CIO’s View: September 2022 - Tough times ahead, but pockets of opportunities remain

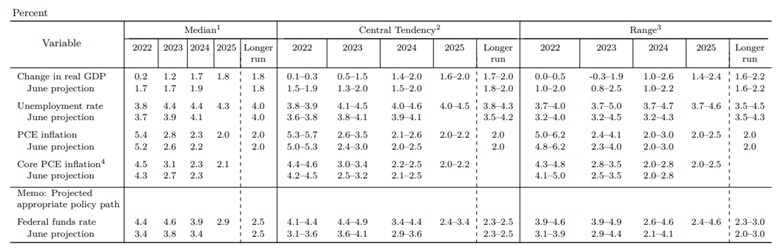

The Fed’s FOMC raised the Fed funds rate (the Fed’s policy rate) target range by 75 basis points to the range of 3.00% to 3.25%, as widely expected by the market. The median forecast by the FOMC in the Summary of Economic Projections now shows a Fed funds rate midpoint of 4.4% at end-2022 and 4.6% at end-2023. This would likely translate to a 75bp rate hike at the November meeting, a 50bp rate hike at the December meeting, and a 25bp hike at the January meeting, as the Fed’s expectation of the policy rate path (aka. the Dot Plot). This terminal rate of 4.6% at end-2023 turned out to be higher than the market had been expecting before the meeting, which subsequently led to a negative market reaction. The Dot Plot also shows a cumulative policy rate cuts of 175bp from 2024 onwards, as the Fed’s favorite inflation gauge – the Core PCE – moves closer to their 2% target at 2.3% in 2024, and to 2.1% in 2025. The Summary of Economic Projections also showed substantial increases in the unemployment rate, rising from its previous forecast 3.7% level to 3.8% by end-2022, to 4.4% by end-2023, and to 4.4% by end-2024. The Fed’s forecasts also showed downgrades to GDP growth in 2022 to only +0.2% from +1.7%, downgrades to 2023 GDP growth to +1.2% from +1.7%, downgrades to 2024 GDP growth to +1.7% from +1.9%; while keeping the 2025 and longer-run GDP growth at +1.8%.

Table: Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under their individual assumptions of projected appropriate monetary policy, September 2022

Source: Projection Materials, Federal Open Market Committee, Board of Governors of the Federal Reserve System released 21 September 2022.

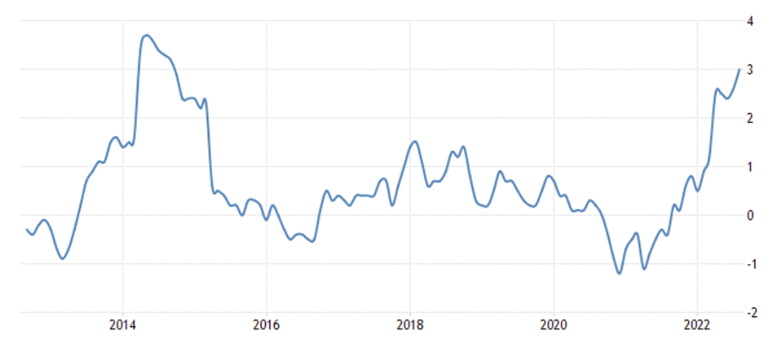

On the European side, the ECB’s Governing Council announced on 8 September 2022 that they have decided to raise the three key ECB interest rates by 75 basis points. This was more than the market was expecting going into the meeting, and hence, put the interest rate on the main refinancing operations, the interest rates on the marginal lending facility, and the interest rate on the deposit facility to 1.25%, 1.50%, and 0.75% respectively, to become effective on 14 September 2022. Based on the ECB’s assessment, the Governing Council expects to raise its policy rates further over the next several meetings in order to slow down demand and guard against the risk of a persistent shift in inflation expectations, as inflation remains far too high and is likely to stay above target for an extended period. The Eurozone inflation, as measured by Harmonized Index of Consumer Prices (HICP), increased by 9.1% over a year ago in August, due to soaring energy and food prices, demand pressures in some reopening sectors, and supply bottlenecks. According to the ECB, they have revised up their inflation forecasts to 8.1% in 2022, 5.5% in 2023, and 2.3% in 2024. Moreover, in terms of economic growth, after a rebound in the first half of 2022, recent data point to a substantial slowdown. The September flash composite PMI released on 23 September 2022, showed the downturn of Eurozone deepening further, with business activities contracting for the third consecutive month. According to the ECB, very high energy prices are reducing the purchasing power of people’s incomes, and although the supply bottleneck issue has been improving, they are still constraining economic activity. Moreover, the adverse geopolitical situation between Russia and Ukraine is weighing on the confidence of businesses and consumers. Hence, the ECB adjusted down its GDP growth outlook to 3.1% in 2022, 0.9% in 2023, and 1.9% in 2024.

Chart: Harmonized Index of Consumer Prices: All Items for Euro area (19 countries)

Source: Eurostat, Harmonized Index of Consumer Prices: All Items for Euro area (19 countries) [CP0000EZ19M086NEST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CP0000EZ19M086NEST, 25 September 2022.

Chart: S&P Global Flash Eurozone PMI Composite Output Index)

Source: S&P Global, Eurostat, released on 23 September 2022.

Meanwhile, right on the heel of FOMC, the BOJ also had their Monetary Policy Meeting, where they had unanimously decided to maintain the status quo across all monetary policy parameters, including the yield curve control, asset purchase programs, and forward guidance. At the press conference, Governor Kuroda noted that Japan is still in the midst of recovery from Covid-19, and the economy would still need another 2-3 years to realize the BOJ’s inflation target. He also stated that forward guidance will be maintained, and that no rate hike is required during that period. Japan is now the only country left with a negative interest rate policy still in place, after the Swiss National Bank of Switzerland decided to exit its negative interest rate policy on the same day, by increasing its policy rate by 75bp to 0.5%. The direct consequence of BOJ Governor Kuroda’s comments was a decline in the yen to a multi-decade low against the dollar, breaching JPY145 level during intraday. Japan’s Vice Minister of Finance, Masato Kanda, who is responsible for foreign exchange rate intervention, stepped up his verbal intervention immediately after the central bank meeting, and soon afterward the MOF had immediately intervened to buy yen for the first time in 24 years to stem the depreciation of the yen. With its foreign currency reserves of around USD1.3 trillion, Japan’s intervention in support of the yen would involve selling down its large reserves of US Treasury bonds, causing further increase in US bond yields. With Japan’s inflation rate firming to the highest level since 2014 at 3% in August, it’s hard to see the BOJ holding its current negative monetary policy in place for another 2-3 years as Governor Kuroda had mentioned. Japan might need to adjust its yield curve control policy when Governor Kuroda’s term ends in April 2023.

Chart: Yen breached JPY145 versus the dollar during intraday of 22 September 2022

Source: TradingView, as of 26 September 2022.

Chart: Japan’s inflation rate reached 3% in August

Source: TradingEconomics.com, Ministry of Internal Affairs & Communications, released on 20 September 2022

Bloomberg News had reported last Friday, 24 September 2022 that China Construction Bank Corp (CCB). will set up a CNY30 billion, or the equivalent of approximately USD4.2 billion, fund to buy properties from developers. The fund will invest in existing assets of real estate companies and renovate the properties into rental housing. The fund will last for 10 years, with a possible extension, according to CCB, one of the big four state-owned lenders. China has sought to expand the rental housing market to ensure sustainable growth in real estate over the long term and CCB has been spearheading that national strategy. We consider this another positive development in addition to the plan to offer CNY200 billion or the equivalent of approximately USD29.2 billion in special loans to troubled developers, according to Bloomberg News report on 22 August 2022. The same article mentioned that on Friday 19 August 2022, the Chinese state media reported that China will support construction and delivery of unfinished residential projects through special loan schemes from policy banks, but the loan amount was not disclosed. Meanwhile, the renminbi hit a 28-month low against the dollar on Monday, 26 September 2022, trading at CNY7.16 to the dollar. As a result, the PBOC has outlined measures to prop up the renminbi. It would seek to increase the reserves that banks must post with it when selling certain foreign exchange derivatives. China’s foreign exchange risk reserve requirement, which will from Wednesday [28 September 2022] rise to 20% from 0% previously, would increase the cost for certain FX hedges that involves selling of the renminbi, and discourage sales of FX derivative products. This shows that the PBOC is starting to feel discomfort with the rapid depreciation of the renminbi amid continued strengthening of the US dollar. Overall, the downside concern for China’s economic outlook seems to be improving. Chinese data reported on Friday, 16 September 2022 showed a pickup in growth in August from the prior month, while also beating expectations across the board. Retail sales grew 5.4% vs 3.5% expectation, from passenger car sales, catering sales, online sales of physical goods, and low base effect from last year. Industrial production rose by 4.2% in August from a year ago, beating 3.8% expectation, with help from passenger car production surging by 33%. Fixed asset investment for the first eight months of the year rose by 5.8%, above 5.5% expectation, mainly coming from manufacturing investment increasing by 10%. However, real estate investment for the year declined further in August, down by 7.4% from a year ago, compared to 6.4% decline that was reported for July.

Chart: Yuan hits 28-month low at CNY7.16 versus the dollar

Source: TradingView, as of 26 September 2022.

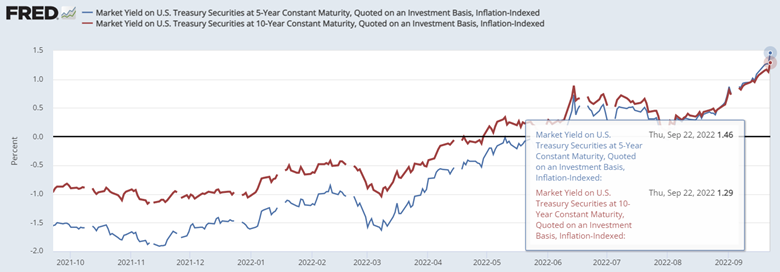

Overall, the hawkish central bank tone over the past month have pushed up real yields – e.g. 5-year US Treasury yields have increased by 152 basis points, and 10-year US Treasury yields have increased by 120 basis points – which have been weighing heavily on risk assets globally. However, equities are starting to show short-term positive signs from very low level of investor positioning in the asset class, technical oversold signal from rapid declines over the past two months, and valuation getting more attractive. We recommend Principal China Equity Fund (PRINCIPAL CHEQ) and Principal Asia Pacific Dynamic Income Equity Fund (PRINCIPAL APDI), as a good investment choice for China and APAC exposure. Our clients can also participate in short-term positive signal for US equities via our Principal US Equity Fund (PRINCIPAL USEQ). In addition, our recommendation for long-term quality tilt still holds as core recommendation, which are Principal Global Brands Fund (PRINCIPAL GBRAND) Principal Global Infrastructure Equity Fund (PRINCIPAL GIF), and Principal Global Equity ESG Fund (PRINCIPAL GESG ). Lastly, we still like Vietnam from a long-term structure growth story. Investors can invest with us via our Principal Vietnam Equity Fund (PRINCIPAL VNEQ). However, investors should take caution of the frontier market nature of Vietnamese equities, and the structurally higher volatility of the asset class, by limiting the investment exposure within the total portfolio perspective. Please refer to below section for the link to the fund’s information and related documents. Also, please refer to our related article on Asset Allocation Recommendation for a complete set of fund recommendations for the next quarter.

Chart: Spike in US real yields since beginning of August have been significant

Source: Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed [DFII5], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFII5, 26 September 2022.

กองทุนแนะนำ

- Principal Asia Pacific Dynamic Income Equity Fund (PRINCIPAL APDI)

- Principal China Equity Fund (PRINCIPAL CHEQ)

- Principal Global Brands Fund (PRINCIPAL GBRAND)

- Principal Global Equity ESG Fund (PRINCIPAL GESG)

- Principal Global Infrastructure Equity Fund (PRINCIPAL GIF)

- Principal US Equity Fund (PRINCIPAL USEQ)

- Principal Vietnam Equity Fund (PRINCIPAL VNEQ)

Read CIO’s View: September 2022 - Tough times ahead, but pockets of opportunities remain

Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. /PRINCIPAL APDI master fund has highly concentrated investment in Hong Kong. So, investors have to diversify investment for their portfolios. /PRINCIPAL CHEQ master fund has highly concentrated investment in China. So, investors have to diversify investment for their portfolios. / PRINCIPAL GBRAND master fund has highly concentrated investment in America. So, investors have to diversify investment for their portfolios/ PRINCIPAL GBRAND master fund has concentrated investment in the consumer staples sector, which is exposed to risk from changes of the product price, consumer demand or government regulations. The fund concentrates in the information technology sector, which has a risk from changes in consumer behavior and obsolete products. Therefore, if there are negative factors affecting the said investment, investors may lose a lot of money and may have higher risks and price fluctuations than general mutual funds that diversify its investment in many industries. /PRINCIPAL GESG master fund has highly concentrated investment in America. So, investors have to diversify investment for their portfolios. /PRINCIPAL GIF master fund has highly concentrated investment in Europe and North America. So, investors have to diversify investment for their portfolios. /PRINCIPAL USEQ master fund has highly concentrated investment in America. So, investors have to diversify investment for their portfolios. /PRINCIPAL VNEQ master fund has highly concentrated investment in Vietnam. So, investors have to diversify investment for their portfolios. /Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment. /Past performance of the fund is not a guarantee for future performance