold adjusted higher to 57% from 35%. Looking at the end of the year, the market is now pricing in only one cut to the range of 4.00% to 4.25%, with a probability of 40%, compared to the probability of two cuts of 37% to the range of 3.75% to 4.00%.

The European Central Bank (ECB) held its interest rate at 2.0% at its July meeting amid major economic uncertainty. The ECB has cut interest rates at each of its four meetings so far this year, taking its key deposit facility from 3.0% in January to 2.0% in June. At the press conference following the decision, ECB President Christine Lagarde said that the eurozone economy had performed better than expected in the first quarter. That was due to the front-loading of exports ahead of expected tariff hikes and stronger private consumption and investment, rising real incomes and easier financing conditions. The People’s Bank of China (PBOC) kept the 1-year loan prime rate unchanged at 3.0% and kept the 5-year loan prime rate unchanged at 3.5%. The decision comes after the announcement that China’s GDP growth in the second quarter grew at 5.2% from a year ago. This figure beat market expectations of a 5.1% rise. For the first half of 2025, the Chinese economy expanded by 5.3% from a year ago. This keeps China on track to meet its official full-year GDP growth target of around 5%. The better-than-expected Q2 GDP growth was largely driven by the front-loading of exports ahead of the implementation of US tariffs.

Japan’s political landscape is increasingly uncertain, with mounting speculation about the possibility of snap elections amid ongoing leadership doubts surrounding Prime Minister Shigeru Ishiba. In the recent House of Councilors election on July 20, the Liberal Democratic Party (LDP) and its junior coalition partner Komeito secured only 47 of the 125 contested seats, leaving them with just 122 seats in the upper house—insufficient to form a majority. This loss deepens Japan’s political instability, as the ruling coalition already lost its majority in the House of Representatives in October 2024. It was the first time the LDP-led coalition has lost a majority in both houses of parliament since the party’s formation in 1955.

Coming back to the domestic political developments in Thailand. On July 1, Thailand's Constitutional Court has suspended Prime Minister Paetongtarn Shinawatra, who has come under mounting pressure to resign over her leaked phone conversation with former Cambodian leader Hun Sen. The suspension came after the Constitutional Court accepted a petition from 36 senators. The Constitutional Court voted 7-2 to suspend Paetongtarn while they considered the case. Paetongtarn has been given 15 days to formally respond and present evidence in her defense, while she has subsequently sought an extension to this deadline. In the meantime, the deputy PM will serve as the country's acting leader. Paetongtarn, however, will remain in the cabinet as culture minister, a new appointment following a cabinet reshuffle that was endorsed hours before she was suspended.

Thailand’s Cabinet has appointed Vitai Ratanakorn, President and CEO of the Government Savings Bank, as the new Governor of the Bank of Thailand (BOT), effective from October 1. He will succeed Sethaput Suthiwartnarueput, whose term ends on September 30. Mr. Vitai will chair the central bank’s Monetary Policy Committee (MPC) for the first time on October 8. In the vision presentation to the selection committee for the position of Governor of the Bank of Thailand (BOT) on June 24, Mr. Vitai proposed the concept of "Policy Coordination" that emphasizes coordination between the central bank and the Ministry of Finance, government agencies and the private sector to solve structural problems such as the aging society, household debt, inequality and sustainable growth. Mr. Vitai also told local media last month after applying for the governor’s role that the policy rate should be significantly lowered for a sustained period to revive the stagnant economy and commercial banks must also pass on the reduction to customers.

The intensifying military clashes along the Thai-Cambodian border are significantly impacting Thailand's tourism sector, leading to a wave of accommodation cancellations in provinces adjacent to the conflict zone. The Ministry of Tourism and Sports revealed a notable decline in tourist numbers and widespread booking cancellations in Sa Kaeo Province's border districts of Aranyaprathet, Ta Phraya, and Khlong Hat. In addition, several countries, such as the United States, the United Kingdom, Canada, Australia, and Hong Kong, have issued travel warnings or advisories regarding the border conflict between Thailand and Cambodia. These warnings primarily focus on the disputed border areas near ancient temples such as Ta Moan Thom, Ta Muen Tod, Ta Kwai, and Preah Vihear. The Tourism Authority of Thailand (TAT) is aiming to attract 35.5 million international tourists in 2025, maintaining the same target as the previous year. Foreign tourist arrivals for the first half of 2025 are reportedly down by 4.66% compared to the same period in 2024 to around 16.68 million visitors. It appears highly likely that Thailand will miss its 2025 tourism targets. The expected negative impact on the tourism industry, along with the exports decline later this year, and the dovish new central bank governor present a downside risk to our current expectation of the terminal rate at 1.25%, which we will be looking to revise once we get a clearer picture of these developments.

In today’s unpredictable market environment, investors are often faced with sharp swings, conflicting headlines, and a constant stream of noise that can make decision-making feel overwhelming. Volatility isn’t just a headline—it’s a reality that affects portfolios, emotions, and long-term goals. That’s where multi-asset investing comes in. By combining different asset classes—such as equities, bonds, real estate, and alternatives - investors can build portfolios that are more resilient, better diversified, and designed to weather market turbulence. Mult-asset strategies can help investors stay steady, stay invested, and stay focused on what truly matters: long-term growth of your portfolios.

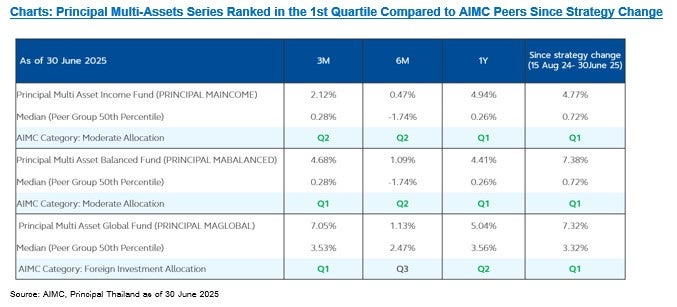

With volatility likely to persist, a balanced approach is key. Diversification across asset classes, geographies, and sectors remains the cornerstone of resilient portfolio construction. Our recommendation to focus on asset allocation diversification appears to remain valid as geopolitical risks keep piling up. Multi-asset funds such as Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED) is appropriate to recommend to clients to stay invested in markets, while we can recommend Principal Multi Asset Income Fund (PRINCIPAL MAINCOME) to more conservative clients or to top up on fixed income funds, and recommend Principal Multi Asset Global Fund (PRINCIPAL MAGLOBAL) to more aggressive clients or to top up on growth or thematic funds to match their profile. We believe that under the current environment, flexibility matters now more than ever due to the elevated geopolitical risk, tariff-driven cost pressure to businesses, as well as diverging central bank policies. Investors should stay diversified and agile to weather potential shocks and to be able to take opportunities when they emerge. The multi asset funds can act as a core portfolio, providing stability and adaptability in uncertain economic conditions. Investors can complement their core holdings with a global fixed income fund to add a conservative tilt to the portfolio; or complement it with a thematic growth fund for a growth tilt to the portfolio. For example, investors can choose to invest in the Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED), which offers a balanced allocation between equities and fixed income, helping to mitigate volatility while seeking steady returns.

I’d like to close this month’s article with an excerpt from an investment article that was written by Seema Shah - Principal Asset Management’s Chief Global Strategist - who wrote it back on June 4. The article - “Mid-year Perspective 2025: Cutting through the noise” - talked about ten key developments that she saw taking shape amid the high volatility that we had been experiencing so far this year. Interested readers can follow this link - "https://www.principalam.com/us/insights/macro-views/mid-year-perspectives-2025-cutting-through-noise” - to read the full article. At the last part of her very insightful article, Seema writes:

The first half of 2025 has tested investor conviction, challenged assumptions, and reinforced just how quickly the macro and market narrative can shift. While the outlook beyond the next few months remains clouded by unresolved policy decisions, the core dynamics - slower growth, persistent inflation, elevated fiscal risk - are now more visible.

Heading into the back half of the year, portfolio should tilt toward resilience and selectivity. As such, investors should consider:

• Short-duration, high-quality fixed income for stability and income.

• Equities with pricing power, strong margins, and clean balance sheets, especially in sectors benefiting from deregulation or insulated from trade frictions.

• Global diversification to hedge dollar weakness and access non-US growth opportunities.

• Active management to identify mispriced risk and sector rotation opportunities in an increasingly idiosyncratic environment.

Even in periods of high uncertainty, there are still ways to position portfolios to take advantage of growing divergences beneath the surface—between sectors, regions, and asset classes. Cutting through the noise means staying grounded in what is known, alert to what is changing, and prepared for what is next.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./ PRINCIPAL MAGLOBAL has a concentrated investment in the United States. Investors should therefore consider the overall diversification of their investment portfolio. /Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results.