CIO’s View: December 2022 - The Year of the Pivot

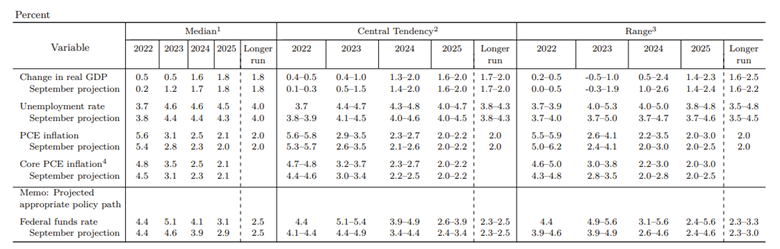

We end this very tumultuous year with probably the most anticipated FOMC. The Fed had decided to hike the Fed funds rate at a reduced pace of +50bp, putting the Fed’s policy rate at the range of 4.25-4.50%. This was the result that the market had widely been expecting to happen this time. Along with the last rate hike decision of the year, the Fed also published their economic projections for the December round. The most important piece of information contained within the so-called “Dot Plot” was probably the projections of the terminal Fed funds rate, which had been moved up to 5.1% versus the 4.6% projection during the last September projection. This suggests that a total of 0.75% increase in the Fed funds rate is likely to come during 2023. The Dot Plot showed that the Fed expects to hold the Fed funds rate at 5.1% for the rest of 2023, after which they expect to cut to 4.1% during 2024.

Chart: Economic projections of FRB members and presidents for the December 2022 meeting

Source: Retrieved from https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl2022121…, FOMC Projection materials, Board of Governors of the Federal Reserve System, as of 14 December 2022.

Following on the heels of the FOMC rate hike, the ECB Governing Council also decided to reduce the pace of rate hike to +50bp at their December meeting, taking the deposit rate to 2.00%. They also announced the plan to start shrinking the EUR5 trillion worth of bonds that it had acquired over the past eight years starting from March 2023. The ECB warned markets not to expect an early end to rate rises next year, while suggesting that two more 50bp rate hikes are likely in the cards. The BoE also raised its policy rate by +50bp to 3.5%, and also gave a warning that further tightening of monetary policy is very likely.

Chart: ECB’s monetary policy statement at a glance for the December 2022 meeting

Source: Retrieved from https://www.ecb.europa.eu/press/pressconf/visual-mps/2022/html/mopo_sta…, European Central Bank, as of 15 December 2022.

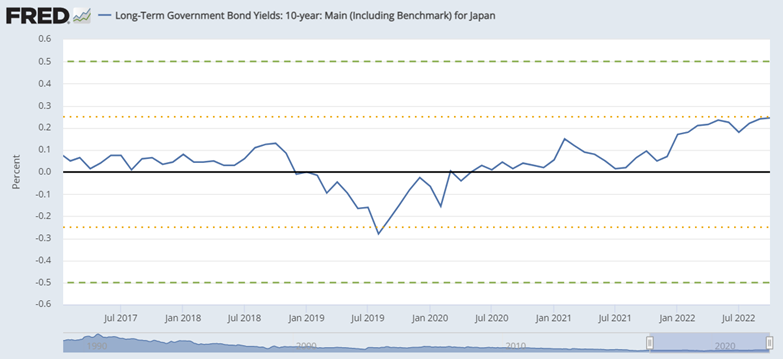

Meanwhile, on 20 December 2022 the BoJ has blindspotted the market with its surprised announcement of a change to its so called “Yield Curve Control” policy (or YCC in short), even while holding its policy rate steady at the still-negative level of -0.10% and the 10-year bond yield at 0%. Most of the market participants had probably been expecting this to happen next year after the current BoJ governor Haruhiko Kuroda’s term has ended. However, this had come sooner than expected. The BoJ has announced that it would allow 10-year bond yields to fluctuate within the range of plus and minus 0.5%, instead of the previous range of plus and minus 0.25%, essentially doubling the previous stance. Governor Kuroda had mentioned that this does not amount to rate hike or an end of YCC policy, but a policy measure to address the increased volatility in the market and to improve the bond market functioning. Immediately afterward, 10yr JGB yield moved up to around 0.4%, while the yen strengthened near 132 level.

Chart: BoJ announced its new YCC range to +/-0.5% from previous +/-0.25%

Source: Organization for Economic Co-operation and Development, Long-Term Government Bond Yields: 10-year: Main (Including Benchmark) for Japan [IRLTLT01JPM156N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IRLTLT01JPM156N, as of 20 December 2022.

Following the week full of big central bank decisions, global equity markets had started to fall again, due to the belief that more rate hikes will need to happen in 2023, which should be negative for stocks, i.e. same as what had happened during this year. I would posit a different scenario that 2023 is likely to be a good year for risk assets, albeit with different outcomes depending on the nature of asset class. The main underlying reason for this is that the Fed has only about 0.75% worth of rate hikes to implement next year, or just a little more than that if inflation doesn’t come down fast enough. This means that I’m expecting the year 2023 to be the year of the Fed’s “Pivot”.

Where I’m most bullish is EM equities, which should be supported by 1) the end of the Fed’s hike sometime in 2023, and 2) the US dollar declining throughout the year. Within EM, I like Asian equities in particular, given that on top of the two things already mentioned, 3) oil price is expected to be moving lower, and 4) China’s full reopening in 2023 will provide another strong support for Asian assets to outperform. As for DM, US equities will tend to underperform in 2023 due to 1) expensive valuation both against itself and against other DM markets, and 2) US earnings trajectory which should be heading lower from past rate hikes taking effect, and reduced demand from recessionary backdrop. The other DMs should be able to outperform the US, chiefly due to Japan’s reopening activities and the BoJ maintaining relatively easy monetary stance; while Europe is mainly on cheap valuation, and also from lower terminal rate of the ECB versus the Fed, relative to their own neutral/longer-run levels.

Along with our preference for EM equities, EM debt should also do well, especially for the local currency emerging market bond strategy, from the outperformance of EM currencies versus the dollar. Global IGs should be able to perform well from favorable credit fundamentals, as well as its long duration profile on the back of declining Treasury yields environment. Global HY will probably struggle due to difficult liquidity backdrop still affecting high yield companies’ ability to source fundings, amid recessionary environment in some major economies. This means that we are still negative on tech/growth companies as well, due to the difficult financing environment, and the overall negative macro environment affecting aggregate demand.

For Thailand, the most exciting part of the recovery is probably over, which is the initial rebound of the tourism sector. Tourism will continue to recover in 2023, but the economy will also face headwinds coming through the trade channel. There is a risk that DM’s recession affecting Thailand’s trade outweighs the positive push from recovering tourism sector, as the export sector usually contributes significantly more to GDP than the tourism sector. Hence, on the aggregate demand side, risks are looking quite balanced at the moment, while the BoT will probably continue with its 25bp hikes a few more times and end the year at around 2.00%. This means that there’s remaining duration risk for Thai fixed income next year. On the currency side, Thai baht will probably have a strengthening bias vs the US dollar throughout the year from 1) the reverse of monetary policies, 2) better growth levels of Thailand vs the US, and 3) broad dollar index heading lower.

Fund Recommendation