CIO View:June 2025

June 2025 has brought a wave of policy shifts, trade developments, central bank recalibrations, and fresh geopolitical conflicts that are reshaping investor sentiment across global markets. From the easing of trade tensions between major economies to renewed debates over interest rate trajectories, investors are navigating a landscape marked by both opportunity and uncertainty.

The recent agreement between the U.S. and China to roll back select tariffs has injected fresh optimism into global markets. Export-heavy sectors, particularly in Asia and Europe, have seen a rebound in investor interest. In late May, the US Court of International Trade ruled that the Trump’s administration’s use of the International Economic Emergency Power Act (IEEPA) to institute sweeping tariffs is illegal. However, the US Court of Appeals for the Federal Circuit granted the government’s request for a stay, effectively pausing the Court of International Trade’s ruling and allowed President Trump’s tariff to remain in effect for the time being. Oral arguments on the appeals are scheduled for July 31, 2025. On June 3, President Donald Trump announced a tariff hike on steel and aluminum from 25% to 50%. The increase applies to all trading partners except the UK which the rate remains at 25%. On June 10, the US and China have reached an agreement in principle to a framework on how to implement the consensus reached by the previous round of talks in Geneva last month, stabilizing what had become a fraught relationship with both countries accusing each other of violating the Geneva trade agreement. The trade deal between the US and the UK has been signed on June 16. The deal implements key parts of a framework agreement reached in May. The US agreed to reduce its import tariff on UK cars from 27.5% to 10% for a quota of 100,000 vehicles annually. Some of UK aerospace products will be exempted from US tariff. The UK will remove its 20% tariff on US beef and establish a tariff-free quota for 13,000 metric tons of US beef imports. The UK will also reduce tariffs on US ethanol imports to zero, with a duty-free quota of 1.4 billion liters.

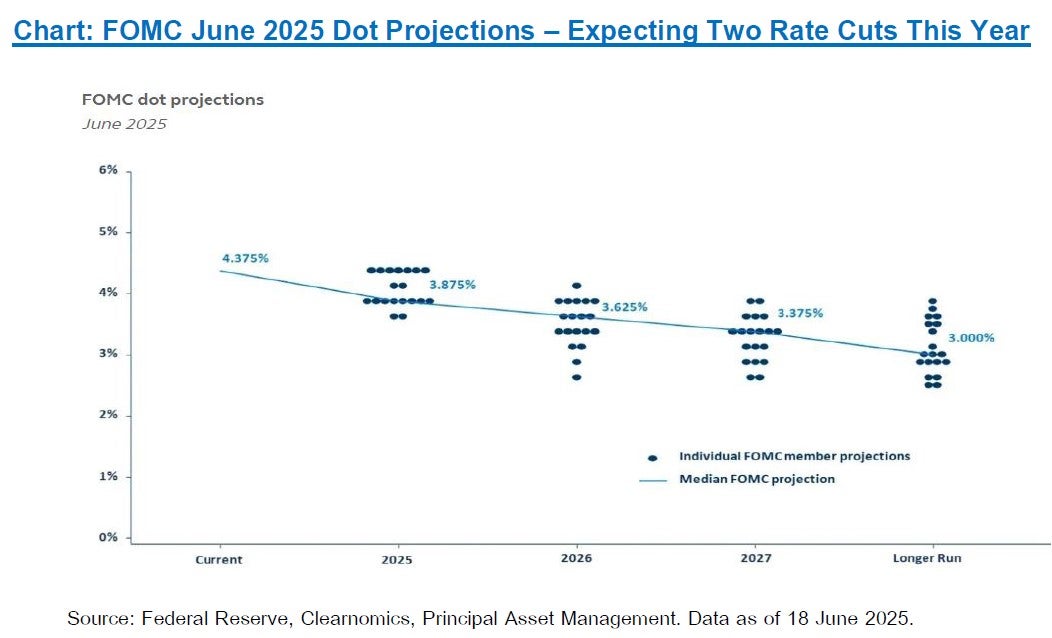

In monetary policy development, the Federal Reserve (Fed) kept the federal funds rate unchanged at 4.25% to 4.50% on June 18, amid expectations of higher inflation and lower economic growth ahead. The Fed released its Summary of Economic Projections (SEP), which revised forecasts from the last update in March, following the FOMC meeting that pointed to further stagflationary pressures. The Fed cut its economic growth forecast for 2025 and 2026 to 1.4% and 1.6% from 1.7% and 1.8%, respectively. The Fed also raised its Core PCE inflation forecast for 2025 and 2026 to 3.0% and 2.4% from 2.7% and 2.2%, respectively. The median projection for the federal funds rate at year-end 2025 remained at 3.9%. This still implies that the FOMC members still expect two 25 basis point rate cuts by the end of the year. However, it dropped off one reduction for both 2026 and 2027, putting the expected total future rate cuts at four, or a full percentage point. Chairman Powell reiterated the Fed’s wait-and-see approach, stating that the Fed is well positioned to wait to learn more about the likely course of the economy before considering any adjustments to their policies.

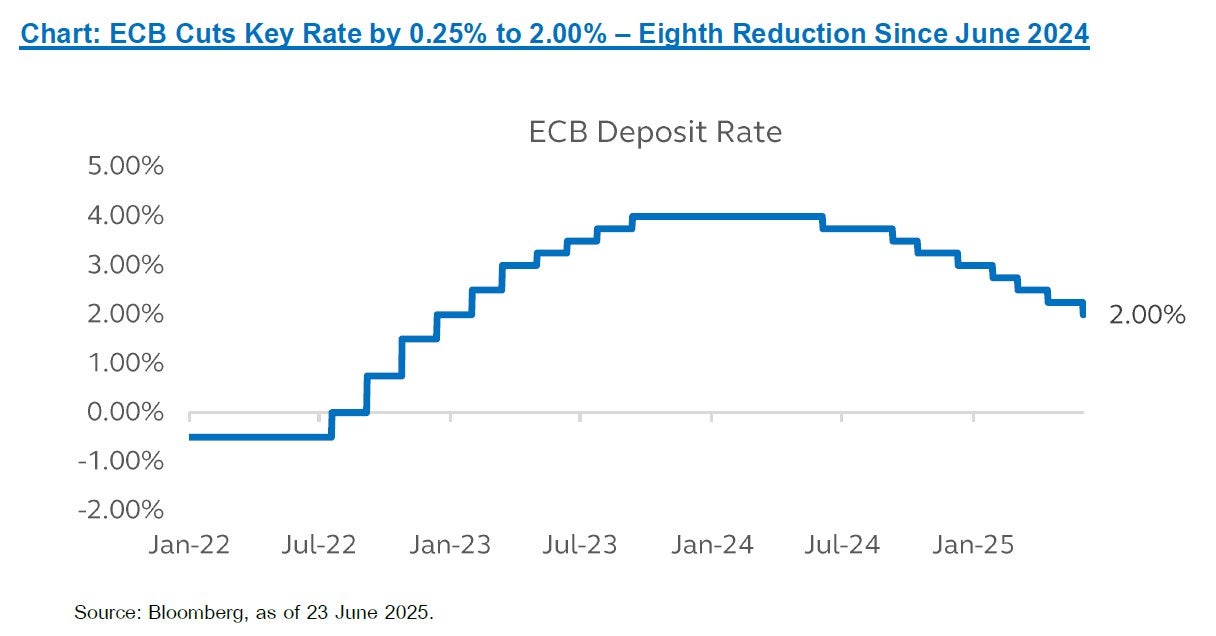

The Bank of Japan (BOJ) maintained its policy rate at 0.5% on June 17, which marked the holding off on rate hikes for the third consecutive meeting. Governor Ueda told the news conference that the future of US tariffs, as well as their impact on overseas economies and price trends is extremely uncertain. The BOJ reiterated it would continue reducing its monthly purchase of JGBs by about 400 billion yen per quarter to about 3 trillion yen until March 2026. It will then slow the cuts to 200 billion yen per quarter from April 2026 to March 2027, aiming to reach a monthly purchase amount of about 2 trillion yen per month. Its purchase rate is expected to be about 4.1 trillion yen of JGBs a month during the quarter ending June 2025. The BOJ explained that the move was aimed at improving the functioning of the JGB markets in a manner that supports stability in the markets. In contrast, The European Central Bank (ECB) lowered its deposit facility rate by 0.25% to 2.00% from 2.25%. The ECB left its projection for euro area GDP growth this year unchanged at 0.9% and slightly revised down its forecast for 2026 from 1.2% to 1.1%. The ECB also lowered its inflation projections for 2025 and 2026, down 0.3% to 2.0% and 1.6%, respectively.

South Korea recently held a snap presidential election on June 3, following the impeachment and removal from office of former president Yoon Suk Yeol. Lee Jae-myung of the Democratic Party of Korea won the election with a historic 49.42% of the total vote. He has now taken office as the new president of South Korea. Lee has promised to prioritize economic growth during the campaign, given recent growth slowdown and elevated trade risks. He has pledged large-scale investments in Artificial Intelligence and other leading strategic industries, notably bio and healthcare, content and culture, defense and aerospace, energy and manufacturing. Another policy priority of the government will be the implementation of financial market reforms.

Oil prices have spiked in June over fears that the Israel-Iran crisis could spiral into a broader conflict involving the US. The conflict between Iran and Israel has escalated significantly in June as both have launched direct missile and drone attack on each other’s territories. Israel has explicitly targeted multiple Iranian oil and gas facilities and nuclear sites, stating its aim is to prevent Iran from acquiring nuclear weapons. Iran has responded with waves of ballistic missiles and drones aimed at Israel’s infrastructure, including a hospital and the Tel Aviv Stock Exchange building. On June 19, President Trump said he will allow two weeks for diplomacy to proceed before deciding whether to launch a strike in Iran. It appeared that it was an effort by Trump to conceal the timing of the attack by the US. On Saturday, June 21, Trump said the US had struck three nuclear sites in Iran, joining Israel’s attacks on the country and drawing America into another war in the Middle East. The president said US planes dropped bombs on Fordow, Natanz and Isfahan in an effort to disable the Islamic republic’s nuclear enrichment capability and set back its alleged pursuit of an atomic weapon. Trump’s decision to strike Iran escalates the conflict in the Middle East, which has been in turmoil since Hamas’s attack on Israel in 2023; and it came just over a week after Israel launched missiles at Iran and Tehran hit back by striking targets in Israel. The attack brings the risk of Iranian retaliation against the US, especially on military bases and ships in the region, along with potential disruption to oil supplies from the world’s most important energy producing region.

Thailand’s Bhumjaithai Party, the second largest in the government coalition and holder of 69 house seats, withdrew from Prime Minister Paetongtarn Shinawatra’s government. The party said its departure was due to the impact on the nation of a leak on June 19 of a phone call recording between Paetongtarn and Hun Sen, the former premier of Cambodia, with which Thailand is involved in an escalating border dispute. This withdrawal has left the Pheu Thai-led coalition with a very slim majority in parliament, raising concerns about the ongoing political instability, and the impact that would have on the country’s economic outlook. Pheu Thai party has had plans to reshuffle the cabinet positions and ministries under responsibilities of the coalition parties. However, the slim majority of just a little over 250 seats would translate to more difficulty in passing the party’s sponsored legislations. On the other hand, some political commentators are also waiting to see whether there the situation would lead to a dissolution of the House of Representatives, which will lead to fresh election; or rather a resignation of Paetongtarn Shinawatra from the PM position, which would mean the government coalition choosing someone else for to be the prime minister. If the lower House is dissolved, it would mean a significant delay of the fiscal budget and government stimulus measures. Thai economic outlook is already gloomy from the expected negative impact on the export sector from the possible tariff hike by the US, and the tourism sector that has been underperforming expectations this year due to weak numbers of Chinese tourist due to safety concerns. With weak outlook on economic growth and persistently low inflation, we think the Bank of Thailand (BOT) is not done with policy rate cuts; however, the changing landscape of the oil market from fresh conflicts in the Middle East could complicate the BOT’s rate decisions for the rest of this year.

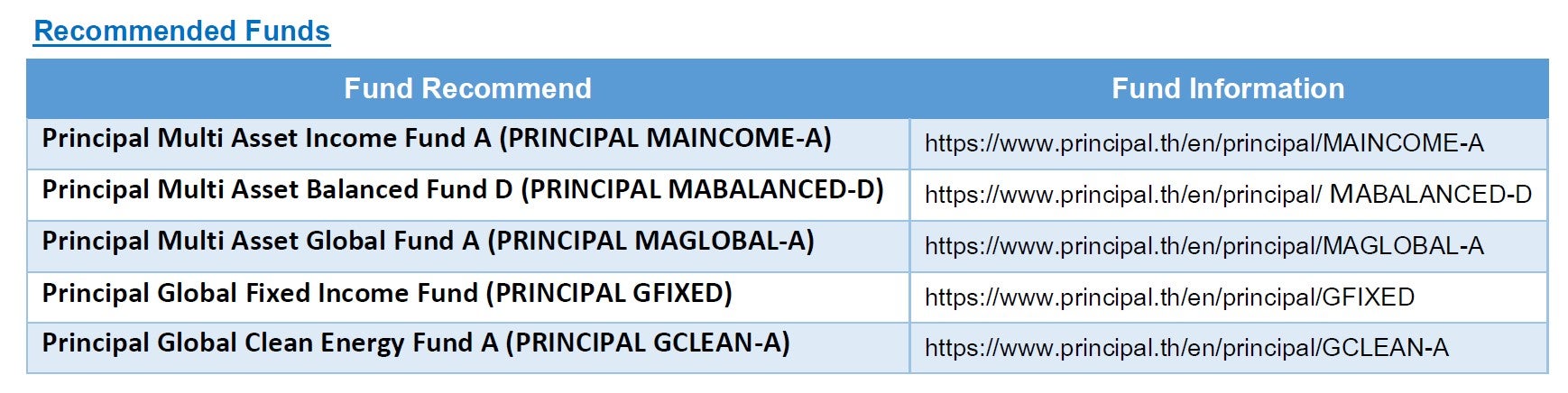

With volatility likely to persist, a balanced approach is key. Diversification across asset classes, geographies, and sectors continues to be the cornerstone of resilient portfolio construction—especially in an environment marked by elevated geopolitical risks, tariff-driven cost pressures on businesses, and diverging central bank policies. We continue to recommend multi-asset funds as core portfolio. Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED) offers a balanced allocation between equities and fixed income, helping to mitigate volatility while seeking steady returns; while Principal Multi Asset Income Fund (PRINCIPAL MAINCOME) with higher exposure to fixed income is suitable to the more conservative clients; and Principal Multi Asset Global Fund (PRINCIPAL MAGLOBAL) with higher exposure to risk assets is suitable to the more aggressive clients. In addition, investors may complement their core holdings with either a global fixed income fund to add a defensive tilt, or a thematic growth fund to enhance growth potential. To add a defensive quality to the portfolio, we recommend the Principal Global Fixed Income Fund (PRINCIPAL GFIXED), which offers protection against rising recession risks. This fund invests in the PIMCO GIS Income Fund, which is actively managed and leverages a wide range of fixed income securities to pursue attractive income, with a secondary goal of capital appreciation. As of the latest data, the fund has a yield to maturity of 6.9% and an average credit rating of AA–, providing a nice yield pickup over Treasurys with excellent credit quality.

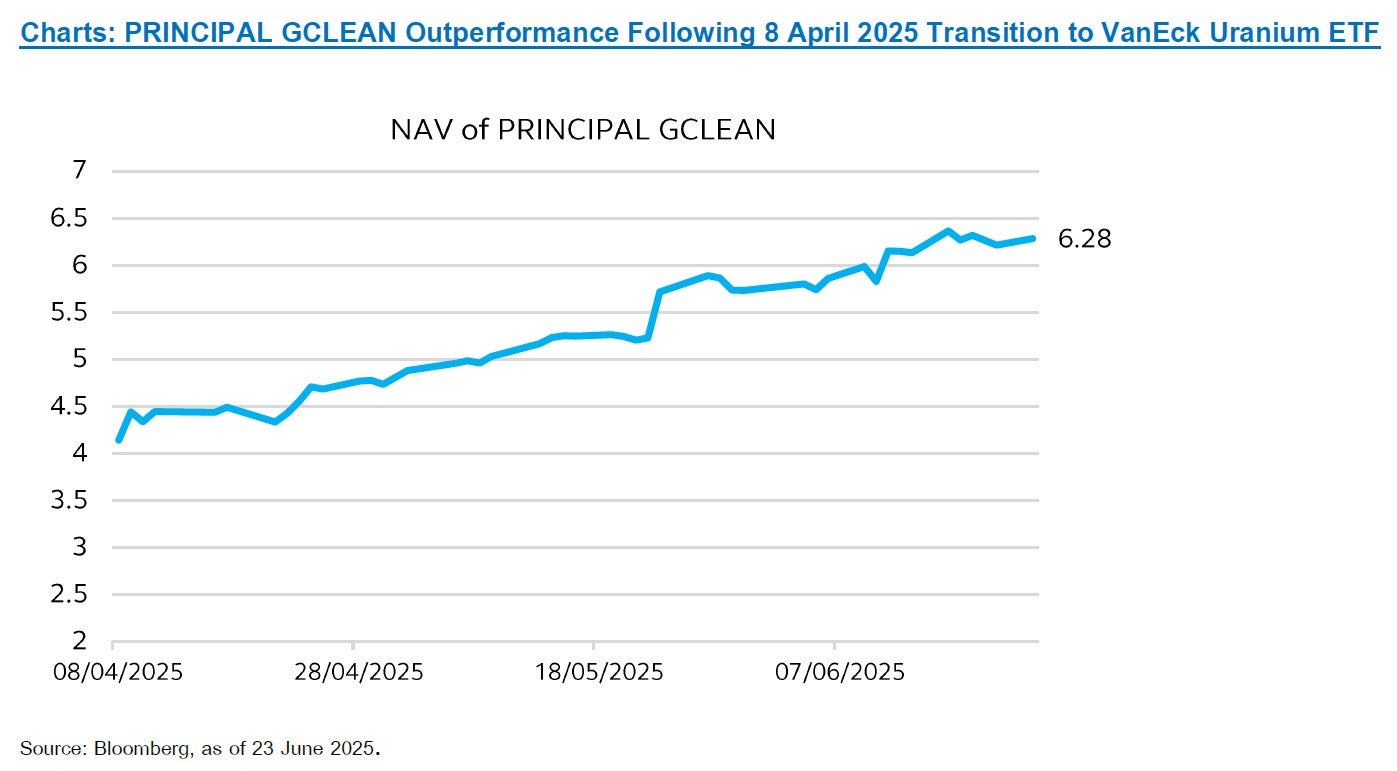

To add a growth tilt, we continue to recommend the Principal Global Clean Energy Fund (PRINCIPAL GCLEAN). This fund focuses on companies in the nuclear energy sector, which is gaining momentum as a key pillar of the global clean energy transition. On May 4, US President Donald Trump signed an executive order to quadruple domestic nuclear energy production over the next 25 years, in response to rising electricity demand from data centers and AI infrastructure. In a related development on June 3, Meta signed a 20-year power purchase agreement (PPA) with Constellation Energy to source electricity from the Clinton Clean Energy Center, a nuclear facility in Illinois, beginning in 2027. This deal highlights a broader trend among tech giants seeking zero-carbon, high-reliability energy sources to support AI-driven growth. These developments reinforce the long-term investment case for PRINCIPAL GCLEAN, which primarily invests in the VanEck Uranium and Nuclear Energy ETF (the master fund). The master fund targets companies involved in nuclear power generation, plant construction and maintenance, nuclear technology and equipment, as well as uranium mining. As of June 23, 2025, the master fund delivered strong returns of 32.97% YTD, 34.10% over 1 year, and 30.05% annualized over 3 years, outperforming its benchmark—the MVIS Global Uranium & Nuclear Energy Index (MVNLRTR)—which returned 32.61% YTD, 33.75% over 1 year, and 30.28% annualized over 3 years. We believe PRINCIPAL GCLEAN presents a compelling thematic investment opportunity, well-positioned to benefit from the accelerating global shift toward clean, reliable energy solutions.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL GCLEAN has a concentrated investment in businesses related to nuclear and uranium sectors. Investors should thoroughly review the prospectus before making an investment decision. The master fund of PRINCIPAL GCLEAN also has a concentrated investment in the United States. Investors should therefore consider the overall diversification of their investment portfolio. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results.