Monthly Report as of August 2023 for PVD Members

Note*: This shows a change in yield not price return.

Source: Bloomberg as of 31 July 2023

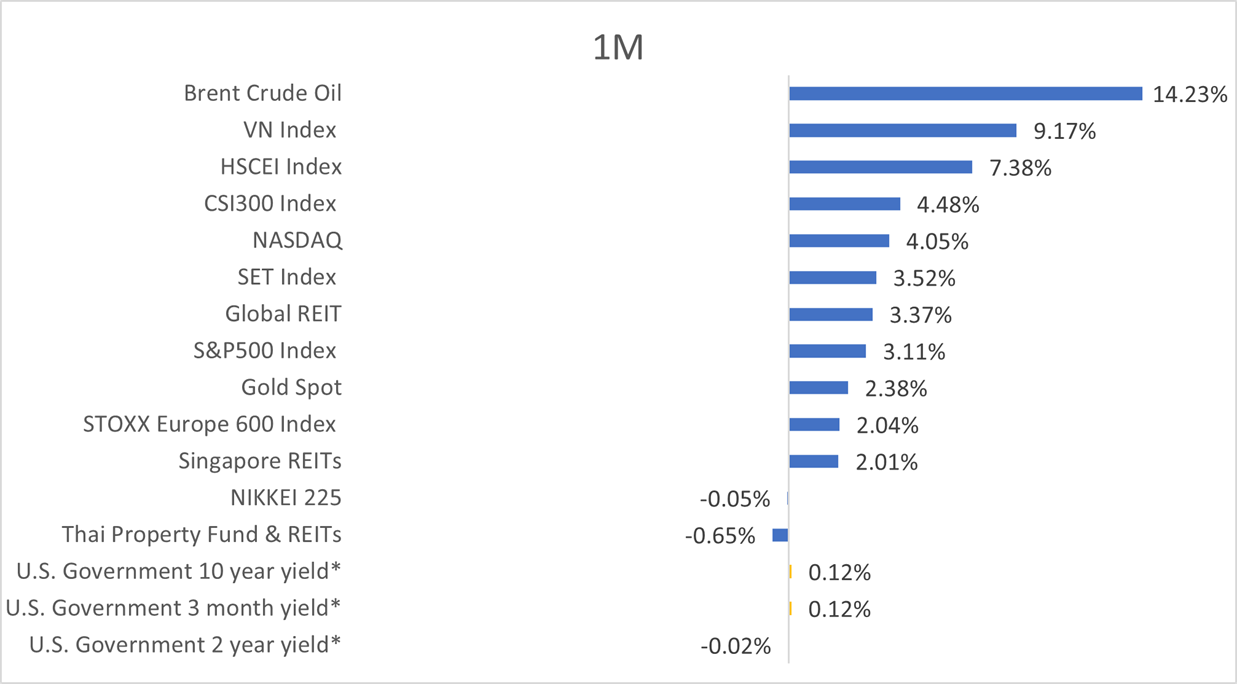

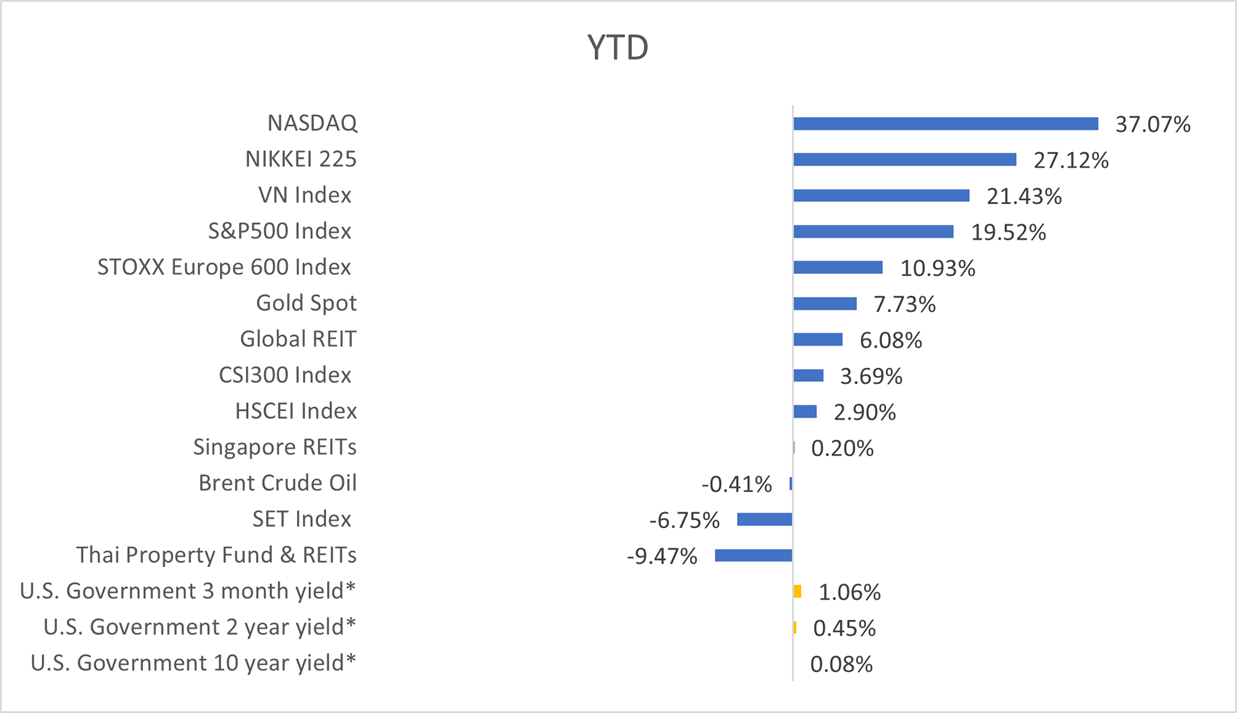

Global Markets Performance in July 2023

Market Review for July 2023

The US stock market increased as CPI (Consumer Price Index) inflation dropped more than the market expectations, boosting investors’ confidence that the Fed will pause its rate hikes in the next meeting. EU stock market also rose after ECB (European Central Bank) signaled pausing interest rate rises for the upcoming meeting. China stock market increased thanks to new stimulus policies launched by the government although economic data did not recover as expected. Thai stock market went up, driven by foreign factors despite domestic political uncertainty. Vietnam stock market soared 9.17% thanks to recovering economic data and the return of retail investors. Regarding fixed income market, the US and Thailand treasury yields increased after the Fed and BOT (Bank of Thailand) raised their interest rates as expected. Lastly, global REITs and Singapore REITs rose as well thanks to the peak-approaching Fed’s rate-hiking cycle.

US Stock Market: S&P500 Index rose by 3.11% in July 2023 after the Fed raised its interest rate by 0.25% as expected and inflation in June fell to the lowest rate YoY in more than two years, at 3%. The Fed increased the policy rate by 0.25%, lifting the fed fund rate to 5.25 - 5.50%, in line with market expectation. Overall, The Fed ‘s statement did not change significantly from its previous meeting. The phrases that indicating that fed would continue to assess additional information for the next decisions and the extent of additional policy firming were emphasized in the statement as usual. However, for the time being, the market thinks that the Fed will stop its rate hike cycle in the next meeting, unlike Fed’s perspective. Regarding inflation, the CPI in June fell more than expected to 3% YoY from 4% YoY of the previous month, while the Core CPI rose by 4.8% YoY, lower than the market expectation of 5%. Moreover, another positive catalyst driving the market was better-than-expected economic growth in 2Q 23 despite recession calls. US GDP rose by 2.4% YoY, better than the market expectation of 2%. The growth was supported by consumer spending, government spending and a drop in PCE inflation.

EU Stock Market: STOXX Europe 600 Index increased by 2.04% in July 2023 as ECB provided the market with hope for pausing rate hike cycle in its September meeting. The ECB decided to raise its interest rate by 0.25%, bringing the deposit rate to 3.75% as expected by the market. However, Christine Lagarde, ECB President pointed out that although pausing rate hikes would be an option for the next meeting but holding rates flat would not mean that the peak of the hiking cycle has ended. Regarding economic data, Eurozone manufacturing PMI fell to 42.7 in July in line with the market expectation and was still weak because of higher borrowing costs from ECB, while composite PMI dropped to 48.9 in July, indicating modest economic contraction over the months.

China Stock Market: In July 2023, Chinese stock markets, both A-share and H-share, rose from last month, 4.48% and 7.38%, respectively, in part due to Beijing’s announcement of multiple economic stimulus policies to tackle weakened economic readings in the past months. The policies focus on promoting consumption of large products such as real estate, household equipment and automobile, especially in rural areas. The NBS (National Bureau of Statistics) reported that manufacturing PMI rose from 49.0 in June to 49.3 in July. This was the fourth consecutive months that the index was under the level of 50, which indicates a manufacturing contraction in China, while non-manufacturing PMI decreased from 53.2 in June to 51.2 in July. Moreover, real estate sector, valued approximately 14% of China’s Gross Domestic Production (GDP), has continued to fall. New home sales of the largest 100 real estate developers in July decreased by 33.1% YoY and 33.5% MoM. The falling of home selling could lead to liquidity crisis in many developer companies, increasing likelihood of default in bond market. Weakening domestic demand sent inflation rate in July down to -0.3% YoY, which was notably lower than the government target of 3%. Falling inflation rate was partly caused by food and beverages price dropping, which explained why China core inflation, in July, went up 0.8% YoY.

Japan Stock Market: By the end of July Nikkei 225 Index was at the same level as the end of June after increased during the previous months. However, a slowdown in global economy negatively affected Japan economy. Manufacturing PMI dropped to 49.6 in July from 49.8 in June, while service PMI presented the same pattern as manufacturing PMI, declining to 53.8 in July from 54.0 in June. The Bank of Japan (BoJ) has maintained policy interest rate at minus 0.1%. However, the BoJ conducted yield curve control with greater flexibility by expanding 10-year government bond reference interest rates frame to shoot up above its previous 0.5% cap, to 1% cap. The expansion of YCC (Yield Curve Control) band could lead to JPY currency appreciation. Currently, JPY has depreciated against USD, which increased household expenditures thru higher importing costs. However, retail sales in Japan have continuously shot up around 6% YoY with high consumer confidence after the country reopened in October.

Thai Stock Market: SET index rose by 3.52% in July with high volatility, mostly supported by several foreign catalysts like a decline in US inflation and soon peaking of Fed rate-hiking cycle as well as many additional China stimulus packages. These could create a good market sentiment for Asia stock markets. Nevertheless, domestic factors - particularly the uncertainty of the new government formation - were important headwinds for investing in the market.

Vietnam Stock Market: VN Index drastically increased by 9.17% in July along with better economic outlooks. Vietnamese inflation rate stayed low at 2.06% YoY in July, which closed to its last month’s 2.00% level. July’s purchasing manufacturing index (PMI) rose by 2.5 to 48.7, which was the fifth consecutive month of manufacturing shrinking. Although PMI was still below 50.0, it showed signs of optimism and more stability. Retail sales in Vietnam climbed up from last month to 7.7% YoY. Increase in PMI and Retail Sales prints were partly caused by easing monetary policy from State Bank of Vietnam (SBV). SBV has decided to continuously cut policy rate since April 2023. The lower policy rate led to the lower mortgage rate and financial costs. As a result, the lower mortgage rate is, the higher domestic homebuyers’ purchasing power. Moreover, from January to July 2023, the number of foreign tourists was around 6.6 million, equal to 83% of the government FY2023 target. Vietnam stock market after the second half of 2023 attracted more retail investors, which regained a trading volume over USD 1bn in July. Not only did upside factors come from strong macroeconomics backdrop, but also from attractive market valuation and robust growth of stocks in financials and real estate sectors. These sectors have benefited from government and SBV policies, which were implemented to alleviate nonperforming loans (NPLs) and defaulting bond issues. Strong economic outlook and attractive market valuation were the two main factors driving the Vietnamese stock market to continuously increase this year. However, investors should closely keep an eye on exports, which depends on the global economy.

Fixed Income Market: The U.S. 2-year treasury yield and the U.S. 10-year treasury yield rose by 0.24% and 0.21% from mid-month to late July 2023, reaching 4.88% and 3.96%, respectively. This movement was in line with the Fed's decision to raise interest rates by 0.25%, aligning with market expectations and bringing the rates to the range of 5.25% - 5.50%. However, the Fed has not yet provided a clear signal to halt the rate hikes in its next meeting(s). The rate adjustment in the September meeting will depend on economic data, particularly inflation. Nonetheless, we believe that the Fed is approaching the peak of its rate-hiking cycle. The current interest rate level will be favorable for investment in foreign fixed income, especially government bonds.

Meanwhile, the Thai 2-year treasury yield and the Thai 10-year treasury yield increased to 2.25% and 2.57%, respectively, by the end of July 2023. This surge followed the BOT inclination to hike the interest rate by 0.25%, moving from 2% to 2.25% at the August meeting. However, both headline inflation and core inflation continued to decrease, and the overall Thai economy is still recovering from setbacks in the tourism and consumption sectors. These factors make it likely that the BOT will maintain interest rates for the rest of the year.

REITs: Global REITs and Singapore REITs index rose by 3.37% and 2.01%, respectively, by the end of July 2023. As the Fed approaches the end of its rate hike cycle, it is unlikely that bond yields will return to an upward trend, like the previous year. Among Singapore REITs, the sector that performed well in July was Chinese-focused sector, which has assets in China. It rose by 3.1%, further supporting the Chinese government's plans to stimulate the economy. Additionally, the data center sector increased by 2.7%, driven by the growing demand for cloud computing, e-commerce, and artificial intelligence (AI) applications.

On the other hand, Thai REITs index declined by 0.65% in July 2023, due to the pressure from the office sector, which dropped by 3.3% because of concerns about sluggish earnings. This decline was caused by the decrease in demand for office space rentals, as more companies adopted the Work-From-Home policy, along with a continuous increase in the supply of office buildings. This situation has resulted in an impact on the occupancy rate and rental rate within the office sector for the upcoming period.

Gold: Gold prices rose by 2.38% in July 2023, driven by a weakened dollar resulting from the ongoing decline in US inflation in June, which was lower than anticipated in the market. However, in the face of an increased risk of economic recession in the future, the price of gold tends to rise, as it is perceived as a safe asset by investors.

Market Outlook and Investment Strategy for the next 3 months

- Although US inflation is quite stable at level of 3% the Fed may raise its interest rate in the next meeting, according to the latest the Fed’s statement. In addition, the high valuation of US tech stocks and an incoming recession in the US which tends to occur in the fourth quarter of this year will be the main contributing factors in a correction of the US stock market. We, therefore, recommend investors should avoid investing in high-growth stocks in the US.

- Neutral exposure is given to global equities focusing on high-quality and defensive stocks as these kinds of stocks can limit negative consequences of global economic uncertainty for the rest of the year.

- We are cautious about investing in China stocks in the short term because for the time being China economy is under pressure from weak global demand, lower-than-expected domestic consumption and the property troubles. However, with the low valuation (Forward P/E) and actively easing monetary and fiscal policies, a neutral view is given to China stock market for the long-term investment.

- We maintain a slightly overweight view for fixed income, focusing on global fixed income thanks to attractive yield, US recession probability and a tendency to end rate hike cycle of the Fed, boosting a chance for investors to receive the capital gain. PIMCO GIS Income Fund, the master fund of PRINCIPAL GFIXED, has a YTM of 7.23% as of 31 July 2023.

More importantly, investors should do asset allocation to create a proper portfolio by diversifying each asset class based on their risk appetites and to help reduce portfolio volatility.

Portfolio Adjustment

- Although the market has mitigated concern over the Fed’s raising interest rate in the next meeting thanks to a decline in inflation, we are cautious about investing in the US stock market because of high valuation and the approaching recession. However, in case investors have exposure to US stocks much lower than the target, buying on dip strategy is recommended.

- Japan stock market tends to have a correction due to high valuation and BoJ signal to end easing monetary policy soon. Lately, BoJ conducted yield curve control with greater flexibility by letting long-term interest rates rise beyond its cap of 0.5%. Nevertheless, we think that it is difficult for BoJ to exit easing monetary policy because of high debt-to-GDP ratio of Japan. Raising interest rates brings about high government debt. Still, from our point of view the main contributing factor affecting Japan stocks is high valuation. We, therefore, recommend investors take a profit and wait for the new opportunity for reinvesting.

- Although China stock market increased in July thanks to additional stimulus policies announced by the government, in the short-term volatility can be expected because of concerns about the property sector, high local government debt and worse-than-expected economic data. As a result, investors should be cautious about investing in China stocks in the short term. However, if investors purchase China stocks at a lower level than the current market, they should keep holding them in the long term thanks to its attractive valuation.

- EU stock market is less attractive after China reopening could not help China economy recover as expected, resulting in the fact that the number of Chinese tourists traveling to Europe has been lower than what the market expected. Additionally, EU inflation is still high due to high energy prices resulting from oil production cuts of OPEC+. Nevertheless, valuation of EU stock market is more attractive than that of US stock market. We recommend investors have exposure to EU stocks a little lower than their own target.

Regarding REITs, REITs indices dropped to an attractive level (Thai REITs and SG REITs provide yield of 7% and 6% respectively) and US interest rate is getting closer to the peak. Yet, the likelihood of US recession and a tendency for the Fed to keep its rates high for a long time will put pressure on REITs. We recommend having exposure to REITs lower than the target asset allocation.

Note:

- Fed stands for Federal Reserve, US central bank.

- ECB stands for European Central Bank

- BOT stands for Bank of Thailand

- REIT stands for real estate investment trust

- YoY stands for year-over-year, which is a way of measuring how a number has changed compared to the same period a year earlier.

- CPI stands for consumer price index, a key indicator to measure inflation.

- PCE refers to a measure of the spending on goods and services, a kind of inflation the Fed prioritizes.

- PMI refers to the Purchasing Managers Index, a measure of economic health in the future.

- Overweight refers to a larger portion of an asset class compared to a benchmark.

- Neutral refers to the same portion of an asset class as a benchmark.

- Underweight refers to a smaller portion of an asset class compared to a benchmark.

- H-Shares stands for stocks of Chinese mainland companies that are listed on the Hong Kong Stock Exchange.

- A-Shares stands for stocks of mainland China-based companies that trade on the two Chinese stock exchanges, the Shanghai Stock Exchange, and the Shenzhen Stock Exchange.

Disclaimer: Investors should understand product characteristics (mutual funds) / Past performance of the fund is not a guarantee for future performance.

Suppachark Erbprasartsook – Head of Investment Strategy

Thaned Lertpetchpun – Investment Strategist

Mintra Juntavitchaprapa – Investment Strategist

Monsichar Utitchalanont – Investment Strategist