CIO View: October 2025

We begin this month’s article with a review of key global market developments that have shaped investor sentiment in recent weeks. And then later, we will be turning ou focus to the Thai equity market, where we see improving fundamentals and a more attractive investment opportunity going forward.

Trade tension seemed to have sharply escalated over the month, when China announced that the country has significantly expanded its rare earth restrictions with new export controls announced in October 2025. The new regulations move beyond just limiting the export of raw rare earth elements and aim to control the entire rare earth supply chain, from processing technology to finished products. Currently, China controls over 70% of global rare earth mining and nearly 90% of processing capacity. The restrictions create major challenges for the global aerospace, defense, electric vehicle, and semiconductor sectors that rely on these materials and technologies. In response to China’s significant expansion of rare earth export restrictions, President Trump has threatened to impose an additional 100% tariff on Chinese goods starting on November 1st. Later, Trump commented that the high tariff rate he has threatened is not sustainable for the long term, easing fears of further trade escalation between the countries.

The International Monetary Fund’s (IMF) World Economic Outlook (WEO) released in October 2025 conveyed a message of fragile recovery with decelerating growth and persistent downside risks, primarily from rising trade tension and high debt. The IMF noted that the global economy has weathered recent trade shocks better than expected. The global GDP growth was projected to slow from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026, with advanced economies growing around 1.5% and emerging market and developing economies just above 4%. However, the overall tone was marginally positive, as growth in 2025 received a little improvement from the previous projections. Growth in 2025 will partly benefit from a temporary boost in trade activities due to front-loading effects, as firms gave accelerated exports before new tariffs took full effect. Nevertheless, global growth would slow further in 2026 as gains from front-loading fade, while downside risks continue to mount. Key downside risks include 1) rising trade barriers and heightened policy uncertainty, which could weigh on growth and trade volumes; 2) inflation concerns, which could constrain the pace of monetary policy easing; and 3) high levels of public debt make many countries lack fiscal space and vulnerable to economic shocks. The IMF acknowledges the global economy’s adaptability but warns that medium-term prospects remain dim unless proactive and coordinated policy measures are taken

Meanwhile, Federal Reserve Chair Jerome Powell’s speech at the National Association for Business Economics (NABE) meeting focused on navigating the dual goals of maximum employment and price stability amidst rising risks and provided insight to the future of the Fed’s balance sheet. He highlighted that downside risks to the labor market have risen, citing a sharp slowdown in payroll gains, partly due to lower immigration and labor force participation. This softening job market was a key factor justifying the recent interest rate cut. He noted that inflation remains above target, but attributed recent price increases largely to tariffs, rather than broader underlying inflationary pressures. He reiterated that the Fed must balance the risk of moving too quickly and leaving inflation unfinished against the risk of moving too slowly and causing painful losses in the employment market. He indicated that the Fed may soon halt the reduction of its US$6.6 trillion balance sheet in the coming months as the central bank is approaching the point where reserves are judged to be ample enough.

Across the Pacific, Sanae Takaichi won the presidency of the ruling Liberal Democratic Party (LDP) on October 4th, after the former Prime Minister Shigeru Ishiba resigned following poor election results. Takaichi had to secure a parliamentary majority because the LDP lost its majority in both houses and its decades-long partner, Komeito party, withdrew from the coalition on October 10th. The LDP secured the needed support by striking a deal with the Japan Innovation Party (JIP). On October 21st, Takaichi has been elected as the new Prime Minister of Japan by the House of Representatives and become the country's first woman prime minister. She secured 237 votes in the 465-seat lower house, surpassing the 233 required for a majority. Takaichi’s alliance is still short of a majority in both houses of parliament, and she will need to win over other opposition groups to pass any legislation. On a policy stance, she has been widely labeled as an apostle of Abenomics, the economic strategy of the late Prime Minister Shinzo Abe, which espoused loose monetary policy, fiscal spending and structural reforms.

On October 16th, French Prime Minister Sebastien Lecornu has survived two no-confidence votes in parliament, winning crucial backing from the Socialist Party thanks to his pledge to suspend President Emmanuel Macron’s contested pension reform. Each vote would have needed to secure 289 votes in favor in order to be passed. The first, which followed a motion filed by the far-left party La France Insoumise, failed by a narrower margin than expected of just 18 votes. The second, however, was never expected to succeed - with MPs considered unlikely to position themselves voting alongside Marine Le Pen's far-right party. Despite surviving the no-confidence votes, the government now faces an even tougher fight on passing the 2026 national budget. The government’s goal is to reduce the budget deficit to 4.7% of GDP by the end of 2026, putting France back on a path toward the EU’s 3% limit. The budget’s austerity focus is opposed by all major opposition parties. The government must negotiate a compromise by the end-of-year deadline or risk another government collapse and further political paralysis. President Emmanuel Macron’s personal standing has reached historic low, with polls in October 2025 showing that only about 14% to 16% of voters have confidence in him.

While global markets remain fixated on geopolitical tensions, interest rate trajectories, and macroeconomic volatility, Thailand’s equity market offers a compelling narrative that’s often overlooked. Beneath the surface of global uncertainty, domestic fundamentals are quietly improving, supported by resilient corporate earnings, targeted government stimulus, and sector-specific tailwinds. For investors willing to look past the noise, Thailand presents selective opportunities for long-term value and strategic positioning.

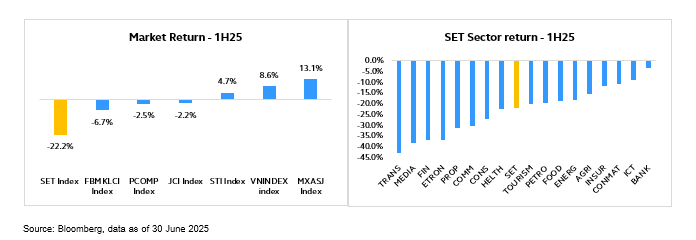

Thai stock market faced significant headwinds in the first half of 2025. The SET Index declined by 22% during the period, making it one of the region’s worst-performing equity markets. This was driven by a combination of factors: uncertainty surrounding reciprocal tariffs, a sluggish domestic economy—particularly in consumption and tourism—political instability, and pressure from LTF redemptions. These concerns have triggered nearly Bt78.7 billion in foreign outflows.

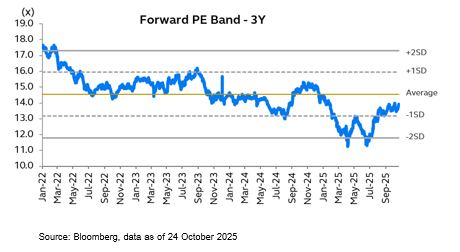

However, sentiment has improved following the smooth formation of a new government and the establishment of a clear electoral timeline, which has helped restore political stability. In the near term, fiscal stimulus measures and a downward trend in interest rates are expected to support economic momentum. The Bank of Thailand's monetary policy maintains an accommodative stance to support Thailand's modest economic recovery, which faces headwinds from global trade tensions, high household debt, and a strong baht. The Monetary Policy Committee recently held the policy rate at 1.50% (as of the October 2025 meeting), noting that the effects of prior rate cuts are still being transmitted to the economy. The central bank operates under a flexible inflation targeting framework (1-3%). With the inflation remaining subdued, the hurdle for further rate cuts is removed. The BOT has signaled its readiness to adjust policy as needed, with some economists anticipating a further rate cut later this year if economic momentum falters. From a valuation perspective, the SET Index is trading at 1 standard deviations below its historical average, making it one of the most undervalued markets in ASEAN. This presents a compelling risk-reward opportunity for long-term investors. The market also offers a forward dividend yield of 4.4%, providing a buffer against downside risk.

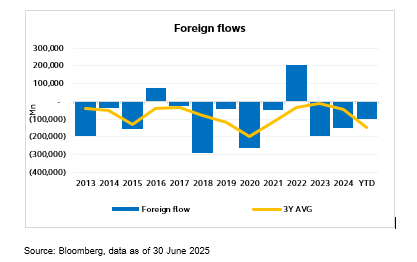

Foreign investor participation, historically a key driver of the Thai equity market, has declined in recent years. Foreign investors have recorded net outflows of Bt437billion during 2023 and the year-to-date reducing foreign ownership to just 34.45% (data as of 30 September 2025). This lower base significantly reduces the risk of further selling pressure and removes a major overhang on the SET Index.

Recent 3Q25 earnings results were largely in line with or have exceeded market expectations, particularly in the banking sector. This performance reflects the already subdued investor sentiment and low earnings expectations priced into the market. Looking ahead, the consensus forecast for 2026 earnings growth stands at 6%, which is notably below the historical average of 10–15%. This conservative outlook leaves room for upward revisions, especially as macro conditions stabilize and corporate fundamentals improve. Importantly, consensus full-year 2025 EPS estimates remained unchanged during the 3Q25, marking a significant shift in sentiment. This contrasts with the previous quarters, when EPS forecasts were downgraded by 3% in 2Q25 and 4% in 1Q25. The stabilization in earnings expectations suggests growing confidence in the recovery trajectory and sets the stage for potential positive surprises in the coming quarters. The combination of continued political stability, rising hopes for economic stimulus measures, moderate earnings recovery, attractive valuation and lower risk from the external sector provide a strong case for investment.

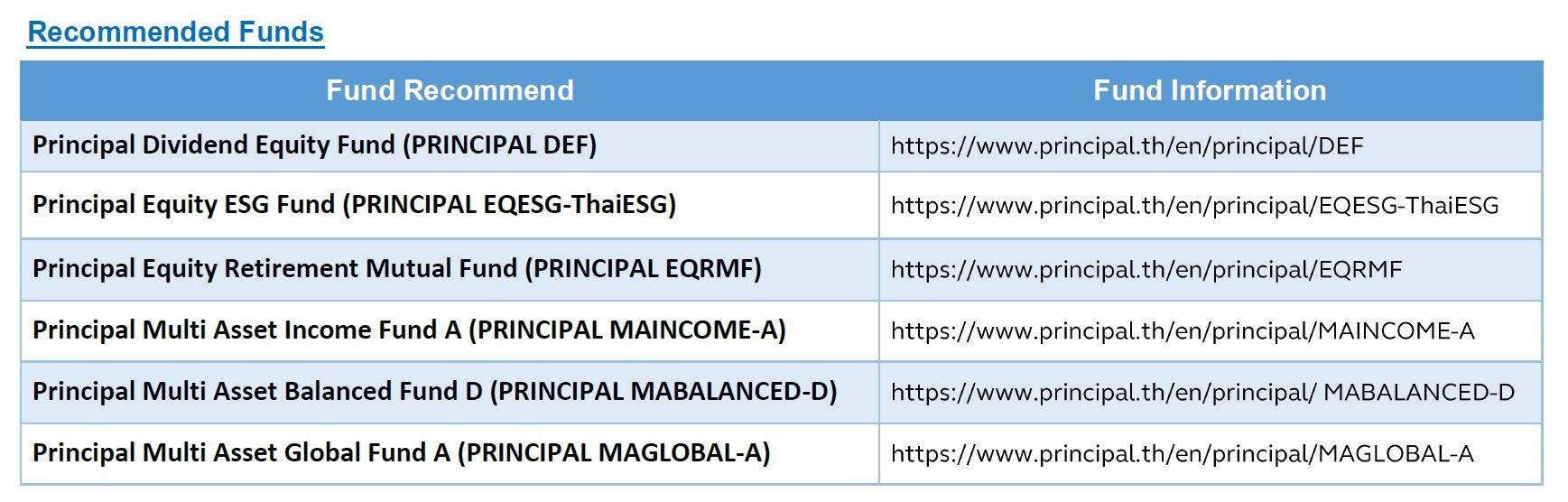

In response to this evolving landscape, we recommend investors consider exposure to Thai equities through PRINCIPAL DEF—a fund that has been recognized for excellence in domestic equity management, receiving consecutive awards from Money & Banking for two years, reflecting its proven expertise and capability in managing Thai equities. For investors seeking tax benefits, we also recommend PRINCIPAL EQESG and PRINCIPAL EQRMF . These funds are well-positioned to capture the upside potential of the Thai equity market, supported by attractive valuations, a stabilizing macroeconomic environment, and improving corporate fundamentals. To navigate this market, we are implementing a “Barbell” portfolio strategy. We focus on high-quality growth stocks with strong earnings visibility, robust cash flows, and attractive valuations. On the other hand, we target stocks that appear to have bottomed out—those that have undergone significant corrections and are poised for recovery. We also see opportunities in companies with unique catalysts, such as active deleveraging or enhanced shareholder returns through dividends or share buybacks.

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ PRINCIPAL MAGLOBAL has highly concentrated investment in US. Therefore, investors should consider the overall diversification of their investment portfolio. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results./ Investors please study information about tax benefits and investment conditions in the Thai mutual fund for sustainability (Thailand ESG Fund) or investment units in Thai sustainability category (Class ThaiESG) in the investment manual in accordance with the criteria set by the Revenue Department for understanding. If investment conditions are not followed, Investors will not receive tax benefits and the tax benefits must be repaid. If in doubt, ask the investor contact person to understand before purchasing investment units. PRINCIPAL EQRMF investor should also study information about tax benefits as specified in the investment guideline. If not complying with investment conditions investors will not receive tax benefits and must return tax benefits.