CIO View December 2023: Q&A on 2024 Outlook: A tale of two halves

Below, we provide some insights into 2024 based on our KeyPoint from the discussion that we had with our Principal Asset Management colleagues around the world

1. What is your outlook for 2024 growth, inflation and rates?

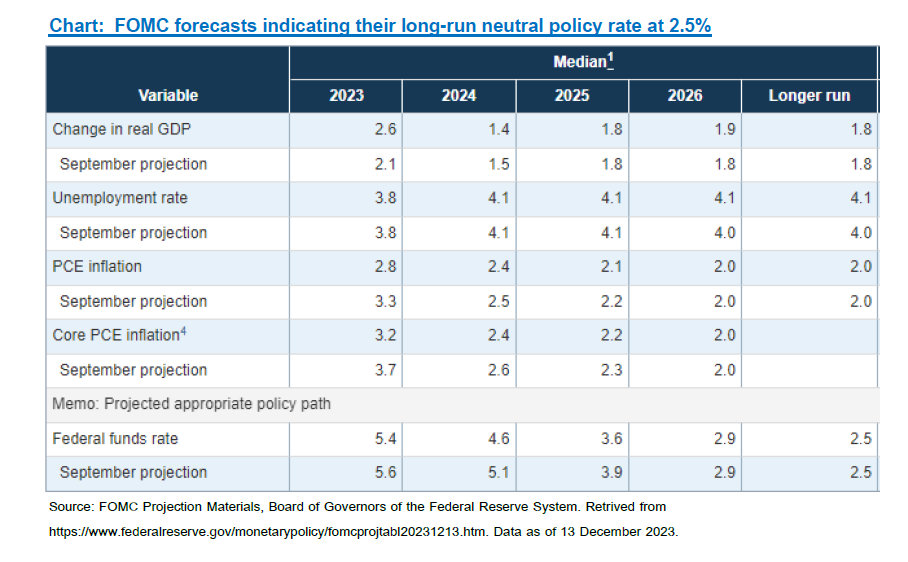

Growth is going to be slower than 2023. High policy rates and bond yields in the developed economies will have full negative effect on growth. Tepid growth from US, China and Europe implies a slowdown in overall growth in 2024. Inflation will eventually decline based on slowdown in overall growth in 2024. However, we need to be careful of long-term structural inflation dynamics causing inflation to be stubborn, preventing policy rates to be cut early. These are things such as geopolitical risks, reduced level of international trades in favor of domestic production, supply chain shift, OPEC risk, etc. Policy rates will be on hold during the first half, which will result in real rates continuing to increase when inflation continues to move downward. Fed will have to start cutting policy rates in the second half to bring down economic tightening that will be caused by the increase in real rates, and prevent it from hurting growth too much.

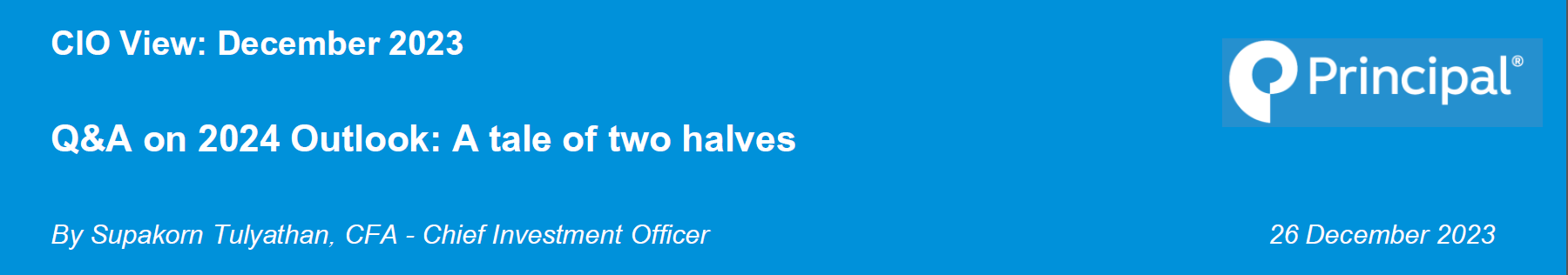

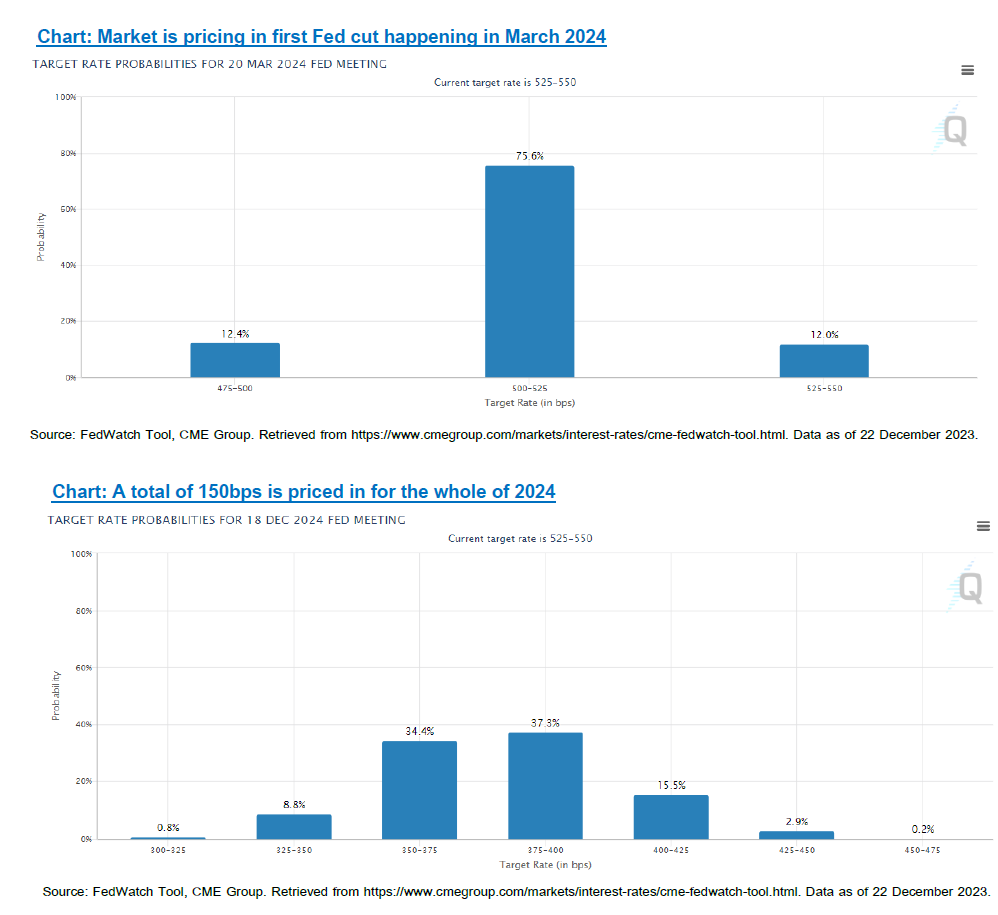

Market has priced in 150bp of rate cuts in 2024, potentially starting in March, which can be considered more than fully priced. With only a growth slowdown (i.e. soft-landing) expected to happen, 50bp to 75bp rate cuts is more likely. As such, we only expect UST10Y to potentially decline by only about 30-40bps more from around 3.9% now to around 3.5%. The 3.9% level is now pricing in 150bps. With the expected UST10Y of 3.5%, that level of bond yield will be pricing in around 175bps to 200bps of policy rate cuts, which will be a lot more than the base case of what soft-landing or mild recession scenario calls for. However, the FOMC dot plot has 2.5% as the long-run Fed funds rate, so there’s a small chance that the market will try to price all of that within the next year.

2. Do you believe that stocks or bonds will be the outperformer next year?

Bonds will be the first to perform, mostly in the first half. IG has already gained a lot in November. There's about half-way of upside to go, mostly from UST10Y yields declining, as spread is already very tight (i.e. expensive). However, the more important factor for investors to consider is usually the level of total yield. This level of total yield of around 6% for IG bonds is still attractive enough for investors to allocate to.

However, it may not be a one-way up from here on as we move into the first quarter, as spreads are very tight, and UST10Y yield is already now below 4.00%. Why? Because market is now pricing in 150bp of rate cuts in 2024, potentially starting in March, which can be considered more than fully priced, leaving a lot of room for disappointment, and some corrections to also happen during the first half.

Equities have also recovered a lot of ground that had been lost during the August-to-October correction period. Given the excessive expectation of rate cuts now priced into the market, there’s also some room for correction to happen. However, any correction in equities will also be short and shallow, as market will be supported by the Fed getting nearer to cutting its policy rate around the middle of the year. Equities will be able to have a sustainable rally in the second half once the rate cut is underway.

3. What is your forecast for the S&P 500, range of returns and path?

S&P 500’s forward path will predominantly depend on a few moving parts that are still uncertain such as the direction of the Fed funds rate and the magnitude of actual cuts happening. The current sentiment, VIX, futures market suggest we might have a good santa rally to end the year on a strong and cheerful note. However, with the S&P 500 having already made year-to-date high, and is merely a few points away from testing all-time-high that was made back in December 2021, market will want to see confirming evidence of resilient 4Q 2023 corporate earnings for the S&P 500 to continue its rally well into 1Q 2024.

However, historical records usually provide valuable information to consider along with any set of fundamental outlook and valuation consideration. Statistically, the 10-year historical average return for the S&P 500 is around 12%, with half sigma return (i.e. 0.5 times the standard deviation of the S&P 500’s historical return) of around 20%, and one sigma return of around 28%. In a year with rate cuts happening, we might be looking at the S&P 500 to give us around 12% to 20% return, depending on how much of the rate cuts actually happening. We don’t think the Fed’s going to cut 150bp like the market is currently priced in; therefore, we think the chance of the S&P 500 making extraordinary return range such as 20% to 30% is still quite low (however, for growth equities, that might be possible).

4. What are your views on a regional, size, style and sector basis?

Developed market (DM) equities will start to perform in second half, led by the US. Emerging market (EM) equities will perform more than DM, on the back of declining bond yields and declining USD, acting as double tailwind for EM equities. With these two things happening, EM equities could give +20% return, which is quite rare, as it is a more-than 1 sigma probability. However, it is possible given the right condition, and it will be very volatile so need to be cautious and nimble.

China will not perform as much, as policy - makers are being modest in terms of their GDP target and stimulus packages. Therefore, investors should continue to use the opportunity to further reduce their position. Not everyone has de-risked from China yet. There must be those that are still holding on to losses. Next year will probably give them that opportunity. Therefore, we favor EM ex-China as a theme in 2024. For Asia, we favor Asia ex-China on countries with structural story such as India, Korea, Japan and Vietnam.

5. True to its nature, commodities has been volatile. What is your outlook for oil and broader commodities?

Tepid growth from US, China and Europe implies a slowdown in global growth in 2024.

Oil can go down a lot more when global growth is weak. Recent historical examples are periods of 2008, 2014, 2015, and 2020 that we had witnessed extreme drawdowns on crude oil during weak global growth periods. Additionally, US has started to produce more crude oil. So even if the Fed cut rates during 2024, there is still the issue of US supply increasing. The outcome is too uncertain to predict at this point.

6. Given the increased focus on alternatives and private market investments, what is your outlook on this for 2024 and beyond?

The turnout of 2022 poor performance of both equities and bonds has spurred many inquiries for a true uncorrelated strategy and many were looking for private markets this year. However, with interest rate getting quickly higher recently, those uncorrelated offerings, many of which with varying range of liquidity lock up, have become less attractive, especially during this period that bond yields are at attractive levels. We see inquiries flocking more into fixed income, especially high-quality IG instead. Understandably, this is the period where coupons are high, with chance of capital gain from expectation of peaking rates, and investors cherish the high/daily liquidity to support the need to be ‘agile’ as soft-landing (or mild recession) period approaches us. The need to have readily - available liquidity to deploy as opportunity in equity markets come, would argue against illiquid investments such as private assets.

7. What is your top trade idea for 2024?

IG credits during the first half, as market backdrop and condition should still be favorable for quality assets. While spreads and Treasury yields are low, they could still decline further on speculation flows before the actual rate cut actually happening around mid-year.

Emerging Markets excluding China is the top theme for us next year. 2024 will be an interesting year to witness further movement of capital away from China. We have seen it in 2023 already, and we think the FDI/FAI investment flows will continue to show signs of both domestic and foreign corporates relocate investment away from China towards EM economies. Also, we think that overall equities will have a positive story during the second half, as soon as the Fed cut is certain around mid-year. Portfolio diversification would call for a good mix of equity types in the portfolio. Core holdings should definitely consist of US equities, while the satellite holdings should consist of exciting opportunities, such as growth equities, EM ex-China equities, Latam equities, etc. But this will be more of a story for the second half, so hang on to your seats until then.

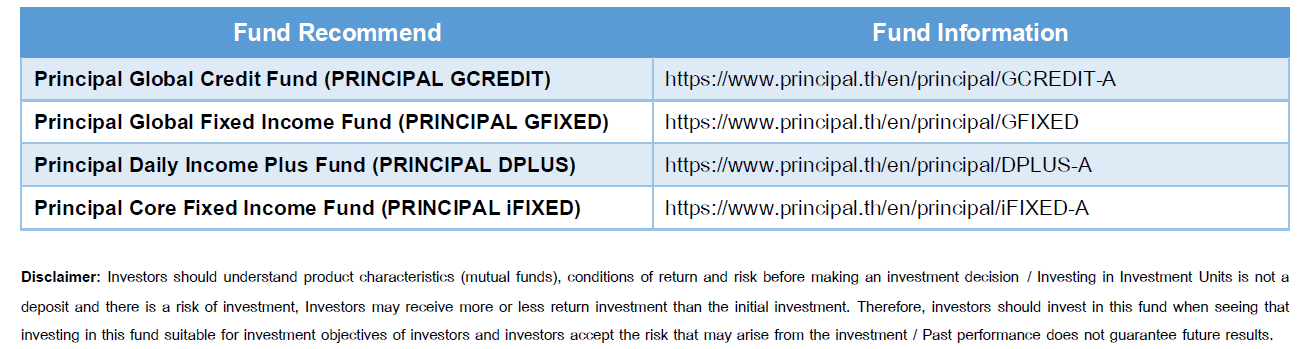

Recommended Fund for 1H 2024: