Monthly Report as of November 2023 for PVD Members

Market Outlook

*Information illustrated percentage of bond yield change not return.

Source : Bloomberg, data as of 31 Oct 2023

In October, most of stock markets dropped from last month, after major countries’ economic indicators in the third quarter released, which disappointed market predictions. Tight monetary policy by rising interest rate in many areas could lead to an economic slowdown in 2024. The U.S. 10-year government bond yield go up to its 16 years highest level, which is a headwind to stock and property markets. The 1-month performance of developed markets were better than emerging markets as these markets, such as China, Thailand, and Vietnam, highly rely on exportation. Moreover, gold price, as a safe haven, remarkably rose after Hamas-Israel confliction. Surprisingly, oil price went down during the month, however, it has been increased since the war has started in early October.

Fixed income : The US 10-year government bond yield reached 5% in October, its highest level in 16 years. This was due to strong economic announcements regarding both retail sales and the labor market. Additionally, Federal Reserve Chairman Jerome Powell has indicated that if the economy remains surprisingly strong, rising market interest rates could force the central bank to take action. As a result, investors anticipate that the Fed will keep interest rates higher for a longer period, leading to an increase in bond yields in recent months.

Meanwhile, Thai government bond yields have also increased in line with the increase in US government bond yields. In terms of economic data, Thailand's inflation rate in September increased by 0.3% YoY, slowing down from 0.88% the previous month due to a slowdown in energy and food prices. We expect that the Bank of Thailand will maintain interest rates at 2.5% at its last meeting of the year.

Equity : U.S. stock index declined by 2.20% in October although earnings announcements in Q3 2023 of the U.S. company were better-than-expected. As same as U.S. stock market, Europe stock market dropped -3.68% from September. The main reason is that overall European economic indexes still weaker than investor expectation. The Purchasing Managers Index for both the manufacturing and service sectors in September shrank below the 50 points level. Overall, the stock markets in both the U.S. and Europe are under pressure from many factors such as 1) a rise in interest rate in major economies 2) a concern on upcoming recession in 2024 3) the latest statement of Jerome Powell indicating opening an opportunity for a rate hike and 4) a prolong conflict between Israel and Hamas. Moreover, stock market in emerging countries, which highly rely on exportation such as China and Thailand, were also decreased from September due to lower global demands and Israel-Hamas conflict.

Property Fund & REITs : Global REITs and Singapore Index went down -4.73% and -6.91%, respectively, after the U.S. 10-year bond yield reached 5% during October and Fed’s chairman speech about an opportunity for a rate hike if economic indicators do not perform as expected.

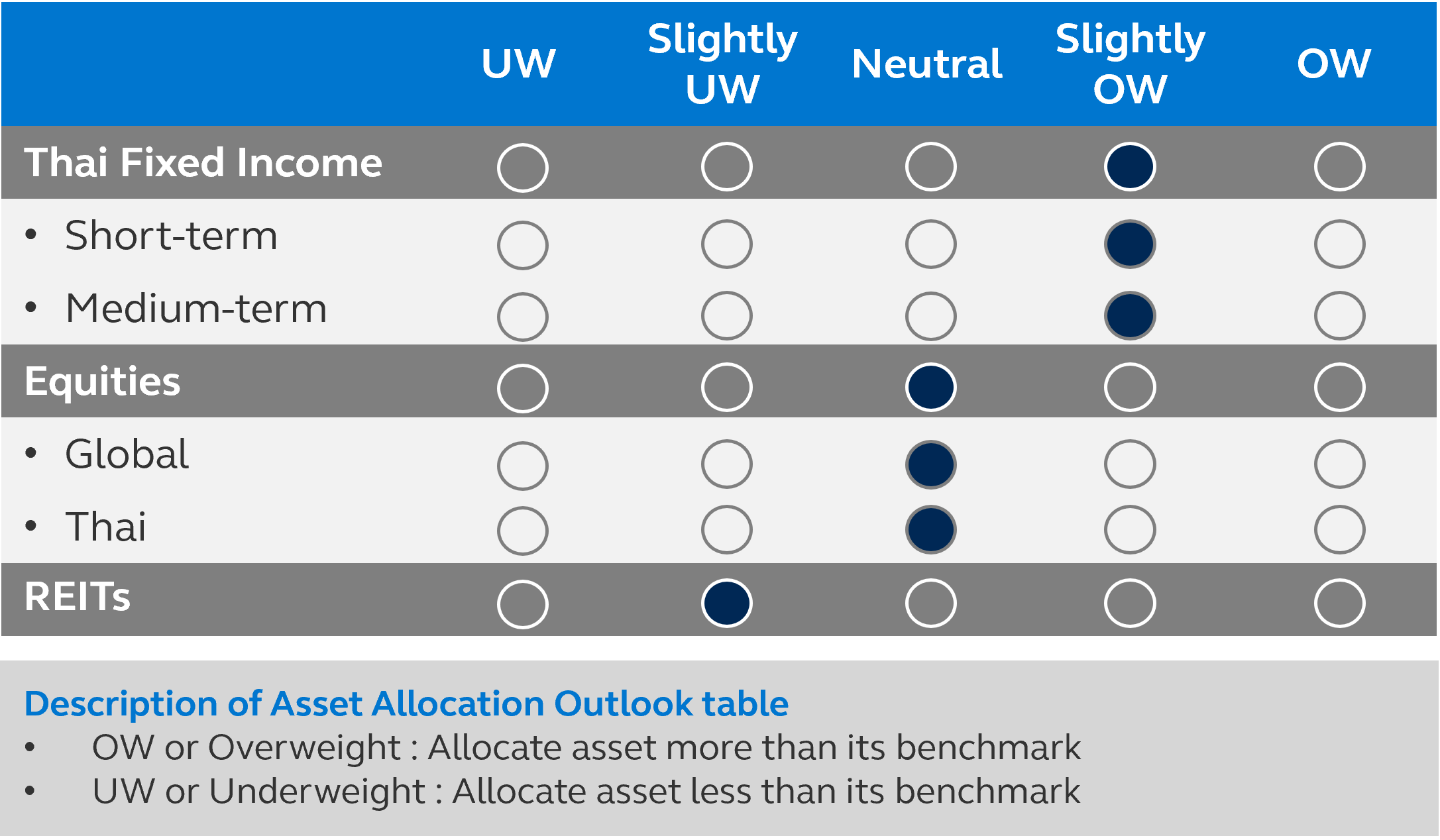

Asset Allocation Outlook

Our fixed income positioning is slightly overweight, focusing on investment grade (IG) with the good quality thanks to a rise in 10Y US treasury yield, while our equities positioning is neutral as recession tends to occur in the beginning of 2024 and an increase in treasury yield makes equities less attractive. However, we consider overall valuation as a positive factor. REITs is at slightly underweight because of a lack of clarity that foreign fund flow will come back.

Caution: Principal Asset Allocation Plan is a service providing advice on allocating investment portfolios by diversifying investment into various financial assets according to investor’s investment risk tolerance. Advisement is considered on market conditions to create or adjust balance portfolio, which will be monthly evaluated and adjusted investment mix or portfolio to ensure that the portfolio is well-diversified and consistent with investment outlooks. Due to market price changing from market conditions, the proportion of each asset may deviate from appropriate allocation. This may cause the portfolio to be at higher or lower risk than it should be. Principal Asset Allocation Plan is only advice from Principal Asset Management and investors may not receive return as expected. Investors should make sure that understand about basic investment allocation, recommended by SEC.

Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision.

Reported by

Suppachark Erbprasartsook – Head of Investment Strategy

Thaned Lertpetchpun – Investment Strategist

Mintra Juntavitchaprapa – Investment Strategist

Monsichar Utitchalanont– Investment Strategist

Read more : Monthly Report as of November 2023 for PVD Members