Principal Upadate: CIO’s View: January 2022

2022 Outlook: Rising rates & volatility, focus on large cap with quality cash flows

By Supakorn Tulyathan, CFA Chief Investment Officer

18 January 2022

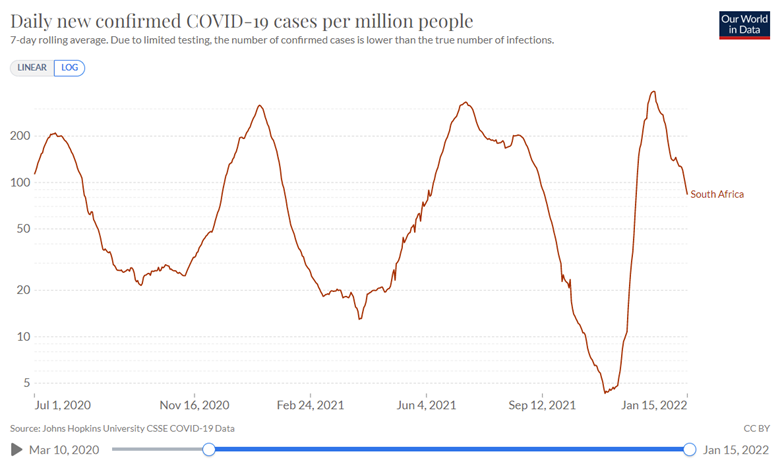

Year 2022 have started with a lot of developments that impact how we look at the global economy and various capital markets. The rise of Omicron that started in South Africa around the end of November last year had greatly impacted risk assets around the world, as investors came to realization that Covid wouldn’t so easily go away, while countries around the world quickly shut down their borders to travelers from South Africa. Capital markets declined as investors were reminded of how a discovery of a new Covid strain could lead to disruptions of economic activities, and to company’s revenue-generating ability. However scary a thought that is, it does seem that this time around, the severity of the new strain has been less than the previous ones; while new cases have already been dropping in South Africa after only about a month of discovery, perhaps suggesting a milder effects on the global economy in 2022.

Source: Johns Hopkins University CSSE COVID-19 Data. Data as of January 16, 2022.

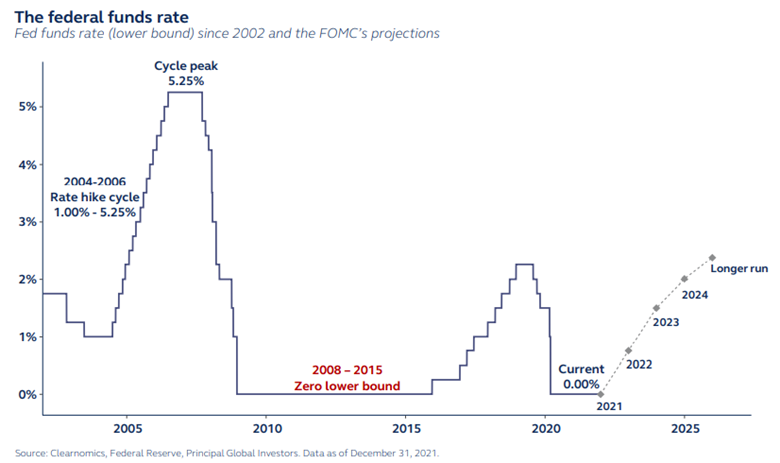

Unfazed by the negative effect that the Omicron may portend, the Fed has been raising their concerns on the inflation outlook, and the changing dynamics of the monetary policy. The minutes of the most recent FOMC meeting revealed the discussion that the members had on the appropriateness of the reduction of QE, or what they officially termed as the “Balance Sheet Runoff”. As this hasn’t been in anybody’s mind at the very start of the year, the discovery that the Fed had already been talking about this back in December had startled the market. Economists around the world are now beginning to move up their expectations of the first hike in the Fed funds rate, dubbed “Liftoff” by the Fed; along with increasing number of hikes expectation; and also, the timing of when the Balance Sheet Runoff would happen in 2022. Currently, our view is for the first hike to begin in June 2022, and for a total of 3 hikes in the year, and for the Balance Sheet Runoff to begin sometime in the second half of 2022, perhaps in Q4.

Source: Clearnomics, Federal Reserve, Principal Global Investors. Data as of December 31, 2021.

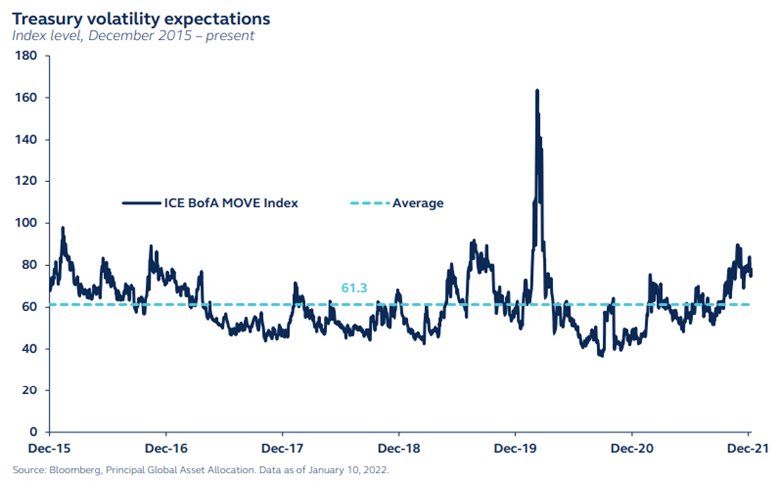

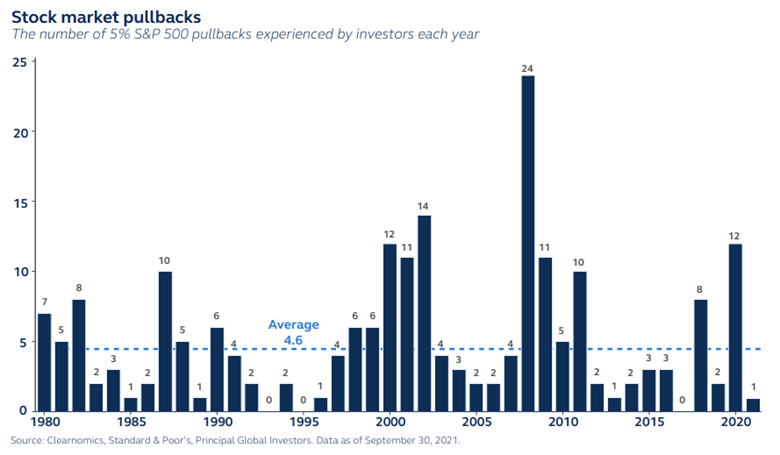

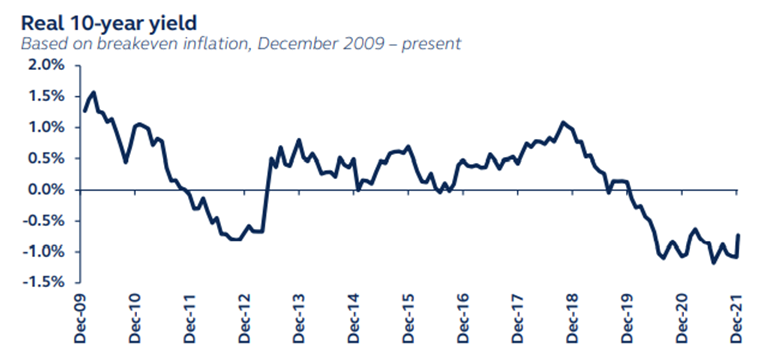

These key developments have now given us a chance to reflect on what could be happening next in the markets. The economic cycle in the US is much more advanced than in other countries, and the Fed probably feels justified to be more vocal in the fight against high inflation. This will be putting downward pressure on financial conditions in the US, first and foremost; while there will also be reverberations across the world as capital flows back to the US. The rise in US Treasury yields is already happening as a result of the Fed becoming more hawkish. We should see further increase in the expected volatility in the bond market in 2022, which is the year that the Fed “pivots” to actively fighting inflation. Historically high correlation between equity and bond volatility also leads us to expect more frequent periods of equity market corrections this year. We should note that historically stock market pullback of around 5% usually happens around 5 times per year on average. Another important point to note is that US real yields is still in a deeply negative territory, while the growth rate of the US will be significantly above trend in 2022.

Source: Bloomberg, Principal Global Asset Allocation. Data as of January 10, 2022.

Source: Clearnomics, Standard & Poor’s, Principal Global Investors. Data as of September 30, 2021.

Source: Bloomberg, Principal Global Asset Allocation. Data as of January 10, 2022.

All this points toward a continued period US equity market outperformance, versus emerging markets, where we see another year of struggling returns resulting from lower China growth rate, declining liquidity from the Fed, a stronger US dollar, slow to recover international tourism, and high oil prices impacting growth of net oil importers. Investors can check out our Principal US Equity Fund (PRINCIPAL USEQ) for our recommendation on this. Another equity market we like is European equities, where think that growth is still favorable, and conducive to positive returns for the equities; while we shouldn’t see policy rate hike there until 2022 have passed. Please check out our Principal European Equity Fund (PRINCIPAL EUEQ) for this.

As the global cycle moves into a slower growth rate period, we are tempering our expectation for equity market returns. However, it should be higher than what you get for investing in bonds during rising rates and declining balance sheet. With volatility awaiting us in 2022, we are more cautious in our equity style preference, and advocate a quality tilt toward big cap exposure, as large companies with positive cash flows will show clear advantage over smaller cap with negative cash flows. We recommend our Principal Global Brands Fund (PRINCIPAL GBRAND) to position for this view.

For Thematic Investments, we still like a few global themes for its potential long-term growth. Once market has priced in enough of the risk of rate hikes and balance sheet runoff, downside might start to be limited, while the structural stories for these themes are quite compelling. We like Electric Vehicle theme due to the high EV adoption rate expected in 2030, translated to near 30% growth of EV sales per year. Another theme that we like is the Metaverse theme. It is still in early days. But that means that the Metaverse-related markets can have a long way to expand. Investors interested in exposures to these themes can check out our Principal Global Innovation Fund (PRINCIPAL GINNO)

Finally, a relook at Thai equities is warranted. This is because equity market returns usually correspond best to improvement in growth, and Thai economy stands out well this year. For illustration, looking at the growth expectation for 2022 vs 2021 published by the Bank of Thailand, Thailand is expected to grow at 3.4% this year compared to 0.9% in 2021. This translates into a growth rate difference of +2.5%, much higher than what the IMF is expecting for the global GDP of 4.9% in 2022 against 5.9% in 2021, meaning a growth rate difference of -1%. In simple terms, Thailand is in a growth recovery phase, whereas the global economy is moving into a mid-cycle phase. Market returns are usually higher for recovery phase economies. Along the same line of thinking, IMF expects Vietnam to grow by 6.6% in 2022 (market economists are forecasting higher than 7% in 2022) against 3.8% in 2021, which has a growth rate difference of +2.8%. Thailand and Vietnam are probably worth having as exposure within the portfolio for 2022 growth recovery. For Thai equities, we recommend our Principal Enhanced Equity Fund (PRINCIPAL EEF). For Vietnam equities, we recommend our Principal Vietnam Thai Opportunity Fund (PRINCIPAL VTOPP)

Fund Recommended