CIO View: November 2024

In November, global stock and bond markets were largely dominated by the U.S. Election results. Donald Trump from the Republican Party secured another victory in what is referred to as a “Red Sweep,” meaning the Republican Party gained majorities in both the Senate and the House of Representatives – a perfect set up for Trump’s side to implement America-first policies, such as increasing tariffs on trading partners, particularly on China, and reducing corporate taxes. As a result, U.S. stock market posed significant gains thanks to Trump’s pro-growth optimism which supporting U.S. stock markets and its economic expansion. In contrast, emerging markets, particularly China stock market, experienced declines due to anticipated pressure from the tariff hike policies. Tensions started escalating when Trump announced plans to raise additional tariffs on imports from Mexico and Canada by 25% and from China by 10%, effective January 20, 2025, the first day he will take the office.

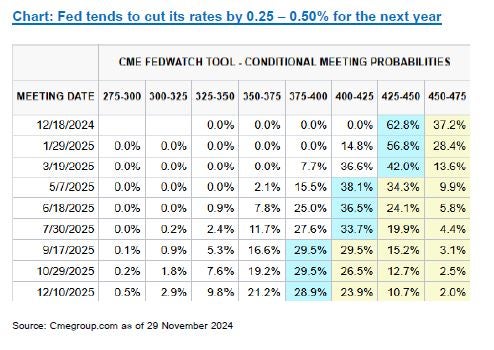

In the bond market, U.S. 2-year Treasury yields rose post-election, reflecting expectations that Trump’s policies might lead to higher inflation, making it more challenging for the Federal Reserve (Fed) to continue rate cuts. Earlier in November, the Fed cut its rates by 0.25% as expected and Fed Chairman, Jerome Powell, clearly stated that Trump’s policies were not yet factored into Fed decisions. However, the market expectations seem to diverge from the Fed’s stance by significantly lowering expectations for further rate cuts in 2025, from a range of 0.75-1.00% before the election to 0.25-0.50%. The upcoming Fed Dot Plot set to be released during the December 17th -18th meeting is expected to provide clearer insights into the Fed’s perspective post-election.

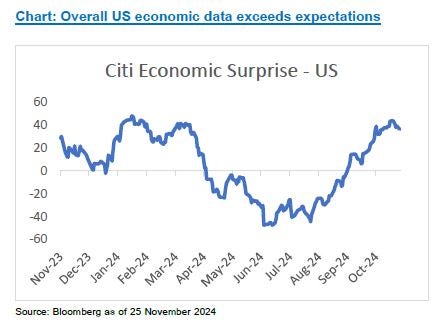

Toward the end of 2024, we believe global stock markets, led by U.S. equities, will continue to have a good performance, supported by Trump’s policies and the robust growth of U.S. economy, along with historical seasonal trends. Trump’s policies are viewed positively as key catalysts for the market, particularly after he selected Scott Bassett as Treasury Secretary, a position highly influential in economic decision-making, including budgeting and trade policies. Scott Bassett, a renowned figure in finance and investment, is expected to pursue policies favorable to US stock markets while potentially mitigating the risk of trade tariff tensions. The strong U.S. economy is indicated by the Citi Economic Surprise Index, which remains at elevated levels, showing better-than-expected economic data. Additionally, historical trends suggest December was typically a strong month for U.S. stocks as S&P 500 Index delivered an average monthly return of 0.93% during the past 30 years, with only 8 years of negative returns during that period. Thus, we anticipate a positive performance for U.S. equities in December.

Tax-Saving Fund Opportunities for Year-End Investments

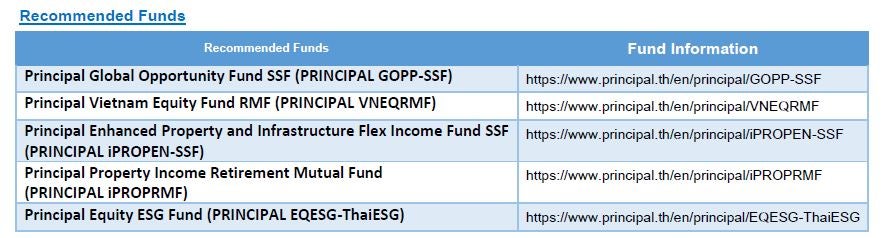

As the year-end is approaching, we believe most investors are considering tax-saving funds. Principal Asset Management has curated the list of tax-saving eligible funds that also fit well with the investment and asset allocation theme for 2025 and recommend the following options:

1. PRINCIPAL GOPP-SSF: This fund primarily invests in the Morgan Stanley Global Opportunity Fund, managed by a team of experts from Morgan Stanley. Its investment philosophy, upheld since its inception, focuses on searching for companies with long-term competitive advantages, steadily high revenue and profit growth (15–20% per year over the next five years), and the ability to adapt rapidly to changing environments. Companies with these characteristics are expected to grow sustainably and navigate macroeconomic risks effectively. The investment approach follows a bottom-up strategy with a long-term perspective of 5–10 years. The fund has a high active share of 90.91% (indicating significant divergence from its benchmark) and an average projected revenue growth of 13.19% over the next three years, versus benchmark’s at 6.01%. Currently, the fund holds a portfolio of 36 companies across diverse industries such as Uber Technologies Inc. - a leading U.S. provider of ride-hailing, food delivery, and package delivery services, holding a 37% market share in the U.S. and expanding into markets with low penetration, such as Brazil and Mexico and Meta Platforms Inc. - The parent company of behind applications such as Facebook, Messenger, Instagram, and WhatsApp, with over 3 billion users globally. The fund has delivered a 10-year average annual return of 14.46%. (Source: Morgan Stanley as of 31 October 2024)

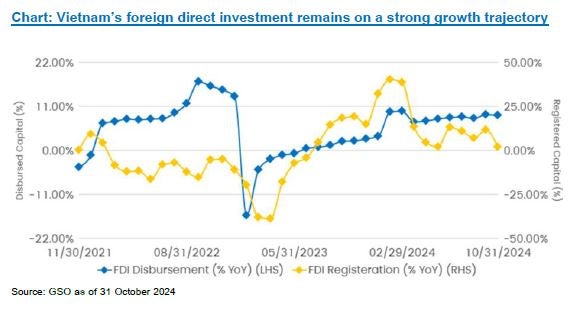

2. PRINCIPAL VNEQRMF: The fund focuses on investing in large-cap companies with strong governance and high-quality fundamentals in Vietnam stock market. The portfolio is designed to capitalize on Vietnam’s long-term economic growth. In November, the VN Index corrected to 1,200 points due to foreign investor sell-offs and tariff pressures from Donald Trump’s policies, bringing the forward P/E ratio below the 5-year historical average which creates another rare but very attractive entry/re-accumulation point for long-term investments. Vietnam’s economic fundamentals remain strong, supported by key indicators such as foreign direct investment (FDI) growing 8.8% year-over-year in the first 10 months, totaling over USD 19.58 billion and exports increasing by 10.1% year-over-year in October as well as manufacturing PMI indicating expansion at 51.2 points in October. The fund management team has reduced exposure to export-related companies since September to prepare for the U.S. election results, and has allocated cash reserves to invest in high-quality, undervalued stocks during market corrections. The portfolio emphasizes financially strong companies like Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB), Vietnam Prosperity Bank (VPB) and Vietnam Dairy Products (VNM).

3. PRINCIPAL iPROPEN-SSF and PRINCIPAL iPROPRMF: These funds focus on high-quality Real Estate Investment Trusts (REITs) with robust balance sheets and the ability to increase rental income over time. They benefit from the down interest rates cycle which is expected to support REIT performance in the future. REITs naturally generate stable rental income, making them less volatile during economic fluctuations and suitable for long-term portfolio diversification.

PRINCIPAL iPROPEN-SSF diversifies investments in REITs across Asia, including Australia, Singapore, Japan, and Thailand. It overweights defensive sectors, such as industrial and infrastructure to reduce portfolio volatility.

PRINCIPAL iPROPRMF focuses primarily on Thailand and Singapore REITs, which are attractively valued compared to developed markets. The fund also overweights infrastructure to enhance risk diversification.

4. PRINCIPAL EQESG-ThaiESG: This new tax-saving fund allows investors to deduct up to 30% of their annual income, capped at THB 300,000, with a minimum holding period of five years from the purchase date. The fund does not count against other tax-saving deductible categories, such as SSF or RMF. PRINCIPAL EQESG-ThaiESG invests in Thai equities with high Environmental, Social, and Governance (ESG) ratings. The investment team combines a systematic investment process and ESG evaluation, leveraging insights from Principal’s global investment teams to enhance returns. The fund is managed by the same team behind the renowned PRINCIPAL DEF and PRINCIPAL EQRMF, both of which received the Fund of the Year Award from the Money & Banking Award 2024.

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. / PRINCIPAL GOPP has highly concentrated investment in North America. So, investors have to diversify investment for their portfolios. / PRINCIPAL VNEQRMF has highly concentrated investment in Vietnam. So, investors have to diversify investment for their portfolios. / PRINCIPAL IPROPEN-SSF and PRINCIPAL iPROPRMF mainly focuses on investment units of property fund and/or real estate investment trust (REITs) and/or infrastructure fund that the fund is exposed to the same risk as investing in real estate or infrastructure directly such as the risk of fluctuations in rental rates and lease rates, Increase in property taxes, changes in relevant laws or regulations, risk from natural disasters, building depreciation over time and the increase in interest rates, etc., as well as the risk of concentration may cause more volatility than investments distributed in many industries / The funds have highly concentrated investment in Asian countries. So, investors have to diversify investment for their portfolios / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment./ Principal Equity ESG Fund may invest in or hold futures contracts to seek benefits and returns, making this mutual fund riskier than other mutual funds. Therefore, it is suitable for investors who want high returns and can accept higher risks than general investors. / Principal Equity ESG Fund has a policy to invest abroad. The management company may invest in derivatives to prevent risks related to currency exchange rates that may occur from investing abroad according to suitability and circumstances at each moment depend on the discretion of the fund manager. Therefore, there may still be some risk from currency exchange rates remaining. This may cause investors to suffer losses from the exchange rate or to receive a refund lower than the initial investment. Moreover, hedging transactions may have costs. This causes the overall return of the fund to decrease due to increased costs. / Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment. / For investor of SSF Class: Investors should study information about investment conditions and requirements of investing in the Super Saving Funds (SSF) in the investment manual under guidance from the Revenue Department before investing. If you have questions, please ask the investor contact for clarification and to understand before subscription the investment unit. / The switching and transferring the investment units of class SSF, investor can switching or transferring among the SSF which have the tax privilege only, except have the change of relevant regulations change in the future. / For investor of SSF Class : Investors cannot bring the investment units of SSF to sell, transfer, pledge or lead as collateral. / Past performance does not guarantee future results.