CIO View: November 2025

Sentiment on US-China trade tension lifted meaningfully over the past month, when the US and China reached a trade agreement after a meeting held in South Korea between President Trump and President Xi on November 1st. China will suspend the global implementation of the October 2025 export controls on rare earths for one year, suspend all retaliatory tariffs announced since March 4th, remove non-tariff countermeasures, take significant measures to curb the flow of fentanyl to the US, and commit to buying 12 million metric tons of US soybeans in the last two months of 2025 and at least 25 million metric tons for 2026. In return, The US will lower the fentanyl related tariff on Chinese import from 20% to 10%, maintain the suspension of heightened reciprocal tariffs on Chinese import for until November 10th, 2026.

The longest government shutdown in US history, which began after Congress missed the September 30th deadline to pass legislation for the 2026 fiscal year, is officially over after President Donald Trump signed a bill passed by Congress on November 13th. The spending bill includes full-year funding for the Department of Agriculture, as well as funding for military construction and legislative agencies and a short-term continuing resolution to fund other departments and agencies through January 30th, 2026. Congress must pass further spending bills or another continuing resolution before January 30th, 2026, to avoid a partial government-shutdown. During the unprecedented shutdown, federal agencies including the Bureau of Labor Statistics suspended operations, which means that the publication of official economic data – including the US jobs report and the Consumer Price Index (CPI) – has been delayed. This poses a headache for the Federal Reserve, which is mulling the prospect of more rate cuts. The shutdown also affected economic productivity as the Congressional Budget Office estimates that the GDP growth rate in the fourth quarter of 2025 will be reduced by 1.5% and will increase by 2.2% in the first quarter of 2026.

The conflict between Japan and China has intensified sharply in November, reaching one of its most severe points in years. The current crisis escalated rapidly following remarks made by Prime Minister Takaichi in Japan’s parliament on November 7th. She stated that a Chinese military attack or blockage against Taiwan could be considered a survival-threatening situation for Japan under its national security laws. This is a critical legal threshold that could allow Japan to activate its right of collective self-defense and potentially intervene militarily. China viewed this as an unacceptable intervention in its internal affairs. In response to Takaichi’s remarks, China has launched a wide range of counterattack including, suspend all imports of Japanese seafood, refused a meeting between Premier Li Qiang and PM Takaichi at the G20 summit, issue travel advisories and discouraged Chinese citizens from traveling to Japan, leading to the cancellation of hundreds of thousands of plane tickets. China also sent coast guard vessels on rights enforcement patrols into the waters around the Senkaku/Diaoyu Islands.

Though the Federal Reserve (Fed) remains concerned about sticky inflation, it is growing increasingly concerned about downside risks to the employment side of its dual mandate. Together with the expected appointment of a “dovish” Fed Chair at the expiry of Jerome Powell’s term next year, this should keep short end interest rates anchored with a bias to the downside even as longer term inflation expectations have remained well anchored. The US labor market remains vulnerable, especially given the extended US government shutdown and equity markets appear to have more than priced in a Goldilocks environment. A decelerating economy that needs bolstering by rate cuts should be supportive for the relative performance of defensive asset classes like REITs.

On the October meeting, The Federal Reserve (Fed) voted 10 to 2 to lower the target range for the benchmark federal funds rate by 0.25% from 4.00%-4.25% to 3.75%-4.00%. The Fed also announced that it would conclude its program to reduce its holdings of US Treasury and mortgage-backed securities on December 1st, 2025. The October Federal Open Market Committee (FOMC) minutes were released on November 19th. The main message is that while the FOMC voted to cut the benchmark interest rate, there is now strong division among policymakers regarding the path of interest rates, particularly for the next meeting in December. Many participants supported the cut, viewing it as necessary to guard against a sharp rise in the unemployment rate. Several officials opposed a December rate cut, with some arguing that progress on bringing inflation back to the 2% target has stalled. They warned that a premature cut could be misinterpreted as a lack of commitment to their inflation target. Officials noted that economic activity was expanding moderately, but job gains were slowing, and the unemployment rate had edged up. They also agreed that inflation remains elevated. The minutes noted officials expressed concern about their ability to assess economic conditions due to the prolonged government shutdown, which had delayed the release of critical economic data like the September jobs report and the October inflation report.

The official US jobs report for September was released on November 20th, after a significant delay caused by the government shutdown. Non-farm payrolls increased by 119,000 in September, up from the 4,000 jobs lost in August following a downward revision. The unemployment rate edged higher to 4.4%, the highest it has been since October 2021. Average hourly earnings increased 0.2% for the month and 3.8% from a year ago, compared to respective forecasts for 0.3% and 3.7%. The jobs gains for July and August were revised down by a combined 33,000. This indicates that the job market was weaker than previously thought. The Bureau of Labor Statistics (BLS) announced that the October jobs report has been cancelled entirely because the necessary household survey data could not be collected during the shutdown. This means the September data will be the last official unemployment rate the Federal Reserve has to consider before its crucial December meeting.

In other region’s monetary policy development, the European Central Bank (ECB) held its deposit facility rate at 2% on October 30th for the third consecutive meeting. The decision to pause the rate-cutting cycle was based on the Governing Council’s assessment that the current monetary policy stance is appropriate to bring inflation back to its target. Headline inflation in the Euro Area is currently hovering close to the ECB’s 2% target. The staff projections see inflation averaging 2.1% in 2025 before undershooting at 1.7% in 2026. ECB President Christine Largarde said at her post-meeting news conference that the economy has continued to grow despite the challenging global environment. With inflation under control, the ECB is not likely to change rates again until sometime next year. Lagarde said that the ECB is "not pre-committing to any particular rate path" and will follow a data-dependent approach as they revisit forecasts meeting by meeting.

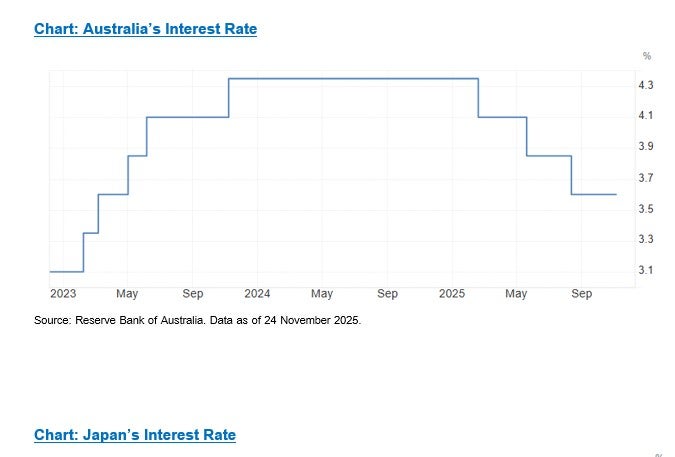

The Reserve Bank of Australia (RBA) kept its cash rate unchanged at 3.6% in November 2025 following earlier rate cuts. Policymakers noted that inflation has fallen sharply from its 2022 highs, despite a temporary uptick over the past couple of months. Policymakers highlighted ongoing uncertainty in both domestic and global outlooks, including stronger-than-expected private demand that could tighten labor markets and fuel inflation, and a slowdown that could weigh on growth. Globally, elevated geopolitical and trade tensions remain risks despite upward revisions to world growth forecasts. Financial conditions have eased, but the full impact of earlier cuts will take time. The RBA remains cautious and data-dependent, closely monitoring inflation, demand, and labor trends. Nevertheless, the board assumes more rate cuts in 2026, with underlying inflation expected to rise above 3% in the near term before moderating to around 2.6% by 2027.

The Bank of Japan (BOJ) held its key interest rate unchanged at 0.5% on October 30th, extending the pause since January. The decision was split 7-2, with board members Naoki Tamura and Hajime Takata proposing a 0.25% hike. Governor Kazuo Ueda said he wanted “just a bit more data” on next year’s wage-growth direction and warned of the boost a weak yen could have on underlying inflation. Although the central bank reaffirmed its commitment to continue raising interest rate if the economy follows its projections, the market expects Japan’s interest rates to stay low under Prime Minister Takaichi as her large 21 trillion JPY stimulus plan signals a clear priority to support growth rather than tighten financial conditions. The package relies heavily on new government bond issuance which increases fiscal pressure so making aggressive rate hikes amidst high public debt level is less likely, since higher policy rates would raise debt-servicing costs and undermine the stimulus itself. With Japan’s economy still showing weak demand, uneven wage gains and only moderate inflation, the BoJ is expected to maintain an accommodative stance to complement fiscal expansion.

Thailand’s economy contracted by 0.6% in the third quarter of 2025 from the previous quarter after seasonal adjustments, with growth slowing to 1.2% year-on-year from 2.8% in the second quarter, the National Economic and Social Development Council (NESDC) reported on November 17. Export growth slowed significantly (6.9% vs 11.2% inQ2), primarily due to the impact of newly imposed US tariffs. Government consumption contracted by 3.9% as budget disbursement was delayed from recent government changes. Although tourism is still recovering, the growth rate in the accommodation and food service sector slowed down. For full year 2025, the NESDC maintained its growth forecast at 2%, down from 2.5% in 2024, with average inflation at 0.2% and a current account surplus equal to 2.8% of GDP.

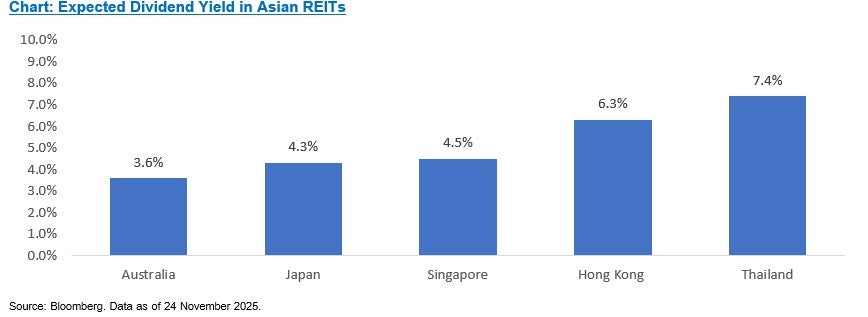

In 2025, broader Asian REIT markets have delivered strong performance. The region-wide segment has generated an average return of 13.4% in the first ten months of the year, outpacing many global equity markets. This outperformance has been supported by improving forward yield prospects as inflation pressures ease across major economies. Investor preference has also shifted away from growth equities toward assets with stable cash flows and real asset backing particularly is attractive when regional currencies are favorable versus the USD.With the global macro backdrop shifting as inflation moderates and central banks signal delays in rate cuts, Asian REITs experienced corrections in November. Nevertheless, we believe this pullback has created a more attractive entry point, as the correction has helped valuations reset. Many REITs are now trading at wider yield spreads relative to historical averages, while operational fundamentals such as renewal rates, occupancy, and rental growth in key markets remain resilient. For example, in Singapore and several other markets, net property income has continued to show healthy growth amid easing financing cost pressures. The combination of stronger yield support, solid underlying cash flows, and the opportunity to enter after a correction makes the current environment compelling for accumulation.

Beyond the near-term valuation opportunity, the structural setup further strengthens the medium-term case. Supply remains constrained in many Asian cities, and demand drivers such as urbanization, tourism recovery, and growth in digital/industrial real estate are gaining traction following the resolution of U.S. tariff uncertainties. With many REITs expected to refinance at lower rates over the next 12–24 months, there is upside potential in distribution growth as interest-cost tailwinds begin to flow through. In other words, the recent correction should be viewed not only as a pullback, but as a reset to the sector’s risk and return profile, offering a more attractive point for investors willing to engage over the medium term. We continue to believe that the REIT sector offers an appealing investment opportunity, with valuations still inexpensive relative to public equities. REITs are also relatively insulated from direct tariff impacts and the broader de-risking away from America. Supported by steady fundamentals and durable cash flows, they remain a compelling way to diversify risk within portfolios.

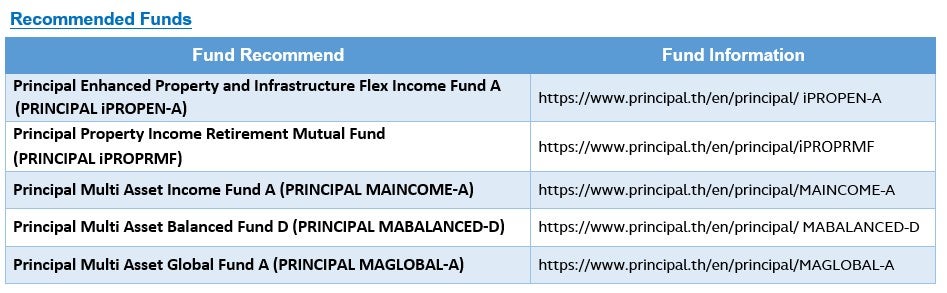

PRINCIPAL iPROPEN offers investors an effective way to capture the long-term growth potential of Asian listed REITs while enjoying diversification and steady income, supported by an expected dividend yield of 4–6%. The fund provides access to high-quality REITs and real-estate securities across major Asia Pacific markets including Australia, Japan, Singapore, Hong Kong, and Thailand, benefiting from structural themes such as urbanization, logistics expansion, data-centre demand, and stable rental cash flows. Meanwhile, PRINCIPAL iPROPRMF is designed for long-term savers seeking tax-efficient retirement accumulation through the RMF structure, with exposure to Thailand and Singapore REITs delivering an expected dividend yield of 5–7%. Our portfolio strategy continues to emphasize bottom-up stock selection and strong company fundamentals to generate excess returns. With a preference for quality and strategic overweights in resilient long-term earnings growers, we expect the portfolio to be well-positioned for periods of economic weakness and lower yields. If markets revert to a risk-on environment, some relative performance headwinds may emerge, but the funds remain anchored by solid fundamentals and durable income characteristics.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL MAGLOBAL has highly concentrated investment in US. Therefore, investors should consider the overall diversification of their investment portfolio. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results./ PRINCIPAL iPROPEN and PRINCIPAL iPROPRMF mainly focuses on investment units of property fund and/or real estate investment trust (REITs) and/or infrastructure fund that the fund is exposed to the same risk as investing in real estate or infrastructure directly such as the risk of fluctuations in rental rates and lease rates, Increase in property taxes, changes in relevant laws or regulations, risk from natural disasters, building depreciation over time and the increase in interest rates, etc., as well as the risk of concentration may cause more volatility than investments distributed in many industries / PRINCIPAL iPROPEN has highly concentrated investment in Asian countries. So, investors have to diversify investment for their portfolios / PRINCIPAL iPROPRMF is concentrated in the property sector. Therefore, if there are negative factors that affect the investment, investors may lose a lot of money. PRINCIPAL iPROPRMF investor should also study information about tax benefits as specified in the investment guideline. If not complying with investment conditions investors will not receive tax benefits and must return tax benefits.