CIO’s View: January 2023 - Happy Lunar New Year

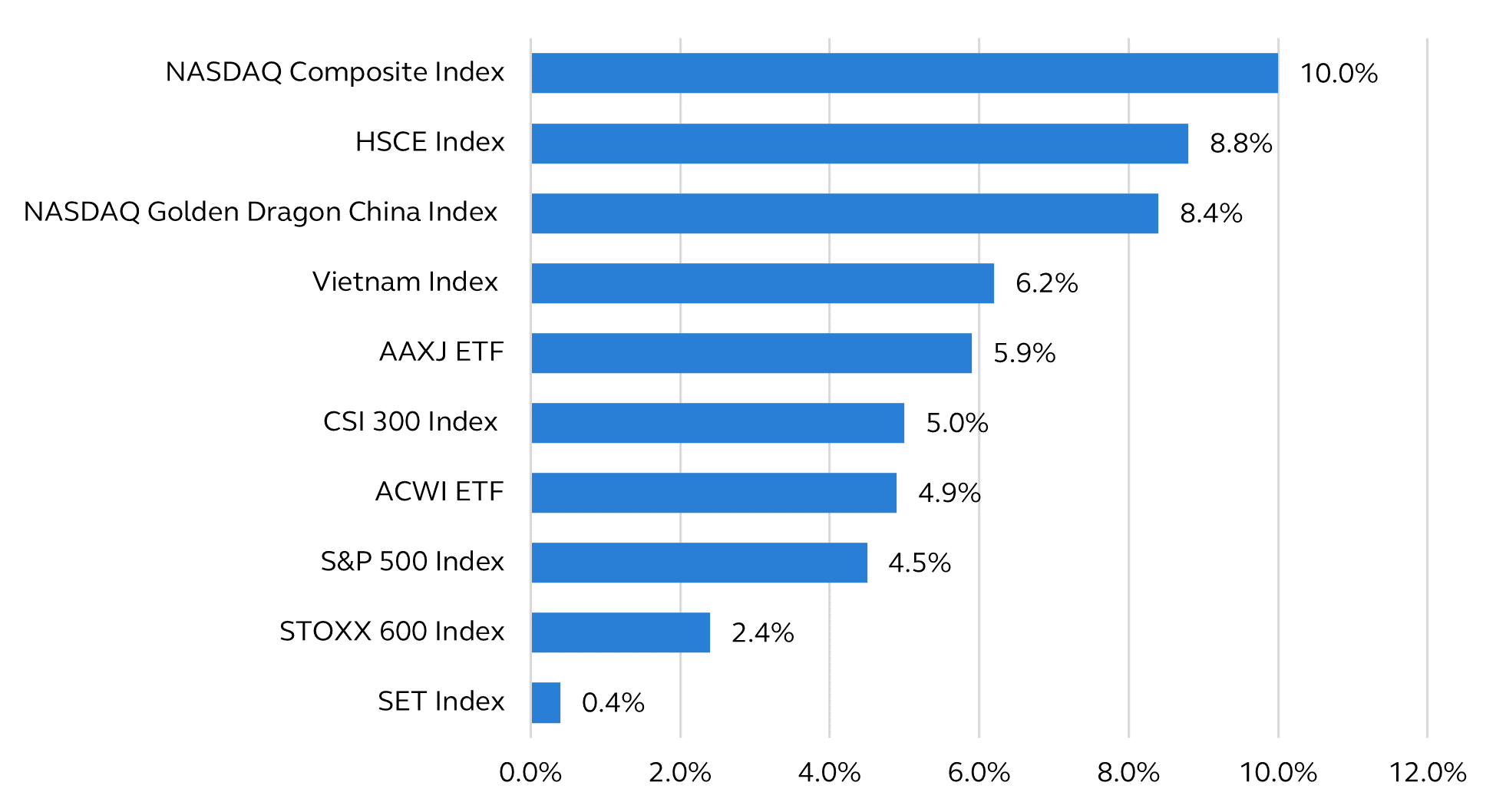

We started the year on quite an upbeat note for global equity markets, as the global equity index (measured by the ACWI ETF) went up by +4.9% in the YTD as of January 27, and the S&P 500 Index went up by +4.5%, while the NASDAQ Composite Index rallied significantly more by +10%. European equity market, that had dominating concern on the risk of hard-landing due to high energy costs, had managed to show a positive return of +2.4%, as measured by the STOXX 600 Index. Asian equity markets performed better overall, judging from the Asia equity index (measured by the AAXJ ETF) that went up by +5.9%. Within Asia, Chinese equities led the pack, as China’s HSCE Index rallied significantly by +8.8%, and the US-listed NASDAQ Golden Dragon China Index also rallied similarly by +8.4%. The China onshore CSI 300 Index went up by +5%, near the performance of the global equity index. Vietnamese stocks managed to go up by +6.2%, after having fallen significantly last year. Thai equities only managed to show a marginal gain at +0.4%, as we had communicated through our previous articles and outlook seminar.

Chart: YTD of major stock markets as of 27 January 2023

Source: Investing.com

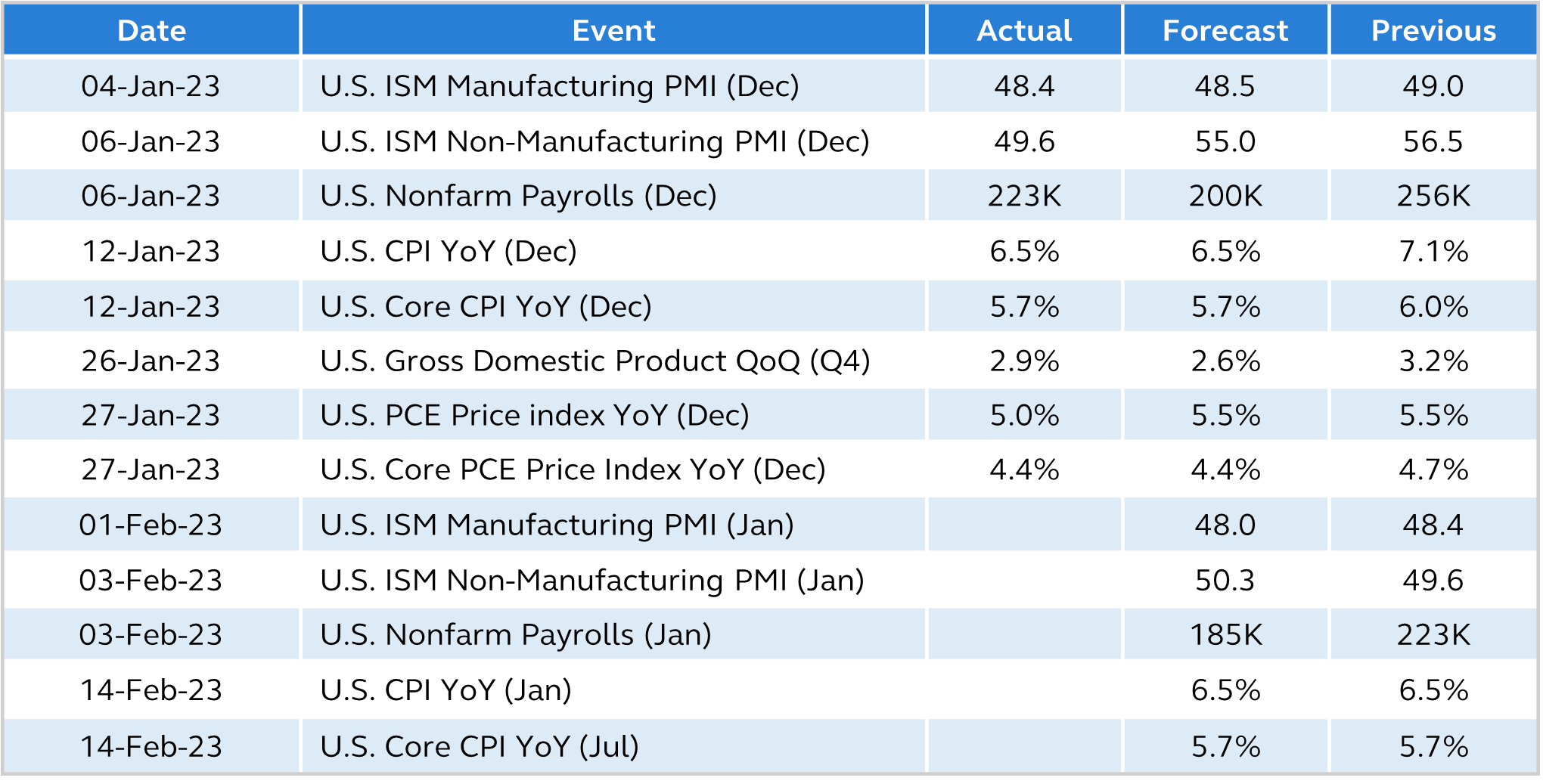

US GDP for the 4th quarter of last year grew by +2.9% on a seasonally adjusted annualized rate (SAAR) from the previous quarter, which came in better than market’s expectation at +2.6%, but it grew at a lesser rate of +3.2% of the previous quarter. This provided a positive sentiment to the market that had been expecting a hard-landing economic scenario for the US following more than 400 basis points of continuous rate hikes by the Fed. However, the details of the GDP report gave us quite a bit of concern, as the positive contributors to GDP had been the reduction in US imports of at -4.6%, coupled with the reduction in machinery investment that declined -3.7%, while the inventory buildup was +1.5% to GDP. When we look at the final sales to private domestic purchasers,

it only had a marginal increase at +0.2%, which was almost flat. The weak detail of the 4Q22 US GDP have given us quite a concern about the trajectory of growth in the US this year. These conflicting signals between the headline GDP and the details keep us attentive to the next quarter GDP release, as the risk of hard landing has not gone away. Nevertheless, we are expecting the FOMC meeting that will be held on January 31 to February 1 to result in a reduction in the pace of policy rate hikes to +25 basis points, taking the Federal funds rate up to 4.50% to 4.75% target range. Recently reported US PCE inflation for December came out at +5.0% year-on-year, coming down from +5.5% rate reported in the previous month. While the core PCE inflation came out at +4.4%, matching market’s expectation, but at a declining rate of +4.7% from the month before.

Table: US Economic Events

Source: Investing.com, as of 28 January 2023.

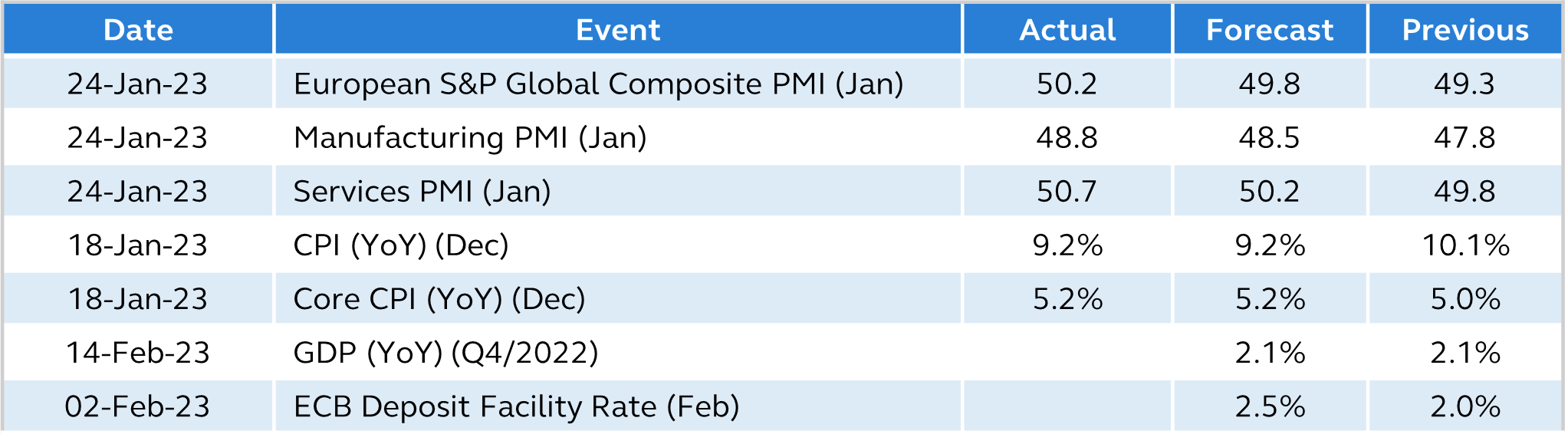

Meanwhile, Eurozone activities showed marked improvement, as the European S&P Global Composite PMI for January increased to 50.2, better than market expectation at 49.8, and had improved from 49.3 reported in the previous month. This was a balanced increase from both the manufacturing side and the service side of the economy. Market had subsequently reduced its perception of the hard-landing recession scenario that had been priced in before. Previously, there was widespread concern on the risk of recession due to high dependency on natural gas imports by Europe. However, Dutch TTF Natural Gas prices had come down significantly to EUR55 as of January 27, from the peak of around EUR346 during August of the previous year.

However, Eurozone CPI inflation was still hovering at an uncomfortably high level of +9.2% during January, even if down from a higher level of +10.1% of the previous month; while core CPI inflation for January increased to +5.2% from +5.0% of the previous month. Therefore, we are still expecting the ECB to increase its policy rate by +50 basis points, taking the rate of the Deposit Facility up to 2.5% at the Governing Council meeting due to be held on February 2.

Table: Europe Economic Events

Source: Investing.com, as of 28 January 2023.

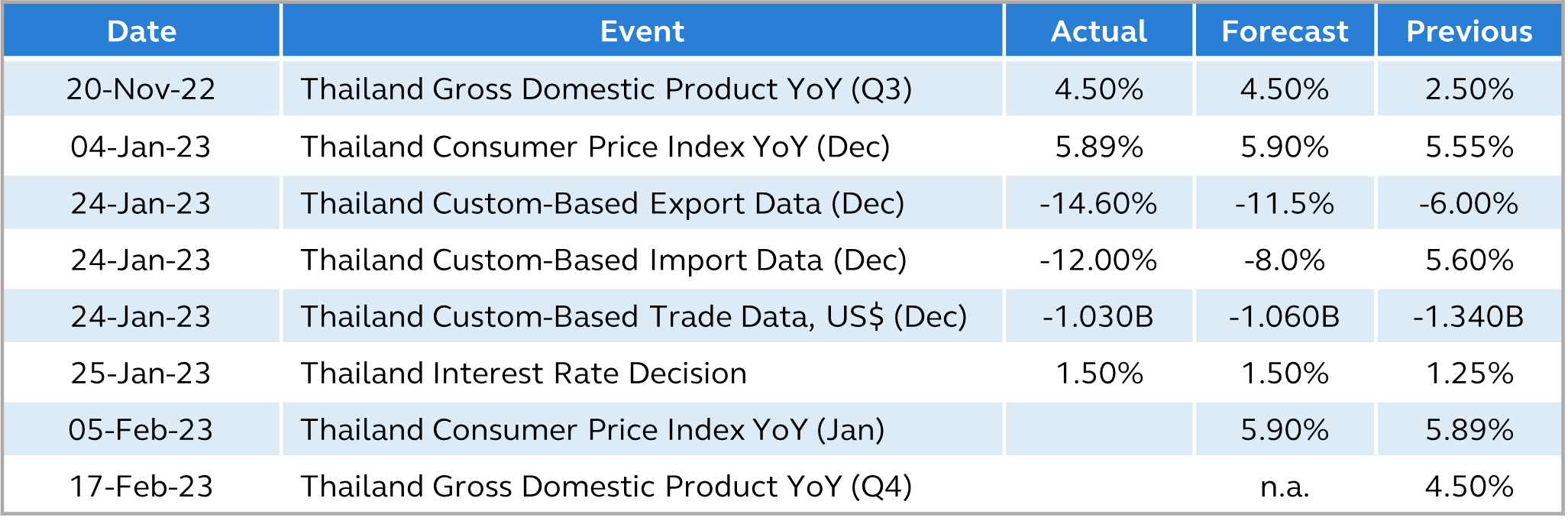

For the first meeting of the year, the Bank of Thailand (BoT) had decided to continue to hike its policy rate by +25 basis points up to 1.5% target level, as had been widely expected. We still expect there to be another three rate hikes by the BoT, as we judged that they are still some way behind what the neutral policy rate should be at around 2.00% to 2.25% range, when measured over the course of a full business cycle. This is in view of the headline CPI inflation that is still high at +5.9% during December, and an increase from +5.6% of the previous month, which puts it uncomfortably higher than the 1-3% inflation mandate of the BoT. Meanwhile, December exports showed a continued negative number of -14.6% from a year ago level, which was a larger decline from -6.0% reported during the previous month. This followed our expectation that we have been communicating for a while that exports should face increasing headwinds from reduction in global demand as DM economies move closer to recession, even though Thailand’s tourism sector is getting a lift from increase in Chinese tourists, following full reopening of the country from their previously iron-clad zero-Covid policy.

Table: Thailand Economic Events

Source: Investing.com, as of 28 January 2023.

We are sticking with the calls that we have been making since November last year that China equities and Asia equities would be the main beneficiary this year from China reopening, Fed’s reaching the end of rate hikes, and the dollar weakness. For developed market equities, we maintain our recommendation for quality and defensive equity exposure, such as global ESG equities and global infrastructure equities. For fixed income recommendation, even though we are expecting up to three more rate hikes from the BoT, which makes investing in Thai fixed income susceptible to duration risk from potential rise in bond yields, we think that global income bonds present us with opportunity of a decade, due to attractive yield levels supported by the outlook that the Fed and ECB would be reaching the end of their rate hikes sometime in the middle of this year, which would also lead to a reduction of bond market volatility. Lastly, we recommend investors to dollar-cost average into gold positions as the trajectory of the dollar is on the downside throughout this year.

- Principal Asia Pacific Dynamic Income Equity Fund (PRINCIPAL APDI)

- Principal China Equity Fund (PRINCIPAL CHEQ)

- Principal Global Equity ESG Fund (PRINCIPAL GESG)

- Principal Global Infrastructure Equity Fund (PRINCIPAL GIF)

- Principal Global Fixed Income Fund (PRINCIPAL GFIXED)

- Principal Gold Income Fund (PRINCIPAL iGOLD)

Read CIO’s View: January 2023 - Happy Lunar New Year