CIO’s View: May 2023 - Patience is a virtue

31 May 2023

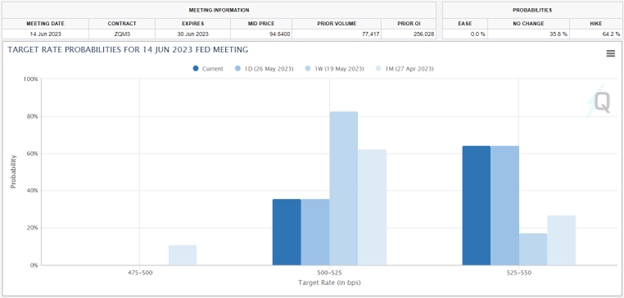

Several Fed members have recently made comments supporting a June rate hike. It seems like the odds on further policy tightening have been increasing along with the hawkish comments. Latest check on rate hike probability of the Fed funds rate indicated a 64.2% chance of rate hike, which had increased significantly from 26.8% chance of rate hike over a month ago. While probability of no change in Fed funds rate was indicated at 35.8% compared to 62.2% over a month ago.

Chart: CME FedWatch Tool for 14 June 2023 FOMC meeting

Source: T CME FedWatch Tool, CME Group Inc., as of 27 May 2023.

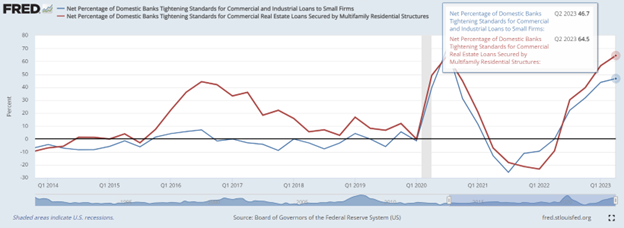

We have been watching loans data from the Fed’s senior loan officer survey, and the recent data confirms our view that there indeed have been tightening of loan standards reported for Commercial and Industrial Loans for Small Firms, and for Commercial Real Estate Loans Secured by Multifamily Residential Structures.

Chart: Fed Senior Loan Officer Survey – net percentage of tightening loan

standards some categories

Source: Board of Governors of the Federal Reserve System (US), FRED, Federal Reserve Bank of St. Louis, as of 8 May 2023.

The US is expected to run out of cash to pay its bills on June 5. Over the weekend, there has been a preliminary agreement between the President Joe Biden and the House Speaker Kevin McCarthy to raise the debt ceiling until 2025 and to set limit on non-defense spending for the next two fiscal years, while allowing the Pentagon budget to grow as planned by president Biden. Before the bill could be passed into law, it will need to pass both chambers of Congress in the coming week, which will likely face resistance from some lawmakers in both the Republican and the Democratic parties. Until then, there will still be uncertainty over the potential for a US default, along with expected volatilities in capital markets.

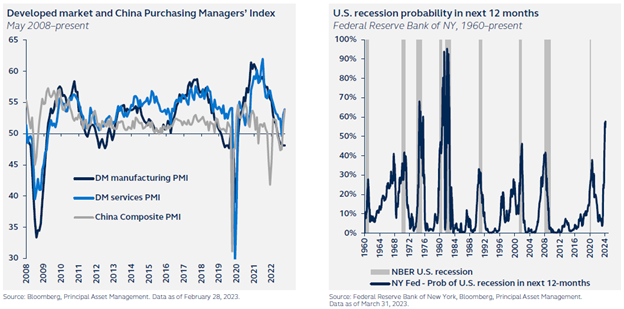

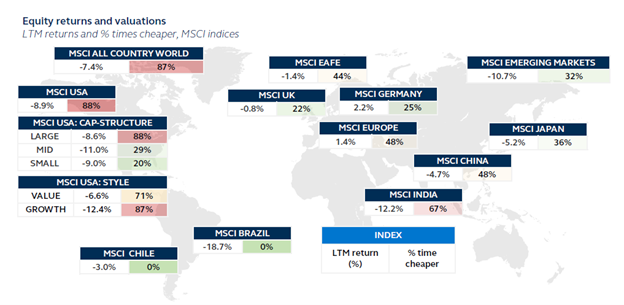

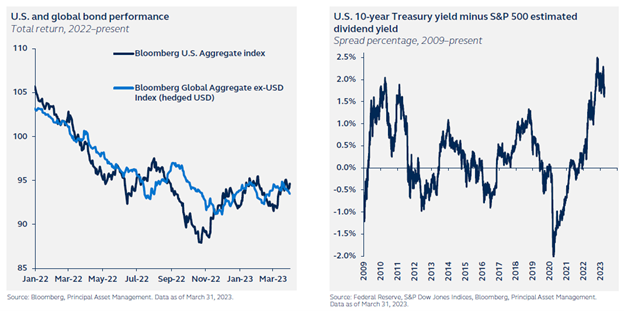

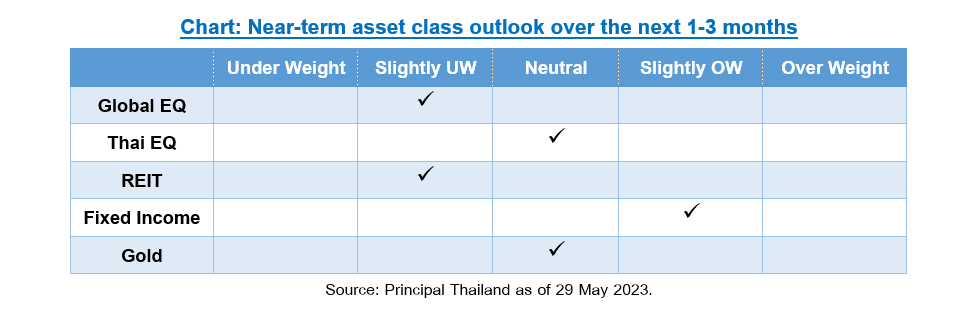

The risk-reward for equities is poor given elevated risk of recession, stretched valuations, high rates and tightening liquidity, which makes us slightly bearish on equities overall due to these structural issues. Aside from these structural issues, the reason that US equities have been able to hold up quite well in the YTD seems to be due to the expectation of a Fed pause along with the expectation that the debt ceiling issue could be resolved soon. The stickiness of core inflation could spell trouble for those expecting a pause, while the debt ceiling debate has yet to pass respective parties. As such, we remain conservative in terms of risk-taking, where we advise clients to remain patient with taking too much equity position, while the better investment is in the fixed income opportunity. The recent adjustment in bond yields present an opportunity to accumulate Principal Global Fixed Income Fund (PRINCIPAL GFIXED), which is the fund that we advise based on a very solid investment team, process and long-term track record.

Chart: US recession probabilities have risen to very high-level indicating recession later in the year

Source: Global Asset Allocation Viewpoints 2Q2023, Principal Asset Allocation. Data as of 31 March 2023.

Chart: US equities screen as very expensive compared to other markets

Source: FactSet, Bloomberg, MSCI, Global Asset Allocation Viewpoints 2Q2023, Principal Asset Allocation.

Data as of 31 March 2023.

Chart: Elevated bond yields finally present an investment opportunity

Source: Global Asset Allocation Viewpoints 2Q2023, Principal Asset Allocation. Data as of 31 March 2023.

Fund Recommend