How Often Should Fund Members Switch Funds?

One of the most important reasons that the Provident fund has been considered as one of the best investment tools for retirement planning is that the provident fund acts as a long-term investment vehicle. Monthly contributions that invested in the provident fund are considered as using Dollar-Cost Averaging (DCA) strategy. By using Dollar-Cost Averaging (DCA), fund members invest consistently in the specific time period with the same allocated amount plus the employer will contribute the amount according to what we invest in the provident fund. Besides, employees can also enjoy tax privileges and other benefits associated with the provident fund which could motivate the fund members to stay with the provident fund longer.

The question is, is it enough to just contribute to the fund monthly and do nothing then we can reach our retirement successfully? Or should we switch the fund and change the investment plan to match the market condition? If it is necessary to switch the fund, how often should we do it?

In general, most people tend to switch their investment to a fund that shows higher past performance returns. For example, equity funds have high returns, so people will “switch” their investments into more stocks for the opportunity to earn higher returns. However, there are high opportunity to lose their initial because they might buy it when it is already overpriced. Making decisions based on emotions and feelings, regardless of other factors may lead to huge loss.

In reality, switching of investments primarily depends on ability of each fund member that can accept the risk or we called “Risk Appetite”. If you are getting close to your retirement, asset allocation in your age must be switching towards low-risk assets. Decreasing the portion of risky assets investment as you move closer to your retirement, e.g., stocks, and switching to invest more in fixed income to help maintain initial investment and to ensure that fund members can retire securely as expected. We could say that we must switch our investment proportions and investment plans when our risk acceptable risk or “Risk Appetite” changes.

Another reason to invest in provident funds is that they have a professional fund manager to support our investment decisions. Investors only choose their acceptable risk level or “Risk Appetite. Then, the fund manager will arrange the appropriate long-term investment assets that match the investor’s risk appetite e.g., Thai stocks, offshore stocks, fixed income, or a low-risk assets like savings.

For investors who concerns about short-term market volatility, Principal Asset Management focuses on investor’s desired risks by using Tactical Asset Allocation (TAA). A TAA strategy focuses on keeping the ideal mix of asset types to fit the investor's risk appetite in order to maximize portfolio returns while keeping market risk to a minimum.

Investors generally tend to make investment decisions based on their “Emotional" which can cause huge losses on the investment. However, adjusting the portfolio by the fund manager will be made base on rational factors using all available information. Thus, investment decisions will be in line with the investment strategy to ensure long-term benefits for members.

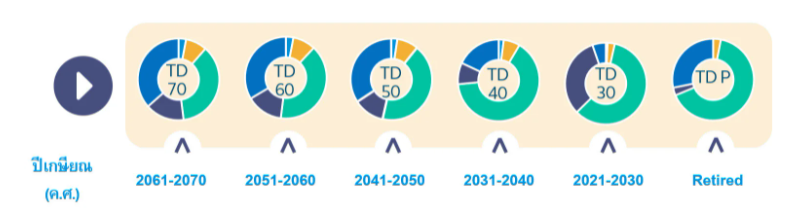

Principal Asset Management has registered “Principal Target Date Retirement Fund” to provide investor (fund member) who wishes to select assets class that he/she wants to invest. Then, the fund manager will automatically arrange and switch the appropriate investment policy and asset allocation to suit the member’s age. This will help fund members to have an appropriate level of investment risk throughout their investment life.

In the process of deciding and calculating the investment potions in each asset to arrange suitable investment policy of “Target Date” provident fund for each fund member. The fund will allow members to follow 2 main questions as follows:

1. The year of retirement: The fund members can calculate by using his/her "year of birth" plus the retirement age that the company required. For example, fund member A was born in 1985, the retirement age of the company is 55 years. Thus, the retirement year of the member will be in 2040.

2. Choose an investment plan according to the retirement age on the table above. Then the fund manager will manage your investment until retirement age.

Additionally, the fund manager will automatically arrange the appropriate long-term investment portfolio and adjust the portfolio for the current market situation by using the portfolio rebalancing technique. So, the fund members do not have to decide on their own. Also, to ensure that each asset class selection comes with good fundamentals and the ability to grow in the long term to generate steady income.

Another option for fund members who already plan out their retirement and able to manage their investment assets. “Principal Target Risk Fund” allows the fund members to select their investment portions in a do-it-yourself policy. This investment plan is highly recommended for fund members who have expertise in investing and have time to monitor the market.

In conclusion, it is undeniable that provident fund is one of the best investment tools to reach retirement goal. Proper retirement planning is necessary for every employee who plans to reach their long-term goal that require later in their life. The earlier you plan your retirement, the higher chance you are able to reach your retirement goal.

For more information, please click here https://www.principal.th/en/provident-fund

Contact us at https://www.principal.th/en/ or call 02-686-9595

Follow us on;

Facebook : https://www.facebook.com/principalthailand

LINE : https://lin.ee/C6KFF6E or @principalthailand

YouTube : https://www.youtube.com/channel/UCqELMp69UteyKgtWo4JuBqg