CIO View: May 2025

In early May, the US and the UK announced that they have reached a trade deal. The deal provides targeted relief from some of the recent tariffs and sets a framework for deeper economic cooperation, particularly in key industrial and agricultural sectors. The US agreed to reduce its import tariff on UK cars from 27.5% to 10% for a quota of 100,000 vehicles annually. The US also removed the 25% tariff imposed on UK steel and aluminum. The UK will remove its 20% tariff on US beef and establish a tariff-free quota for 13,000 metric tons of US beef imports. The UK will also reduce tariffs on US ethanol imports to zero, with a duty-free quota of 1.4 billion liters.

On May 10-11, the US and China held significant trade talks in Geneva, Switzerland, marking the first face-to-face meetings between senior officials since the US imposed a 145% tariff on Chinese imports, with China responding with a 125% levy on some US goods. The most significant outcome was a joint agreement to drastically roll back tariffs on each other’s goods for an initial 90-day periods. The US will temporarily lower its overall tariffs on Chinese goods from 145% to 30%, while China will cut its levies on goods imported from the US from 125% to 10%. In addition, both sides agreed to establish a mechanism for continued discussions on economic and trade relations. The representative from Chinese side for these discussions will be He Lifeng, Vice Premier of the State Council, and the representatives from the US side will be Scott Bessent, Secretary of the Treasury, and Jamieson Greer, United States Trade Representative (USTR).

In monetary policy developments, the Federal Reserve (Fed) maintained the federal funds rate in its target range of 4.25% to 4.50% on May 7. The Federal Open Market Committee (FOMC) acknowledged that uncertainty about the economic outlook has increased further since its March meeting. They also stated that the risks of both higher unemployment and higher inflation have risen, presenting a challenging scenario for the Fed to navigate. The Committee signaled a wait-and-see approach to future rate adjustments, emphasizing patience over pre-emption.

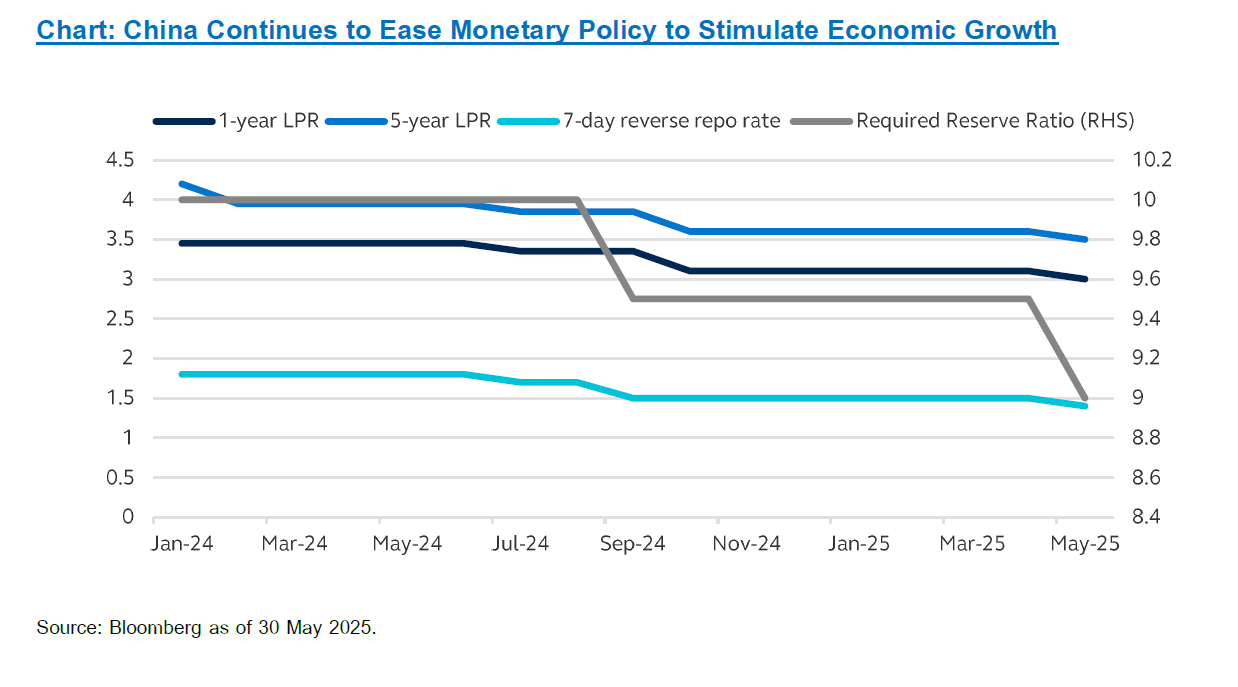

In Japan, the Bank of Japan (BOJ) maintained its policy rate at 0.5% on May 1. The BOJ cut its economic growth forecast for the fiscal year ending March 2026 and 2027 to 0.5% and 0.7% from 1.1% and 1.0%, respectively. Governor Ueda reiterated the BOJ’s data-driven and flexible approach, stating that they would continue to raise the policy rate if economic and price conditions align with their forecasts, but also acknowledging the possibility of the economy temporarily stalling due to tariffs. In contrast, the People’s Bank of China (PBOC) announced several significant interest rate cuts and other monetary easing measures. The PBOC cut 7-day reverse repo rate by 0.1% to 1.4% from 1.5%, the one-year Loan Prime Rate (LPR) by 0.1% to 3.0% from 3.1%, and the five-year LPR by 0.1% to 3.5% from 3.6%. The PBOC also cut interest rates on central bank lending by 0.25%. This includes rates on 3-month to 1.2%, 6-month to 1.4%, and 1-year central bank lending for rural development and micro and small businesses to 1.5%, as well as rates on pledged supplementary lending to 2.0% and specialized structural monetary policy instruments to 1.5%. Alongside the interest rate cuts, the PBOC also announced a 0.5% cut to the Reserve Requirement Ratio (RRR), bringing it to 9.0%.

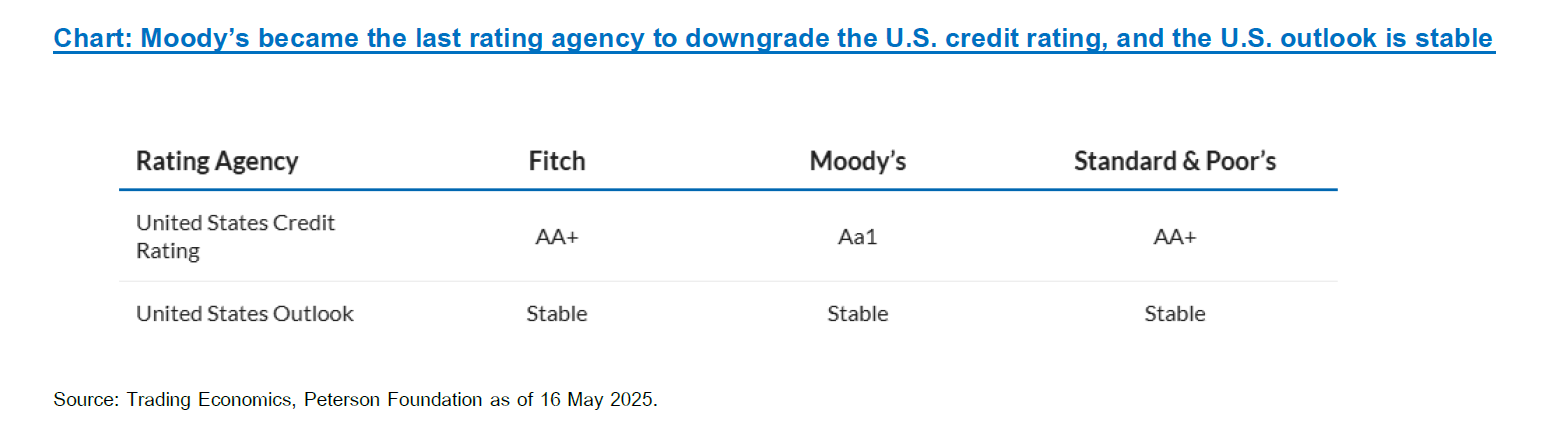

On May 16, Moody’s Ratings downgraded the US credit rating by one notch to Aa1 from Aaa due to mounting government debt and rising interest expenses. This downgrade means that for the first time ever, all three major credit ratings agencies (Standard & Poor’s and Fitch had downgraded the US in 2011 and 2023, respectively) have downgraded US credit below their top rating, i.e., the US is no longer a triple-A rated country. In the Rating Action report, Moody’s analysis stated that “successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” and that “The US’ fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns.”

The Republican-controlled US House of Representatives on May 22 passed a sweeping tax cut bill. The bill is a comprehensive legislative package designed to extend and expand upon the 2017 Tax Cuts and Jobs Act (TCJA), while also introducing new, temporary tax breaks. The bill also cancels many green-energy incentives passed by Democratic former President Joe Biden. According to the Congressional Budget Office, the bill is estimated to add approximately USD3.8 trillion to federal deficits over the next decade.

In Thailand, BOT cut interest rates by 25bps down to 1.75% due to worsening economic outlook and inflation lower than target. Five committee members voted to cut, while two members voted to hold. High uncertainty and slower global growth caused by the US trade policies were cited by the BOT. This will have negative effect on Thailand’s economy, but the impact will become more evident in the second half, and it will be highly dependent on the responses of the government, according to the BOT statement. Meanwhile, inflation is expected to decline to below the BOT’s target range of 1-3% due to falling global oil prices and government subsidies. Furthermore, financial conditions remain tight, and loan growth and credit quality continue to deteriorate. All these points argue for the policy rates to be adjusted lower. And while comments from some BOT officials sound reluctant to provide cues to more rate cuts, we think that the weakening fundamentals will probably argue for another 25bp cut down to 1.5% in the next one or two meetings.

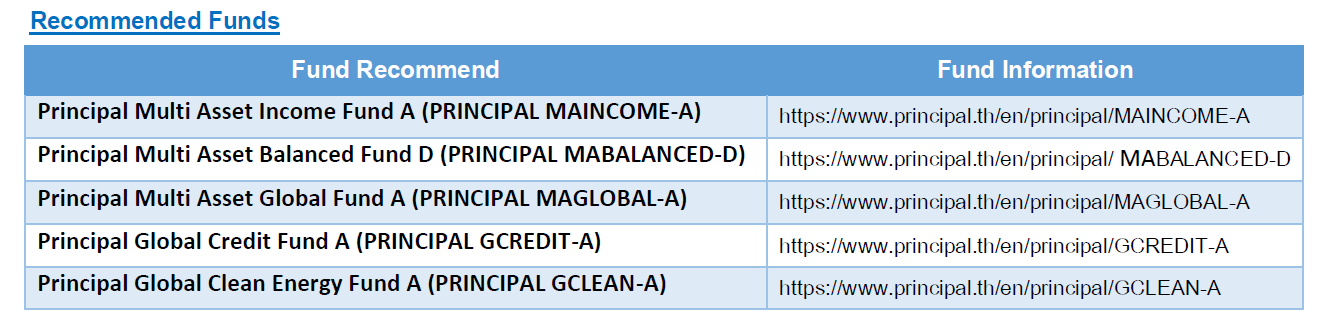

Our asset allocation view favors cautiousness. Major equity indices experienced large drawdowns in early April, and then within the latter part of April and continued into May rallied post the announcement of the 90-day tariff pause to go back to near the highs reached during Feb-Mar. We are slightly UW for global equities, while Thai fixed income is slightly OW. Multi-asset funds such as Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED) is appropriate to recommend to clients to stay invested in markets, while we can recommend Principal Multi Asset Income Fund (PRINCIPAL MAINCOME) to more conservative clients or to top up on fixed income funds, and recommend Principal Multi Asset Global Fund (PRINCIPAL MAGLOBAL) to more aggressive clients or to top up on growth or thematic funds to match their profile.

We believe that under current environment, flexibility matters now more than ever due to the elevated geopolitical risk, tariff-driven cost pressure to businesses, as well as diverging central bank policies. Investors should stay diversified and agile to weather potential shocks and to be able to take opportunities when they emerge. The multi asset funds can act as a core portfolio, providing stability and adaptability in uncertain economic conditions. Investors can complement their core holdings with a global fixed income fund to add a conservative tilt to the portfolio; or complement it with a thematic growth fund for a growth tilt to the portfolio. For example, investors can choose to invest in the Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED), which offers a balanced allocation between equities and fixed income, helping to mitigate volatility while seeking steady returns. To add a defensive quality to the portfolio, we recommend the Principal Global Credit Fund A (PRINCIPAL GCREDIT), which offers a defensive positioning against rising recession risks. This fund invests in the BNY Mellon Global Credit Fund, focusing on investment grade credit with a yield to maturity of 5.5% and an average rating of A, positioning it to benefit from potential declines in bond yields.

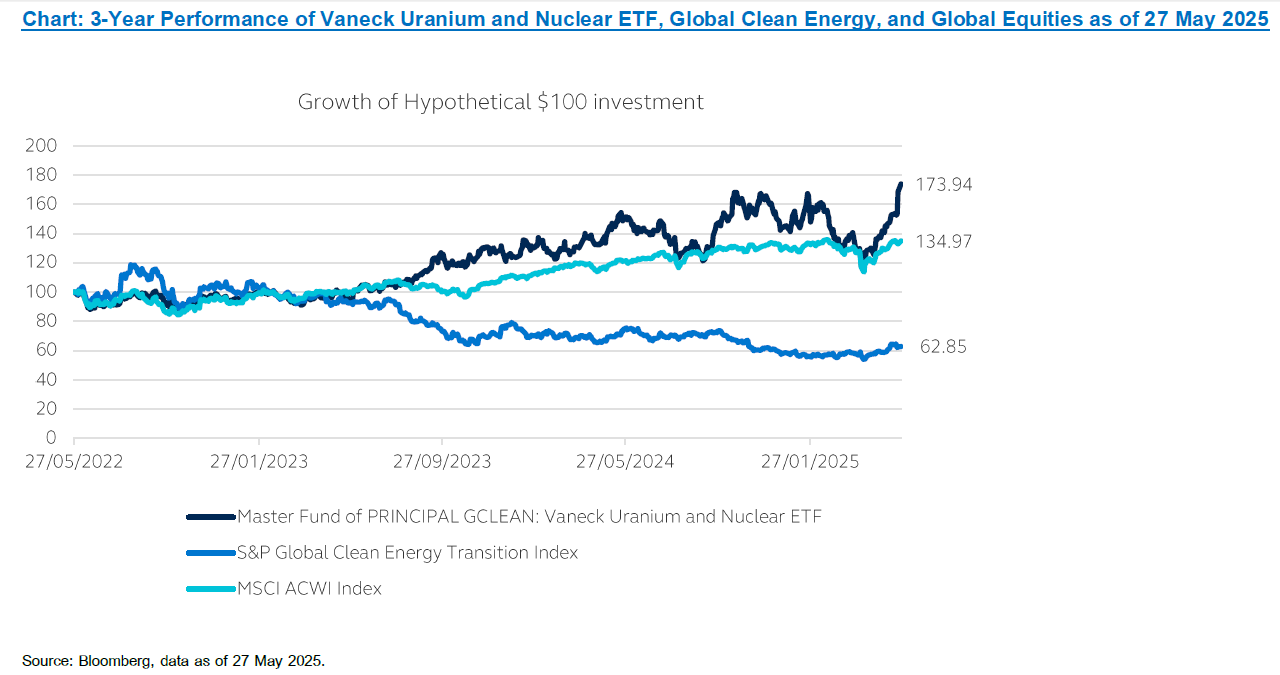

Lastly, to add a growth tilt to the portfolio, we continue to recommend the Principal Global Clean Energy Fund (PRINCIPAL GCLEAN). The fund focuses on investments in nuclear energy, which we view as a vital solution in the transition to clean and sustainable power. On 4 May, US President Donald Trump signed executive orders aimed at quadrupling domestic nuclear power production over the next 25 years. This policy move comes amid surging electricity demand, driven by the rapid expansion of energy-intensive data centers and artificial intelligence technologies—placing significant pressure on the U.S. power grid. This further supports the investment case for PRINCIPAL GCLEAN, which primarily invests in the VanEck® Uranium and Nuclear Energy ETF (the master fund). The master fund targets companies involved in nuclear power generation, plant construction and maintenance, nuclear technology and equipment, as well as uranium mining. As of 27 May 2025, the master fund delivered strong returns of 26.13% (3M), 22.98% (YTD), 16.07% (1Y ann.), and 23.18% (3Y ann.). Its benchmark, the MVIS Global Uranium & Nuclear Energy Index (MVNLRTR), also delivered impressive performance: 25.95% (3M), 23.02% (YTD), 16.49% (1Y ann.), and 23.35% (3Y ann.). We believe PRINCIPAL GCLEAN offers a compelling thematic investment opportunity, well-positioned to benefit from the accelerating global shift toward clean, reliable energy solutions.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL GCLEAN has a concentrated investment in businesses related to nuclear and uranium sectors. Investors should thoroughly review the prospectus before making an investment decision. The master fund of PRINCIPAL GCLEAN also has a concentrated investment in the United States. Investors should therefore consider the overall diversification of their investment portfolio. / The master fund of PRINCIPAL GREDIT has a concentrated investment in the United States and Europe. Investors should therefore consider the overall diversification of their investment portfolio. /Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results.