CIO’s View: April 2023 - Go underweight global equities and overweight global fixed income

28 April 2023

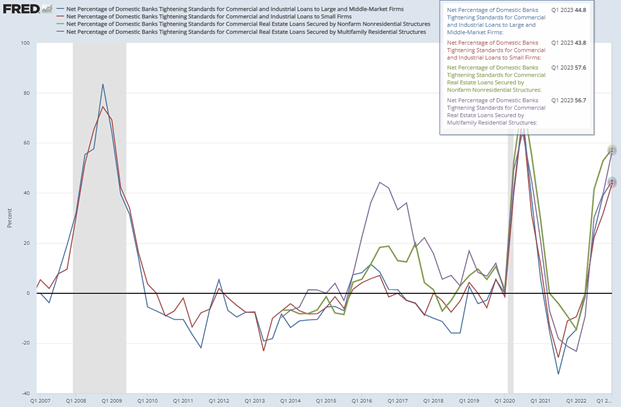

Last month, we made an assessment that the failure of Credit Suisse bank issue should remain an idiosyncratic one, and that the risk of the European banking sector becoming a systemic risk is not very high. We still stand by that assessment, as it still looks to remain that way. However, the real problem lies in the medium term outlook for the US banks and the linkage to the US economy, as we think that there’s a high chance that the banks will be tightening lending standards in the quarters ahead. Taking a look at the Senior Loan Officer Survey on Commercial and Industrial Loans (C&I loans) and the Commercial Real Estate Loans (CRE loans), US banks have actually been tightening loan standards since around end of 2021 to beginning of 2022, to the most recent report back in February this year of over 40% for C&I loans and close to 60% for CRE loans. We think that this will rise further when numbers for Q2 to Q4 comes out later in the year, which will result in the US economy going into recession starting in Q3.

Chart: Senior Loan Officer Survey – Tightening standards for select categories

Source: TradingView, as of 25 April 2023.

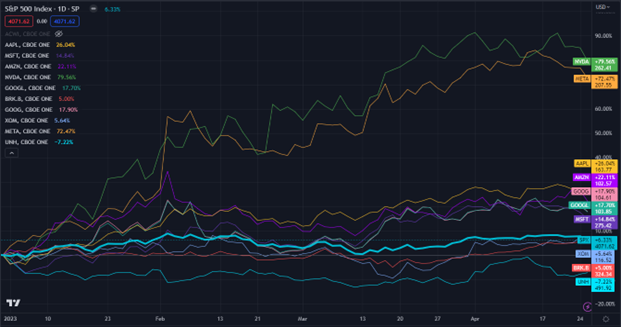

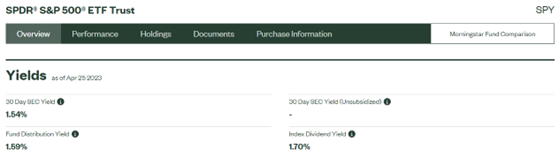

Another interesting development of note is that we have seen that investors have been rotating money into stocks that are considered big with lots of cash on the company balance sheets. We observed that the leadership of mega-cap stocks is considered very extreme, which is seen when looking at year-to-date return comparisons between the top 10 stocks by market cap of the S&P 500 index versus the performance of the S&P 500 itself. As of 25 April 2023, S&P 500 has price return of +5.9%, which is lower than the eighth-ranked Berkshire Hathaway Inc. Class B shown with a year-to-date return of +6.2%. This sets the stage for a potential for the US stocks to head lower in the coming 1-3 months ahead. Together with the piece of information that we provided last month that the US equity market looks unattractive compared to IG credits, with S&P 500’s dividend yield of only around 1.5-1.7% when looking at dividend information on the SPY ETF from the ETF manager’s website. We think this looks extremely unattractive for US stocks, compared to the yield level of around 6.4% for PIMCO GIS Income Fund, which is the master fund of Principal Global Fixed Income Fund (PRINCIPAL GFIXED). This is why we think that allocation to the global fixed income space is the more logical choice for this volatile environment that we’re in.

Chart: YTD Price return of S&P 500 index versus top 10 stocks by market cap

Source: TradingView, as of 25 April 2023.

Chart: Dividend yield level for SPDR S&P 500 ETF Trust listed in the US

Source: State Street Global Advisors, as of 25 April 2023.

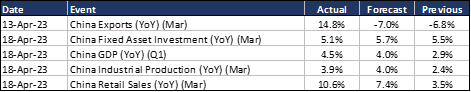

Some update on China’s economic numbers is warranted. China’s 1Q23 GDP release on 18 April 2023 was on the strong side, showing GDP growing by 4.5% from a year earlier, compared to 4.0% expected by the consensus, and 2.9% growth in the previous quarter. The strong GDP growth points to a strong recovery from travel-related consumption and services after the draconian zero-Covid policy. Other indicators released were on the strong side as well. Industrial production in March was +3.9% from a year earlier, an acceleration from +2.4% in the previous month. Retail sales in March was +10.6% from a year earlier, an acceleration from +3.5% in the previous month. Exports in March was +14.8% from a year earlier, an acceleration from -6.8% in the previous month. Fixed asset investment in March was on a softer note, rising only +5.1% from a year earlier, a slight downshift from +5.5% in the previous month. Despite good numbers reported, Chinese stock markets have been trading weaker in the latter half of April. We think that this is due to traders turning more cautious on geopolitical issues between US and China. However, we are still of the view that corrections are short-term and that these instead provide good entry points.

Chart: China’s economic data releases

Source: Investing.com, as of 25 April 2023.

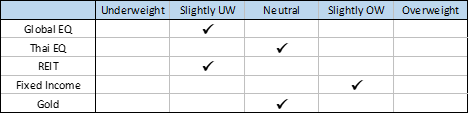

Next week, investors around the world will be closely watching the outcome of the FOMC and the accompanying statements. We expect the Fed to raise the Fed fund rates by 0.25% to 5.00-5.25% target range. There is a high chance that the Fed will pause after this next meeting, with the market pricing in around 61% chance of a pause at 5.25%. If the Fed does pause, it will be for the wrong reasons, which are the expected tightening of credit conditions and the unexpected banking stress. While on the inflation front, core inflation hasn’t exhibited signs of meaningful decline, even though the headline inflation has been declining due to lower energy prices. This has the potential to generate more volatility in the near term, which is why we are reducing further the recommendation for global equities down to Slightly Underweight from Neutral. At the same time, we have reduced gold down to Neutral due to heavy investor positioning that we’ve seen. This makes global fixed income the only major asset class that we are calling for a slightly overweight position at this time.

Chart: Near-term asset class outlook over the next 1-3 months

Source: Principal Thailand, as of 27 April 2023

Fund Recommend

Read CIO’s View: April 2023 - The best time to get into global fixed income is now