Principal Update: CIO View: November 2566 - Improve your foreign bond portfolio with PRINCIPAL GCREDIT

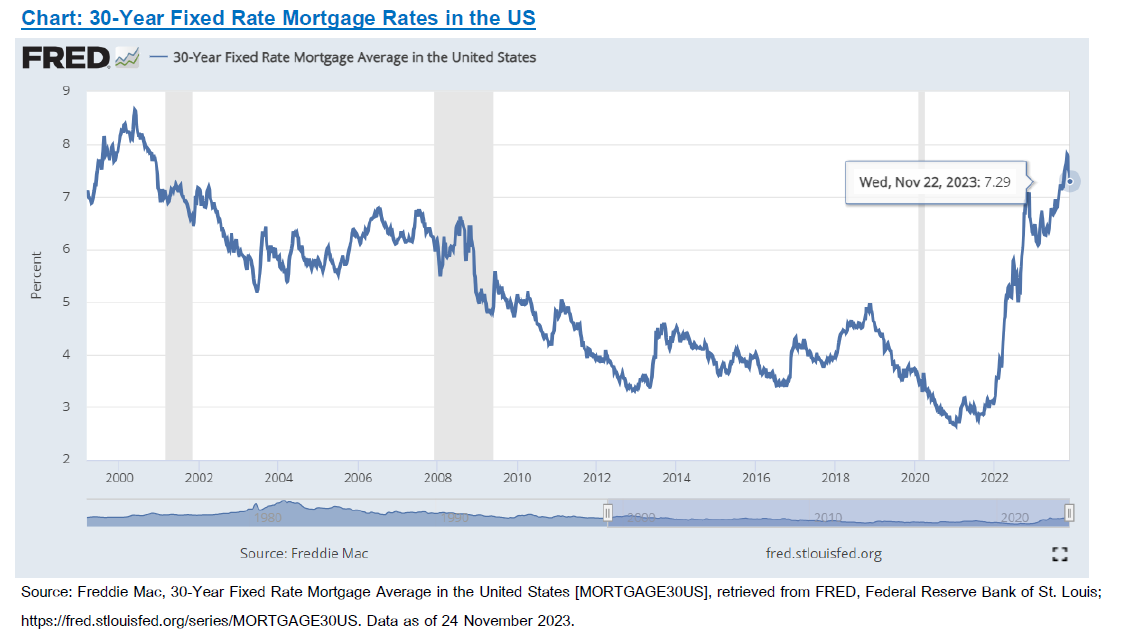

Two pieces of information on the US housing markets provided conflicting signals over the past month. Housing starts increased by 1.9% to 1,372k (saar) in October, against consensus expectations for a 0.6% decline. The increase was led by a rise in the more volatile multi-family starts (+6.3%), while single family starts edged up (+0.2%). Building permits increased by 1.1% to 1,487k (saar) in October, against consensus expectations for a 1.4% decline. Both single family permits (+0.5%) and the more volatile multi-family permits (+2.2%) components increased. Single family permits increased for the ninth consecutive month, reaching the highest level since May 2022. On the other hand, existing home sales declined by 4.1% to a seasonally adjusted annualized rate of 3.79 million units in the October report, below consensus expectations for a 1.5% decline. The median sales price of all existing homes increased 0.6% month-over-month, corresponding to a year-over-year rate of +3.4%. The imbalance between housing supply and demand improved, with the months’ supply of existing homes available for sale increasing from 3.1 months to 3.4 months. The 30-year fixed rate mortgage rates in the US haven't been this high since back in 2000, so housing affordability should continue to worsen.

October CPI rose 0.04% (m/m), below expectations for a 0.1% increase, and below the previous month increase of 0.4%, and the year-on-year rate declined to 3.24%. October core CPI rose 0.23% (m/m), below expectations for a 0.3% increase, and below the previous month increase of 0.32%, and the year-on-year rate edged down 0.1pp to 4.0%. The PPI numbers also came in below expectation, with PPI decreased by -0.5% (m/m) for October versus expectation of 0.1% increase. The PPI ex-food and energy was flat (m/m) for October versus expectation of 0.3% increase. Import prices also came in below expectation, with the headline import prices declined by -0.8% (m/m) in October against expectation of -0.3% decline; while import prices ex-petroleum declined by -0.2% (m/m) in October against expectation of -0.3% decline.

Nonfarm payrolls rose 150k in October, reflecting a 30k drag from auto strikes and a deceleration in underlying job gains that was accompanied by 101k of downward revisions to prior months. Household employment declined, contributing to a further rise in the unemployment rate to 3.9%. The ISM manufacturing index decreased by 2.3pt to 46.7 in October, below consensus expectations for a flat reading. The underlying composition was weak, as the new orders (-3.7pt to 45.5), production (-2.1pt to 50.4), and employment (-4.4pt to 46.8) components declined. The ISM services index decreased by 1.8pt to 51.8 in October, below expectations for a smaller decrease. The underlying composition was mixed, as the new orders (+3.7pt to 55.5) component increased while the business activity (-4.7pt to 54.1) and employment (-3.2pt to 50.2) components both decreased.

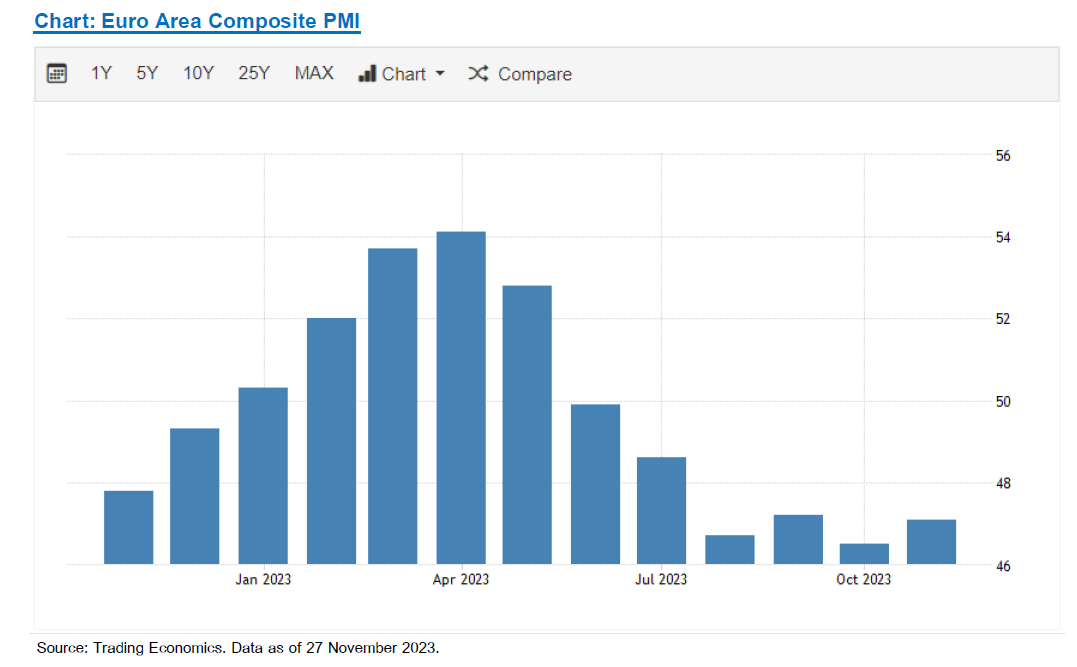

There have been some early signs that the Euro area economic activity might be bottoming. The Euro area composite flash PMI increased by 0.6pt to 47.1, above consensus expectations of 46.9. Across countries, the improvement in the area-wide index was driven by a meaningful acceleration in Germany and the periphery, partially offset by a marginal decline in France. In the UK, the composite flash PMI improved meaningfully and entered expansionary territory at 50.1, above consensus expectations of 48.7, on the back of a pickup in both sectors, with the services sector index entering positive territory at 50.5.

While borrowing costs are rising, global consumers are getting a positive boost to purchasing power from falling energy costs. Crude oil prices are now on the decline due to a sharp rise in non-OPEC production alongside several OPEC+ members failing to adhere to their earlier-announced caps. It was announced that the widely anticipated OPEC+ meeting has been delayed, with news suggesting Saudi displeasure with the current situation. This should provide the US economy with a positive catalyst, as the price of oil, as well as the retail price of US gasoline, is now down roughly 15% from its September peak, giving a positive support to consumers’ purchasing power in the near term.

Chinese policymakers ramped up policy supports in recent months to offset weak domestic demand and property markets. A range of new housing-related initiatives have been announced in recent weeks. Following last week’s Bloomberg report of a 1 trillion Yuan stimulus (0.8% of GDP) to support urban village renovation and public housing, it was reported that Chinese regulators are drafting a list of developers that will be provided with financing support. Banks might also be allowed to offer unsecured short-term loans to qualified developers for working capital purposes, for the first time since the early 2000s. If confirmed, these actions would improve China’s housing market situation.

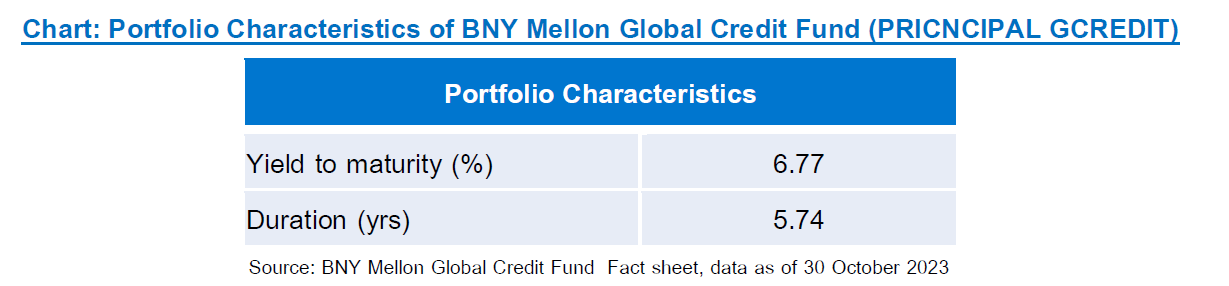

Overall numbers that we observed over the month continued to point towards the Fed remaining on hold at the current level of 5.25% to 5.50%. This condition is supportive of the bond market as we go into the last month of the year and into 2024. We have written since late last year that we were bullish on our Principal Global Fixed Income Fund (PRINCIPAL GFIXED) due to its composition of US Treasurys, quality credits and some high-yield credits, with duration management of around 2-3 years, which we expected at the time to be suitable for the Fed still hiking interest rates that would continue to hurt bond funds with longer duration. Now is the time to lengthen duration and move into Principal Global Credit Fund (PRINCIPAL GCREDIT), which is a feeder fund that will be investing into BNY Mellon Global Credit Fund. This fund will be investing the majority of its assets in investment grade (IG) credits, which is where we believe to be the most suitable sector of credits going into 2024. This fund provides attractive yield from investment grade credit exposure. It offers access to interest rate duration as central banks approach the end of their rate-rising cycle. The fund is also able to invest globally, which gives access to a variety of ideas

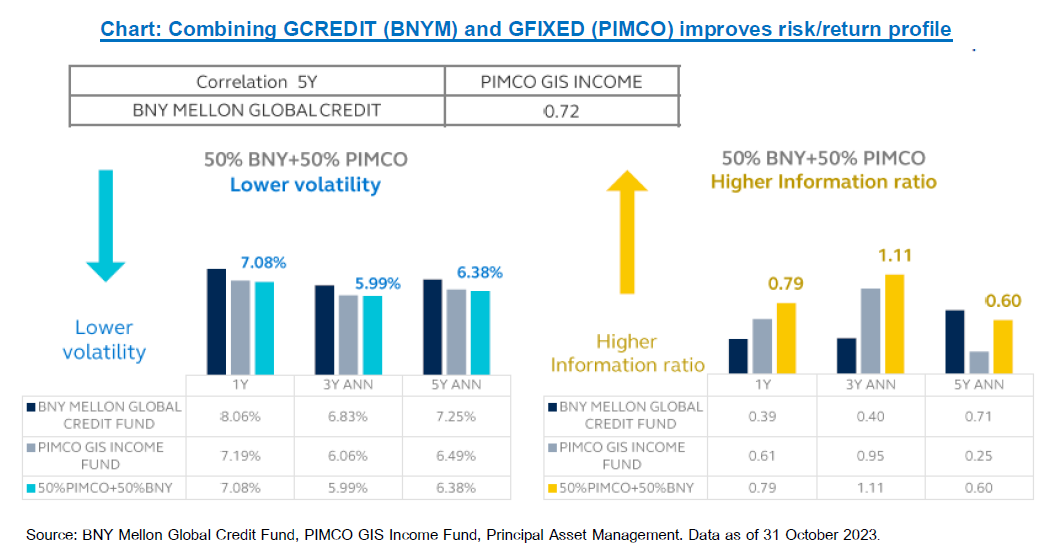

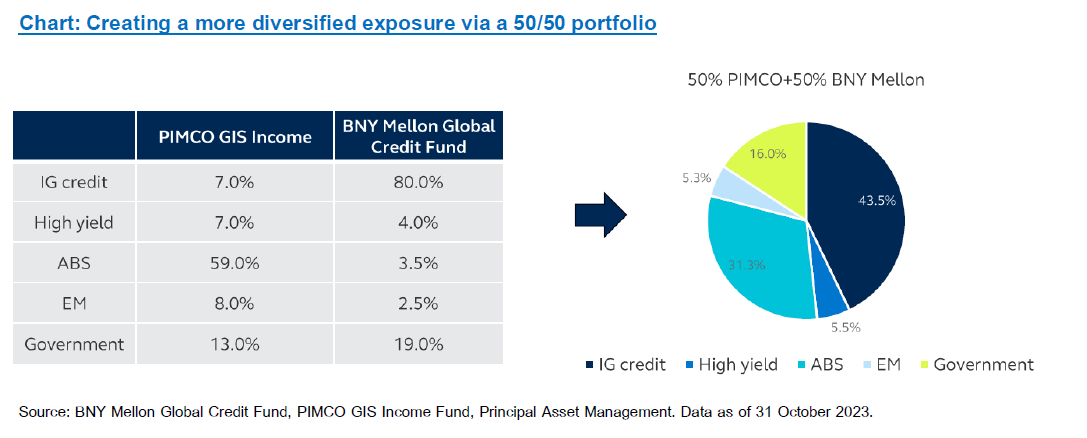

Aside from its own merit, PRINCIPAL GCREDIT (BNYM) provides improvement to your foreign bond portfolio, when it is combined with PRINCIPAL GFIXED (PIMCO). The volatility profile of a 50/50 GCREDIT/GFIXED portfolio is estimated to be lower across the 1-year, 3-year and 5-year periods. The information ratio, which is a measure of risk-adjusted excess returns, is also higher for the 1-year and 3-year periods. This means that a combined portfolio is better than a standalone portfolio of GFIXED by itself. The better risk/return profile is a result of a diversification effect that can be partly explained by a more diversified credit sectors when we combined the two funds together (as shown below).

Read CIO View: November 2566 - Improve your foreign bond portfolio with PRINCIPAL GCREDIT

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision / Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Past performance does not guarantee future results.