CIO’s View: November 2022 - Changing Winds

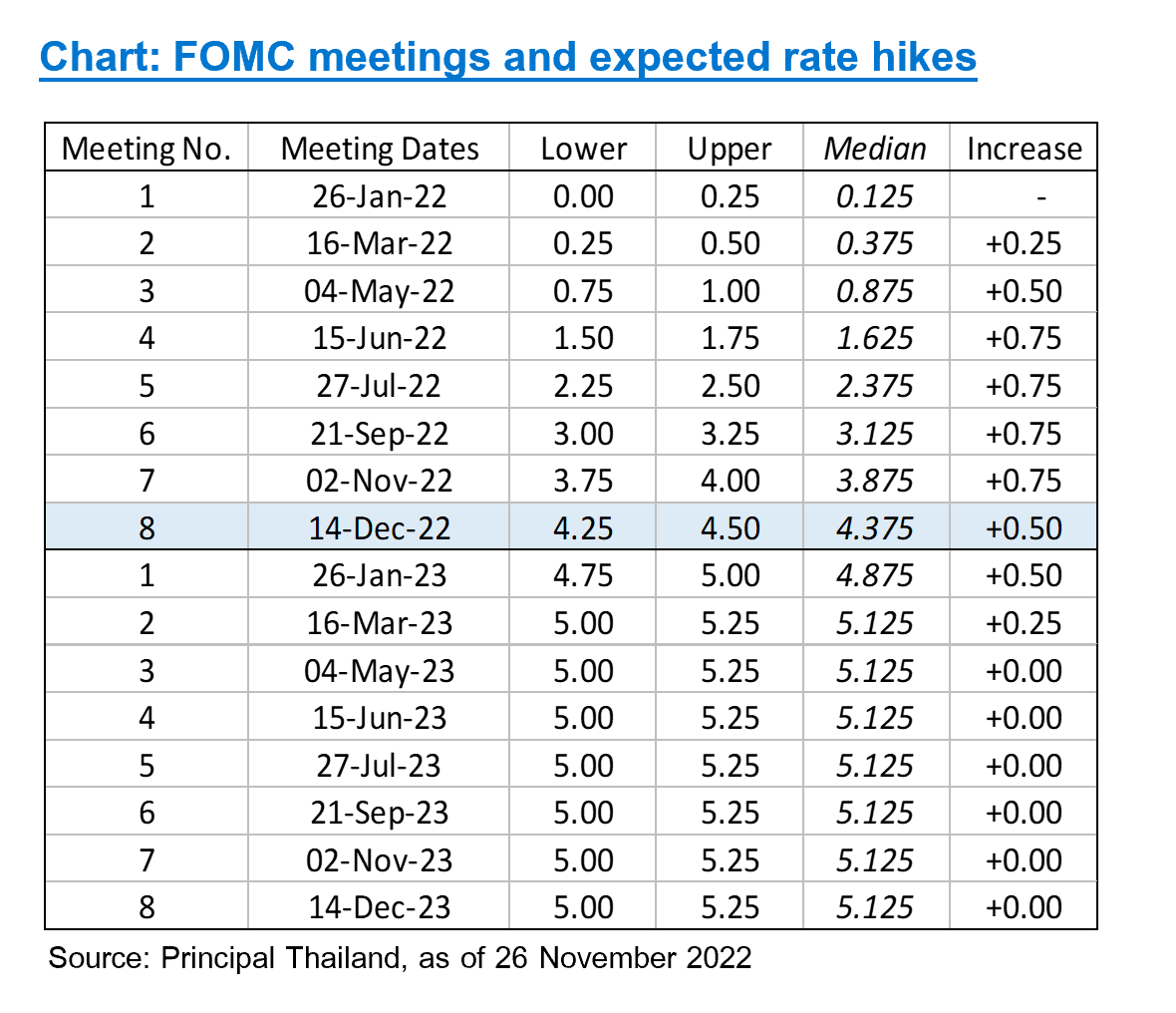

As we move into December, we expect the Fed to slow its tightening pace to a 50bp hike on 14 December 2022, taking the Fed funds rate to 4.5%, and slowing the pace of increase from 75bp hike on each of the previous four meetings. The minutes of the November FOMC meeting noted that a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate, which we expect to happen at the December FOMC meeting. However, Chair Powell’s remarks at the post-meeting conference that various participants thought that the terminal funds rate would be somewhat higher than previously expected should mean that the median terminal Fed funds rate expected by FOMC members is due to be revised up at the December meeting’s Dot Plot from September’s median forecast at 4.625%. Our Principal colleagues in the US are expecting the Fed to take the Fed funds rate up to 5.25% during first half of next year, which we take it to mean that another 50bp and 25bp hike are in the cards that the January and March FOMC meeting early next year.

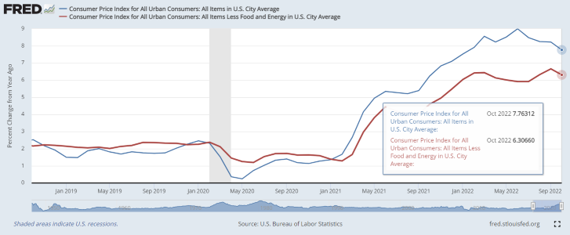

Inflation numbers that were announced during November was the significant catalysts that turned positive the mood for risk assets. On 10 November 2022, headline CPI for October period was announced at 7.7% y/y versus expectation of 8.0% and previous month’s 8.2%. Core CPI for October period was announced at 6.3% y/y versus expectation of 6.5% and previous month’s 6.6%. This showed the fourth decline in headline inflation numbers from the peak of 9.1% inflation number for June period.

Chart: US inflation declining for four straight months

Source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPILFESL, 26 November 2022

Following ECB rate hikes of 50bp in July, 75bp in September and another 75bp in October, the deposit rate has been brought up to current 1.50%. Some notable analysts in the market have called for a reduction in tightening pace down to 50bp increase at the upcoming 15 December 2022 meeting. However, with both the headline and core inflation for Eurozone not having shown any sign of slowing down, with the most recent October rates at 10.6% and 5.0% for headline and core rates respectively, and some members within the Governing Council still focused on upside risk to inflation, there’s also a good chance that another 75bp rate hike is still in the cards. Another 75bp increase at the 15 December 2022 meeting would bring the deposit rate up to 2.25%. We currently see a good chance that the terminal rate could be at 3.00%, following a 50bp hike in February and another 25bp hike in March. However, given the slower trajectory for the Fed, the expected ongoing recession in this quarter, and the reduced inflationary pressure from the natural gas market, terminal rate could turn out to be less than 3.00%

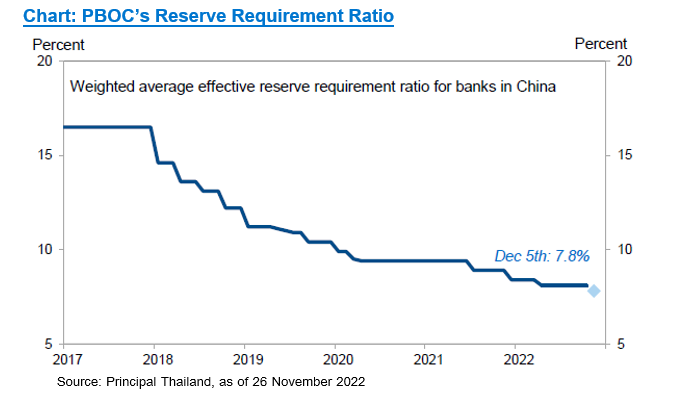

In China, the PBOC announced on Friday, 25 November 2022, a 25bp RRR cut for all financial institutions to be effective on 5 December 2022. The weighted average RRR will be lowered from current 8.1% to 7.8%. This rate cut would release RMB500bn long-term liquidity into the market. PBOC described this cut as part of the policy package to support economic growth, aiming to maintain liquidity at reasonable levels and to keep the broad credit growth largely in line with nominal GDP growth. Earlier in the week on 24 November 2022, there have been news report that Chinese state lenders are extending credit lines of over $162bn into the country’s developers to support project developments and merger and acquisition deals, suggesting the funds may be used to consolidate assets currently still on the balance sheet of struggling developers.

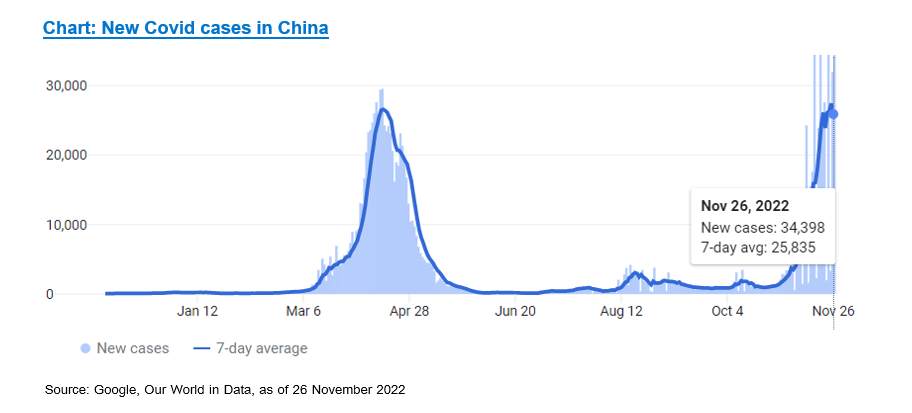

Earlier in the month of November, Chinese authorities have unveiled a 16-point set of directives to promote the stable and healthy development of the property industry. The measures included credit support for highly indebted housing developers, financial support to ensure completion and handover of projects to homeowners, and assistance for deferred-payment loans for homebuyers. These measures also came on the same day that the National Health Commission issued 20 rules for optimizing Beijing’s zero-Covid policy, where certain restrictions were relaxed to limit the policy’s social and economic impact. China has shortened the quarantine period for inbound travelers to 5+3 (5 days of quarantine in a hotel + 3 days at home) from the current 7+3, and reduced the number of pre-departure PCR tests required to one from two. It also scrapped the system of suspending flights from an airline if it carried passengers who tested positive on arrival. However, recent Covid cases in China have been rising rapidly to over 30,000 cases per day, leading China to announce increasing restrictions in several cities including Beijing, Shanghai, and Guangzhou, renewing concerns on economic growth for 4Q22.

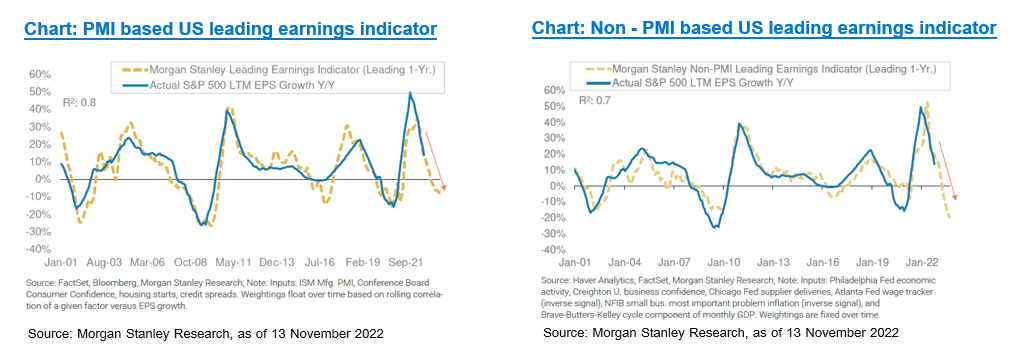

Meanwhile, with 94% of S&P 500 companies having reported operating results for 3Q22, 61% of companies have beaten 3Q22 earnings estimates, and 63% have beaten sales estimates. However, percentage of companies beating earnings estimates have been steadily declining after peaking in 2Q21 at 88%. Sales growth for 3Q22 was reported at 12%, while earnings growth was reported at 1%. However, the bulk of this has been due to extremely high energy sector sales growth of 49%, and earnings growth of 138%. Excluding energy, S&P 500 companies 3Q22 sales growth was 8.5%, while earnings growth turned negative at -6.4%. Since the beginning of the earnings season, whole year 2022 earnings have been revise down by -1%, while 2023 earnings have been revised down by -3.5%. Looking ahead, we expect further downward revision for earnings estimates to continue in 1Q23, when US companies announce operating results for 4Q22, which could potentially induce another leg down for US equities early next year. For now, we expect positive risk sentiment from reducing Fed rate hike pace from 75bp down to 50bp to act as temporary positive catalyst

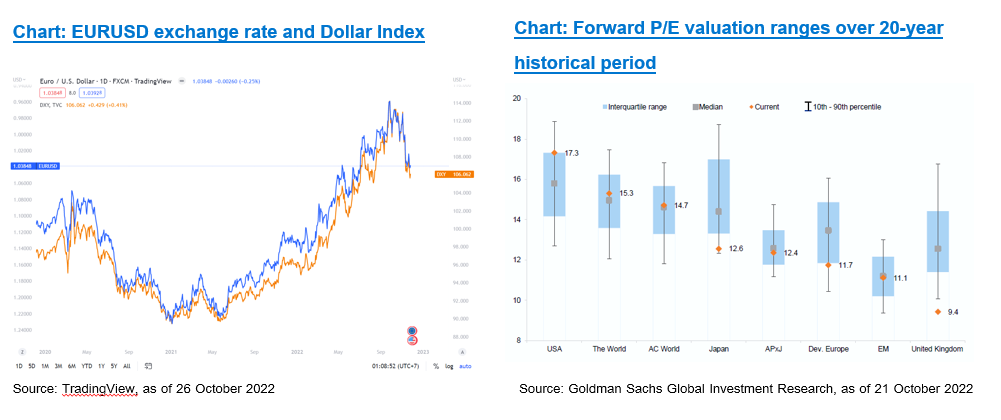

With the expected slowing down in the pace of rate hikes by the Fed, while the ECB is considered to have more work to do to control their inflation narrative, the euro is benefitting from the relative change in the direction of the two central banks. The euro has gained to around 1.04 to the US dollar versus the low of around 0.96 at the end of September. This is also a significant negative catalyst to the dollar index, which has declined to around 106 level from the high of around 114 at the end of September. This change in narrative for the US dollar will eventually prove to be supportive for EM equities as a whole for 2023, when the direction of the US dollar should turn out to be on the downtrend, as monetary policy divergence versus major central banks, and growth differential of the US versus the rest of the world become less supportive of the US dollar. The change to the direction of the US dollar, coupled with changing inflation dynamics, US bond yields turning lower, improving supply bottlenecks, and valuation advantage, will translate to a better outcome for EM equities. However, this will have to be balanced with a drag from US equities that should see earnings contractions and downward revision next year amid a recessionary backdrop, and a relatively more expensive valuation for US equities, which might create an opportunistic entry level at some point

Fund Recommendation